How Much Are Closing Costs For Buyer In Washington State

Closing cost stats in Washington Across the state the average home sells for between 400000 and 500000. On average buyers pay roughly 3700 in.

Closing Costs Cleared Up Real Estate Tips Closing Costs Origination Fee

Closing Costs Cleared Up Real Estate Tips Closing Costs Origination Fee

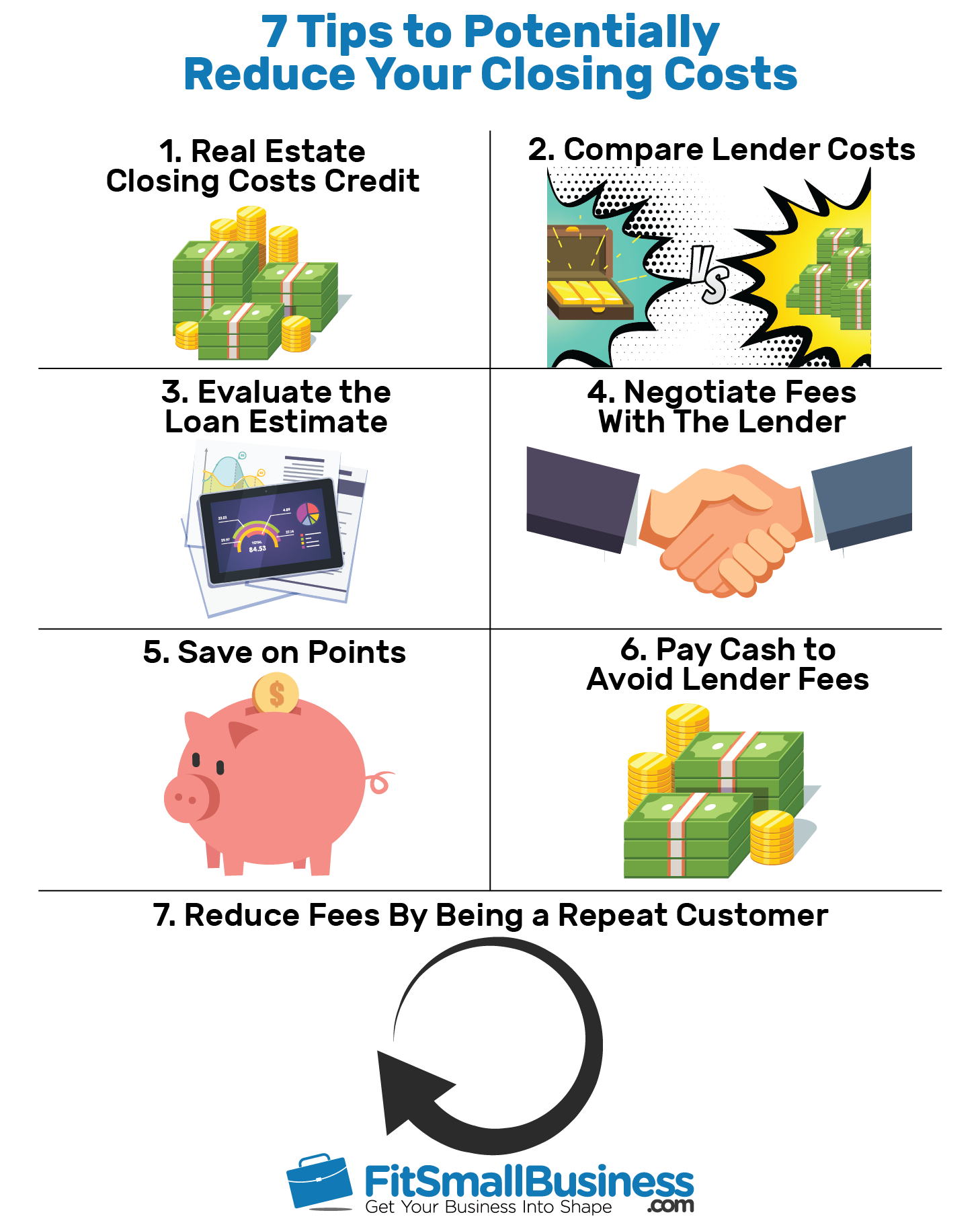

While each loan situation is different most closing costs typically fall into four categories.

