How Much House Can I Afford Gross Or Net Income

Breaking it down this rule of thumb establishes that. Use this calculator to calculate how expensive of a home you can afford if you have 135k in annual income.

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Your net monthly income is your realistic income.

How much house can i afford gross or net income. Input your net after tax income and the calculator will display rentals up to 40 of your estimated gross income. Your mortgage payment should be 28 or less. The amount you can afford doesnt just depend on your salary but on your mortgage rate down payment and more.

Some programs such as the zero-down USDA mortgage have income limits on who can qualify. Look at it this way. This rule asserts that you do not want to spend more than 28 of your monthly income on housing-related expenses and not spend more than 36 of your income against all debts including your new mortgage.

Then total loan payments housing plus all other debt should not exceed 36 of your gross income. Housing expenses should be no more than 28 of your total pre-tax income. Depending on these factors you might afford a.

Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. As a general rule you should look at spending no more than a third of your monthly income after tax and deductions towards your monthly bond repayments. Youll need more income for a more expensive home.

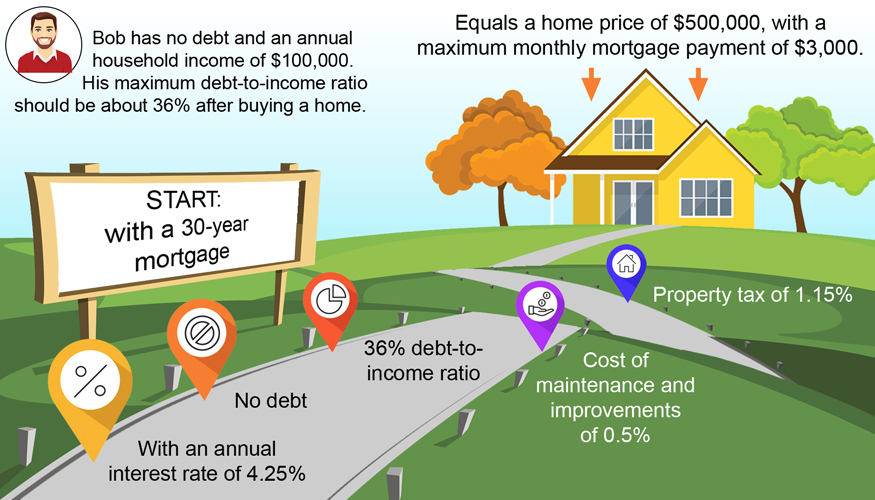

Calculate what you can afford using the Property24 Affordability Calculator. If your household income is 100000 then you can afford to spend around 2300 on your mortgage principal and interest per month. With these numbers and assuming you have good credit a score of 680 and 67 for a down payment then you should be looking at homes priced around 450000.

If you want to make sure that you can afford a monthly mortgage payment of 1500 2000 or 3000 its more realistic to consider how much. Make sure to consider property taxes home insurance and your other debt payments. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related.

The rule states that you shouldnt spend more than 28 of your monthly gross income on housing this includes principal interest taxes and insurance. Your housing expenses should be 29 or less. While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes.

Lenders may determine your ability to afford new debt by using the 2836 Rule. Use our calculator to get a sense of how much house you can afford. Buying a home is a major commitment - and expense.

While online affordability calculators give you a great start there are a ton of factors that go into whats in your budget for your first home including location savings debt and credit score. Property managers typically use gross income to qualify applicants so the tool assumes your net income is taxed at 25. How much home can I afford if I make 135000.

This is how much money you are bringing into your house each month. Make use of a bond affordability calculator to understand what you can afford when buying a property. In most parts of the country income cannot be more than 86850 to take out a.

The 28 36 rule. It may seem like a lot but it is possible to find a home you can actually afford while making just 70000 a year. Follow the 2836 debt-to-income rule.

What is the monthly payment of the mortgage loan. This includes your monthly principal and. This doesnt mean though that you should rely on gross income to determine how much of a house payment you can comfortably afford each month.

Your debt-to-income ratio DTI should be 36 or less. Below is a breakdown of the monthly payment indicating how much goes to principal to interest and the. Actual tax rates vary.

