How Much Mortgage Can I Afford After Selling Current Home

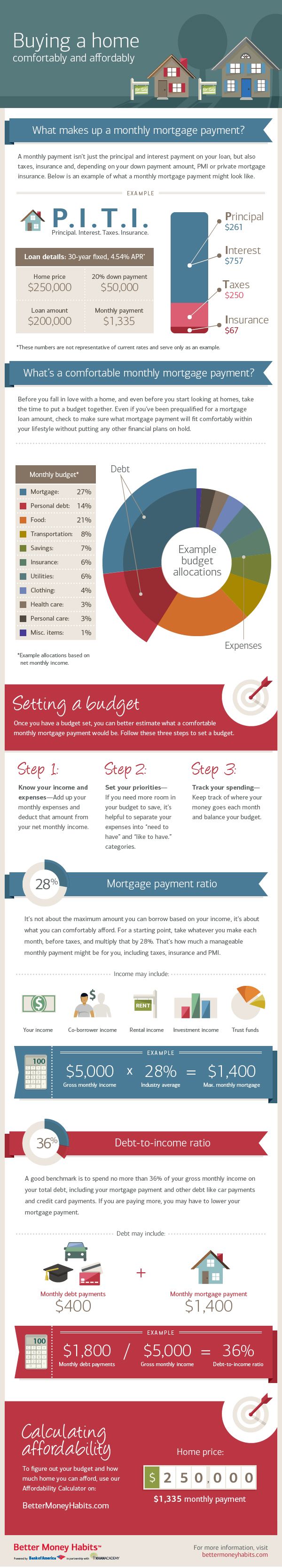

Many financial advisors would suggest following the 2836 principle. Typically lenders want your total monthly housing payment including principal.

5 Essential Home Buying Tips From A Professional Mortgage Broker Home Buying Tips Home Buying Home Mortgage

5 Essential Home Buying Tips From A Professional Mortgage Broker Home Buying Tips Home Buying Home Mortgage

In a perfect world we recommend a 20 percent down payment to avoid paying mortgage insurance.

How much mortgage can i afford after selling current home. For example lets assume that the new home you want to purchase is priced at 500000 and youll be making a 5 deposit 500000 x 005 25000. Purchase price of the new house value of mortgage initial deposit bridge loan. And you may risk missing out on the new home you.

While this is commonly accepted there are other factors that can influence how much home they can actually afford. When your current home sells you can use any excess to pay off the 10 second mortgage on the new one. The key is to determine exactly how much you still owe to make sure the sale of your current home pays off the remainder of your mortgage plus all of your selling costs.

This means that your mortgage payments shouldnt exceed 28 of your pre-tax income and your total debt shouldnt be more than 36 of your pre-tax income. Buying a new home while simultaneously selling your current home is like a well thought out choreographed dance. HOW MUCH MORTGAGE CAN I AFFORD HOW MUCH YOU CAN GET APPROVED FOR A FIRST TIME HOME BUYER Download the Winn-Dixie app.

Otherwise you could be facing a shaky financial situation where you owe more than your home is worth at closing a position that no homeowner wants to be in. Another way that most people figure how much home they can afford is to follow the rule of thumb which states that their monthly payments for the new home should not exceed 28 of their monthly gross income. By following the 2836 rule you can avoid finding yourself underwater with too much debt.

Then you make a 10 down payment. If youve been paying down your mortgage over the years youll have. Because many homeowners often have to use the sale proceeds from their current home to afford their new home attempting a new home buy before your current one sells can leave you in financial limbo.

A 20 down payment is standard if you can afford it. The amount of mortgage you can afford also depends on the down payment you make when buying a home. Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down.

First if you have rented out your home for 12 months and can show 12 months of rental income on your tax return your lender will not count your current mortgage debt toward your new mortgage. If your credit score is below 580 youll need. Borrowers who have good credit could borrow up to 80 of their homes current value with a conforming loan.

Mortgage lenders take a close look at your monthly income and debts to determine how much home you can afford. The total amount youll need to take out with a bridge loan is equal to. Put simply in a traditional sale you should be able to sell your home for more than what you currently owe on your mortgage.

Though some mortgage loans may only require as little as 35 percent down or none at all a larger down payment will have a greater impact on your monthly mortgage payment. And second you can have an appraisal done on your property and if you have sufficient equity usually at least 25 equity and a newly executed lease the lender will.

6 Ways To Buy A New Home Before Selling Your Current House

6 Ways To Buy A New Home Before Selling Your Current House

Buying A Home How Much Mortgage Can I Afford

Buying A Home How Much Mortgage Can I Afford

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

7 Great Referral Sources For Smart Loan Officers Mortgage Infographic Mortgage Infographic Mortgage Protection Insurance Mortgage Loan Officer

Home Maintenance The Best Way To Increase Your Home S Value Frederick Real Estate Online Home Values Home Buying Sell My House

Home Maintenance The Best Way To Increase Your Home S Value Frederick Real Estate Online Home Values Home Buying Sell My House

What First Time Home Buyers Need To Know From Rocket Mortgage Infographic In 2021 First Time Home Buyers Buying First Home Home Buying Process

What First Time Home Buyers Need To Know From Rocket Mortgage Infographic In 2021 First Time Home Buyers Buying First Home Home Buying Process

Can You Sell Your Home Before Paying Off Your Mortgage Smartasset

Can You Sell Your Home Before Paying Off Your Mortgage Smartasset

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford Rocket Mortgage

Pin On Alzheimer S And Dementia

Pin On Alzheimer S And Dementia

How Much Should My Mortgage Be What Mortgage Payment Can I Afford Home Buying Tips Home Ownership Home Buying

How Much Should My Mortgage Be What Mortgage Payment Can I Afford Home Buying Tips Home Ownership Home Buying

Home Affordability Calculator Money

Home Affordability Calculator Money

Tuesday Top Tips About Mortgages How Much House Can You Afford Mortgage Payoff Jumbo Loans Mortgage

Tuesday Top Tips About Mortgages How Much House Can You Afford Mortgage Payoff Jumbo Loans Mortgage

Melinda Gunther On Twitter Real Estate Buyers Rent Vs Buy Real Estate Infographic

Melinda Gunther On Twitter Real Estate Buyers Rent Vs Buy Real Estate Infographic

Are You One Of The Many Millennial Home Buyers Who Thinks You Can T Afford To Buy A House Real Estate And Home Buying Tips Home Buying Current Mortgage Rates

Are You One Of The Many Millennial Home Buyers Who Thinks You Can T Afford To Buy A House Real Estate And Home Buying Tips Home Buying Current Mortgage Rates

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home Home Buying Process First Home Buyer

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home Home Buying Process First Home Buyer

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Many Sellers Want To Move To Larger Home But Can T Real Estate Infographic Real Estate Rentals Selling Real Estate

Many Sellers Want To Move To Larger Home But Can T Real Estate Infographic Real Estate Rentals Selling Real Estate

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

What You Need To Know About The Mortgage Process The Red Door Group Scoop Mortgage Process Mortgage Payment Mortgage Help

What You Need To Know About The Mortgage Process The Red Door Group Scoop Mortgage Process Mortgage Payment Mortgage Help

Post a Comment for "How Much Mortgage Can I Afford After Selling Current Home"