How much are closing costs for buyer in washington state. The listing agents commission will make up the bulk of the fees. According to Zillow the median home in WA sold for 428896. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing.

According to data from ClosingCorp the average closing cost in Washington is 12406 after taxes or approximately 248 to 31 of the final home sale price. 5 rows Many closing costs fall on the buyers side of the score sheet. This helps cover the work that key stakeholders including title companies appraisers lenders and real estate agents must perform to finalize the transaction.

More on buyer closing costs later. Attorney if applicable paid to the attorney that represents the seller Brokers Commission the fee charged by the listing broker for marketing the property. If youre buying too much home.

But the seller might end up paying more money overall due to the agent. Both buyers and sellers pay closing costs but as a seller you can expect to pay more. For example they may have a real estate agents commission to pay which is normally around 6 percent of the sales price.

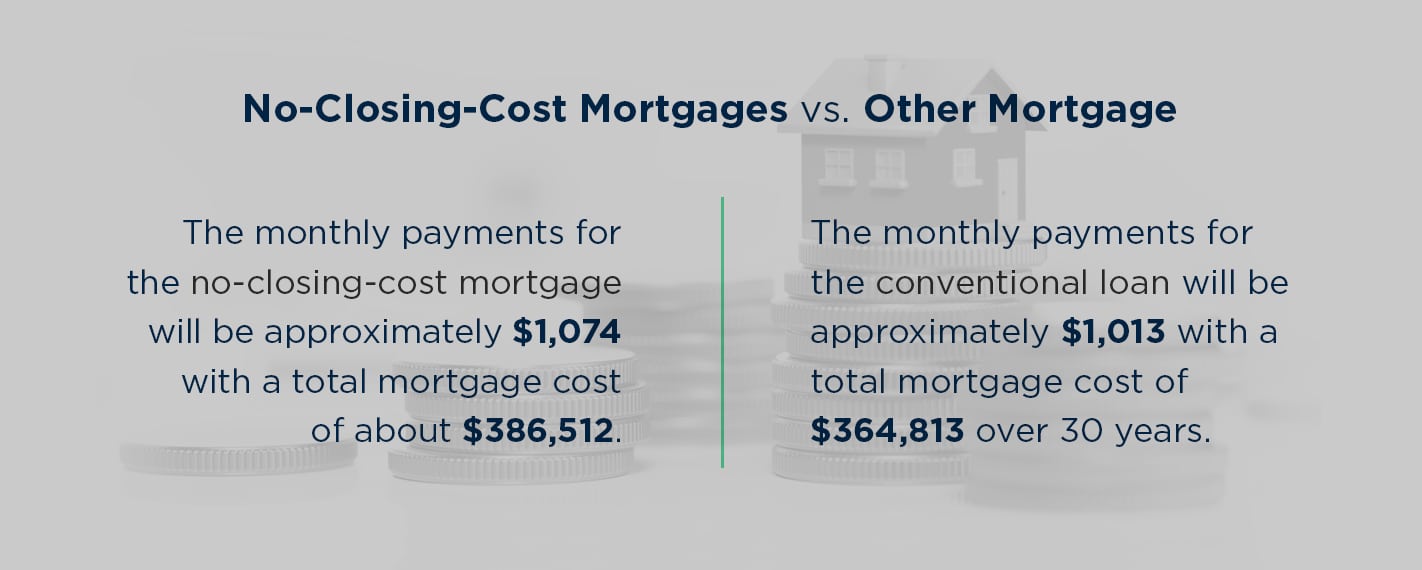

So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. But your negotiating ability will largely depend on the kind of real estate market you are in. On a 300000 house we assume 9261 in closing costs about 34 of the loans value.