How Much House Can I Afford The Simple Dollar

How Much House Can I Afford The Simple Dollar

Looking For A New House Savannah Technical College And The Consumer Credit Co Credit Counseling Consumer Credit Counseling Service Consumer Credit Counseling

Looking For A New House Savannah Technical College And The Consumer Credit Co Credit Counseling Consumer Credit Counseling Service Consumer Credit Counseling

Ebonie Cresp Finance Iphone Good Debt 0 00 Ver 1 0 1 1 99 Tw Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Ebonie Cresp Finance Iphone Good Debt 0 00 Ver 1 0 1 1 99 Tw Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

How Much House Can I Afford Forbes Advisor

How Much House Can I Afford Forbes Advisor

Mortgage How Much Can You Borrow Wells Fargo

Mortgage How Much Can You Borrow Wells Fargo

Money Finance Rent Blog Apartment Hunting Apartment Checklist Dream Apartment

Money Finance Rent Blog Apartment Hunting Apartment Checklist Dream Apartment

Mortgage Calculator Bi Weekly Vs Monthly Mortgage Calculator Calculat Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Mortgage Calculator Bi Weekly Vs Monthly Mortgage Calculator Calculat Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

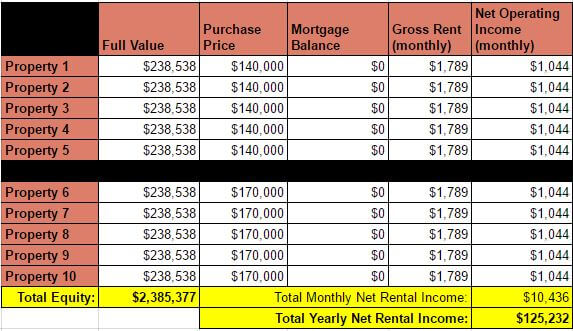

Case Study 100 000 Per Year Rental Income Coach Carson

Case Study 100 000 Per Year Rental Income Coach Carson

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford Rocket Mortgage

Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Nice Print Featu Mortgage Calculator Mortgage Amortization Mortgage

Easy To Use Closing Cost And Mortgage Calculator For Pa Home Buyers And Real Estate Agents Nice Print Featu Mortgage Calculator Mortgage Amortization Mortgage

How Much House Can I Afford Credit Com

How Much House Can I Afford Credit Com

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

How Much House Can You Afford These Mortgage Calculators Will Tell Fina Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

How Much House Can You Afford These Mortgage Calculators Will Tell Fina Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Mortgage Selector Calculator Freeandclear Mortgage Payment Calculator Mortgage Payment Mortgage

Mortgage Selector Calculator Freeandclear Mortgage Payment Calculator Mortgage Payment Mortgage

What Percentage Of Income Should Go Toward A Mortgage Quicken Loans

What Percentage Of Income Should Go Toward A Mortgage Quicken Loans

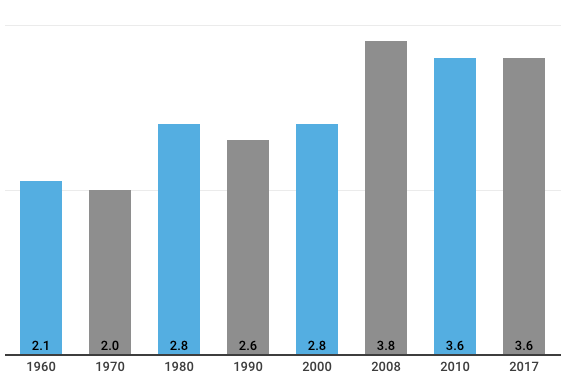

Wages Aren T Keeping Pace With Home Price Growth And It S Putting A Dent In The Housing Market Housingwire

Wages Aren T Keeping Pace With Home Price Growth And It S Putting A Dent In The Housing Market Housingwire

How Much House Can I Afford Fidelity

How Much House Can I Afford Fidelity

Should I Use Net Income Or Gross Income For Tenant Screening The Closing Docs

Should I Use Net Income Or Gross Income For Tenant Screening The Closing Docs

Post a Comment for "How Much House Can I Afford Gross Or Net Income"