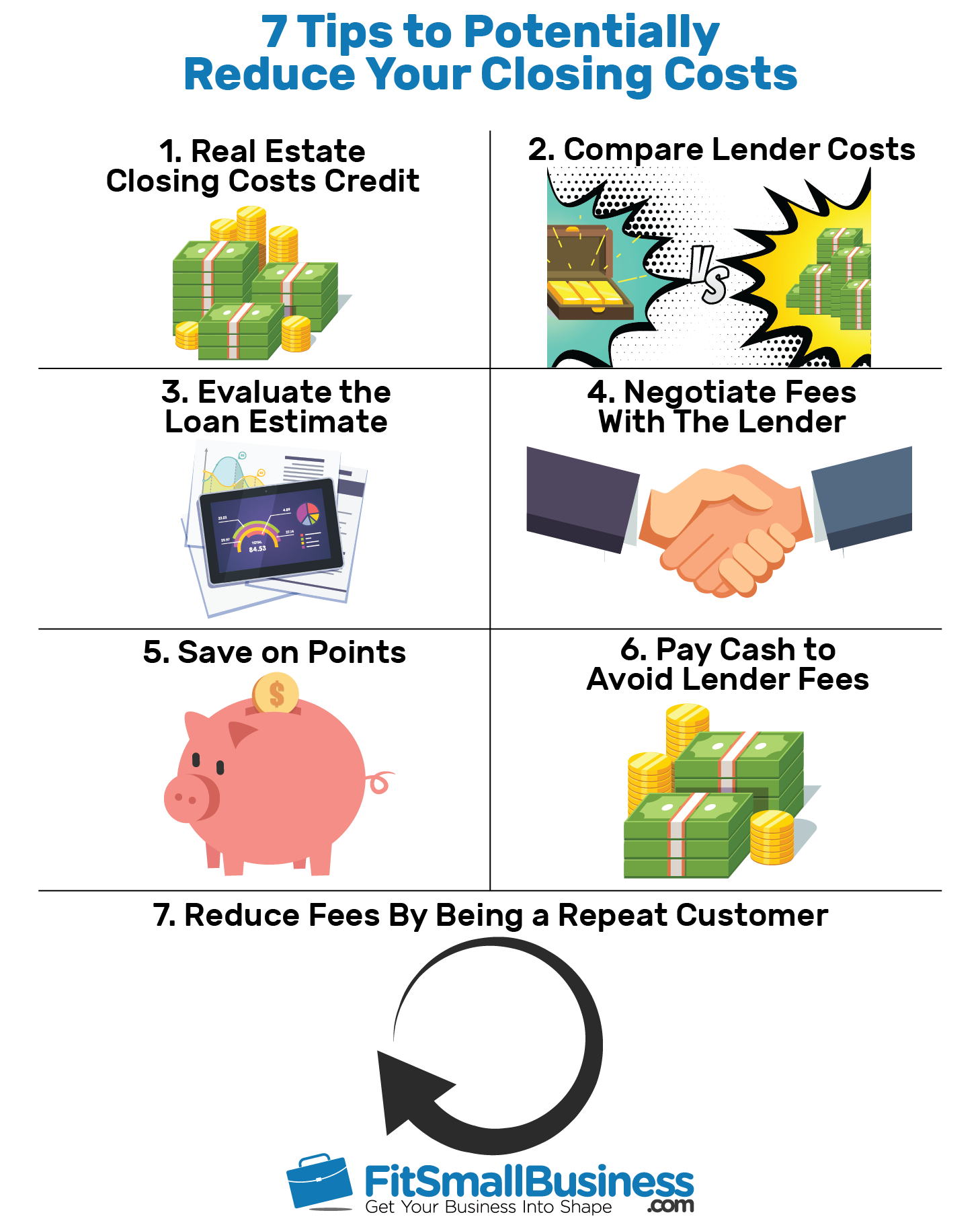

Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. However the average home buyer closing costs in Washington state tend to be between 1 and 3 of the propertys total purchase price. Who pays what closing costs in Washington State comes down to negotiations.

True enough but even on a 150000 house that means closing costs could be anywhere between 3000 and 7500 thats a huge range. Based on the average home value in Washington of 451000 that roughly translates to 5000 to 14000. Sellers also have fees that they must cover during land sales.

In most cases closing costs for Washington home buyers equal between 1 and 3 of the homes total purchase price. Especially because these costs account for 2 to 5 percent of the purchase price. Before you get the keys to your new home youll have to pay closing costs.

Home sellers in Washington can expect closings costs that average from 5 to 9 of the sales price. Washington the Evergreen State. Youre now almost complete in the process of selling your home.

Costs you can shop for amount to about 7600 while fixed costs and fees are estimated to be. How Much are Typical Seller Closing Costs in Washington. How much homebuyers pay for closing costs in Washington state depends on the loan type loan size local tax laws any negotiation that occurs between the buyer and seller and additional factors.

While the buyers will typically be responsible for the lions share sellers should expect to pay between 1-3 of the homes final sale price at closing. How much are closing costs. What is included in closing costs.

However buyers are not the only party that must pay fees at closing. Closing costs also known as settlement costs are the fees you pay when obtaining your loan. Home buyers in Washington usually encounter more individual line-item closing cost expenses.

Across the state the average home sale price is between 400000 and 500000. If you buy a home in that price range the average closing costs before taxes are 5612. Some costs are shared and.

These fees pay for processing appraisal and recording fees plus title insurance municipal searches and more. The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5 of the home value. As a buyer you can expect to pay 2 to 5 of the purchase price in closing costs most of which goes to lender-related fees at closing.

When Buying A Home Keep In The Mind The Closing Costs You Don T Want To End Up Needing Money You Were Mortgage Interest Rates Closing Costs Mortgage Interest

When Buying A Home Keep In The Mind The Closing Costs You Don T Want To End Up Needing Money You Were Mortgage Interest Rates Closing Costs Mortgage Interest

Washington Buyer Closing Costs In 2021 How Much Will You Pay

Washington Buyer Closing Costs In 2021 How Much Will You Pay

What Are Closing Costs For New Construction Southdown Homes

What Are Closing Costs For New Construction Southdown Homes

Closing Costs What Are Closing Costs Zillow

Closing Costs What Are Closing Costs Zillow

Can A Seller Refuse To Pay Closing Costs Clever Real Estate

Can A Seller Refuse To Pay Closing Costs Clever Real Estate

Over Half Of All Buyers Are Surprised By Closing Costs Keeping Current Matters Closing Costs California Real Estate Things To Sell

Over Half Of All Buyers Are Surprised By Closing Costs Keeping Current Matters Closing Costs California Real Estate Things To Sell

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

A Href Https Www Mortgagecalculator Org Helpful Advice Types Of Mortgages Php Epik Dj0yjnu9afdmztrplu14atn2vwhfu In 2021 Understanding Mortgages Usda Loan Mortgage

Pin By Jeannie Nicholson On Real Estate Real Estate Infographic Real Estate Tips Buying First Home

Pin By Jeannie Nicholson On Real Estate Real Estate Infographic Real Estate Tips Buying First Home

How To Estimate Closing Costs Assurance Financial

How To Estimate Closing Costs Assurance Financial

Average Closing Costs For Home Buyers In Wa State In 2021

Average Closing Costs For Home Buyers In Wa State In 2021

How To Estimate Closing Costs Assurance Financial

How To Estimate Closing Costs Assurance Financial

Closing Costs Definition Types Average Amounts

Closing Costs Definition Types Average Amounts

Did You Know That Just By Adding Color Visuals To Their Text Researchers Were Able To Increase Their Audience Buying First Home Home Buying Process Home Buying

Did You Know That Just By Adding Color Visuals To Their Text Researchers Were Able To Increase Their Audience Buying First Home Home Buying Process Home Buying

This Free Homebuyer Class Is Lead By A Washington State Certified Loan Officer To Provide Education On Home Ownership Best Mortgage Lenders Home Buying Process

This Free Homebuyer Class Is Lead By A Washington State Certified Loan Officer To Provide Education On Home Ownership Best Mortgage Lenders Home Buying Process

Home Mortgage How Much Are Closing Costs Home Mortgage Center

Closing Costs In Washington State

Closing Costs In Washington State

Closing Costs 101 Closing Costs Closer Cost

Closing Costs 101 Closing Costs Closer Cost

Afr Announces Homebuyer Program To Grant 2 Of Purchase Price 6 Of Closing Costs Closing Costs Mortgage Loans First Time Home Buyers

Afr Announces Homebuyer Program To Grant 2 Of Purchase Price 6 Of Closing Costs Closing Costs Mortgage Loans First Time Home Buyers

Homes For Sale Real Estate Listings In Usa Real Estate Tips Buying First Home Home Buying Process

Homes For Sale Real Estate Listings In Usa Real Estate Tips Buying First Home Home Buying Process

Post a Comment for "How Much Are Closing Costs For Buyer In Washington State"