Can I Afford To Refinance

Here are some typical fees you may have to pay. Quickly find the maximum home price within your price range.

Can You Afford To Wait To Buy A Home Refinance Mortgage Mortgage Best Home Loans

Can You Afford To Wait To Buy A Home Refinance Mortgage Mortgage Best Home Loans

Refinancing includes much of the same fees you paid when you first bought your home such as.

Can i afford to refinance. When your goal is to pay less every month you can refinance into a loan with a lower interest rate. Borrowers with credit scores of 620 or greater may be eligible to refinance their home but credit scores of 740 or higher receive the most favorable refinance interest rates. If you have a mortgage you must have had it for at least six months.

But remember that when it comes to affordability the amount a lender will lend you and the amount you can comfortably pay without stretching your budget too thin could be very different. Refinancing your mortgage to a lower rate can also free up some cash so you have extra emergency funds on hand if you need it. You may be able to take advantage of lower interest rates but refinancing your loan.

In 2020 closing costs for a refinance averaged nearly 3400 including taxes according to ClosingCorp a real estate data provider. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income DTI ratio. Either way take a close look at your budget and cash flow to determine exactly how much you can afford before applying for anything.

While refinancing can save you money in the long run it comes with upfront fees. The Google Translate feature is a third-party service that is available for informational purposes only. Because the interest rate is also part of your monthly payment calculation your required payment should also decrease.

The ability to borrow at a lower interest rate is a primary reason to refinance a loan. Another way to reduce the monthly payment is to. Find out what you need to meet basic refinance requirements and start saving.

This home affordability calculator provides a simple answer to the question How much house can I afford. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. A mortgage application fee which might range from 250 to 500 Origination fee about 1 of your loan value Appraisal fee 300 to 600 Make sure you know what costs to expect and whether you can afford them.

Consider the term of your new loan. The Bottom Line Refinancing a car loan is a big decision you shouldnt rush through. That lower rate assuming all other factors are equal means you pay less for your car after taking all of your borrowing costs into account.

In the previous example that owner could save nearly 100 a month by. Refinance requirements can be tricky but the rewards are often huge. The higher your credit score the lower your refinance interest rate so its beneficial to have a healthy credit score.

Refinance Your Loan. Another reason to refinance is that you can lower your monthly payment. Refinancing a mortgage can be expensive.

You may be able to get a lower interest rate to lower your payments. But like any estimate its based on some rounded numbers and rules of thumb. You can do a cash-out refinance of a home you own free and clear.

Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature.

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

Debt Refinancing New Challenges For More Tips Go To Www Therightmortgage4u Ca Money Frugal Che Refinance Mortgage Mortgage Payoff Pay Off Mortgage Early

Debt Refinancing New Challenges For More Tips Go To Www Therightmortgage4u Ca Money Frugal Che Refinance Mortgage Mortgage Payoff Pay Off Mortgage Early

Ready To Refinance 8 Steps For Success Trulia S Blog Refinance Mortgage Refinancing Mortgage Mortgage Quotes

Ready To Refinance 8 Steps For Success Trulia S Blog Refinance Mortgage Refinancing Mortgage Mortgage Quotes

Nerdwallet S Home Affordability Calculator How Much House Can I Affor Mortgage Refinance Calculator Mortgage Calculator Tools Mortgage Amortization Calculator

Nerdwallet S Home Affordability Calculator How Much House Can I Affor Mortgage Refinance Calculator Mortgage Calculator Tools Mortgage Amortization Calculator

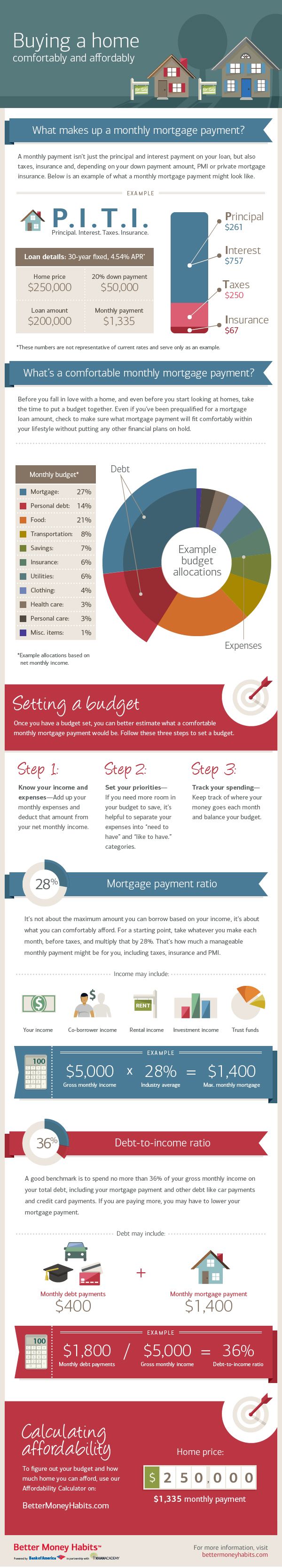

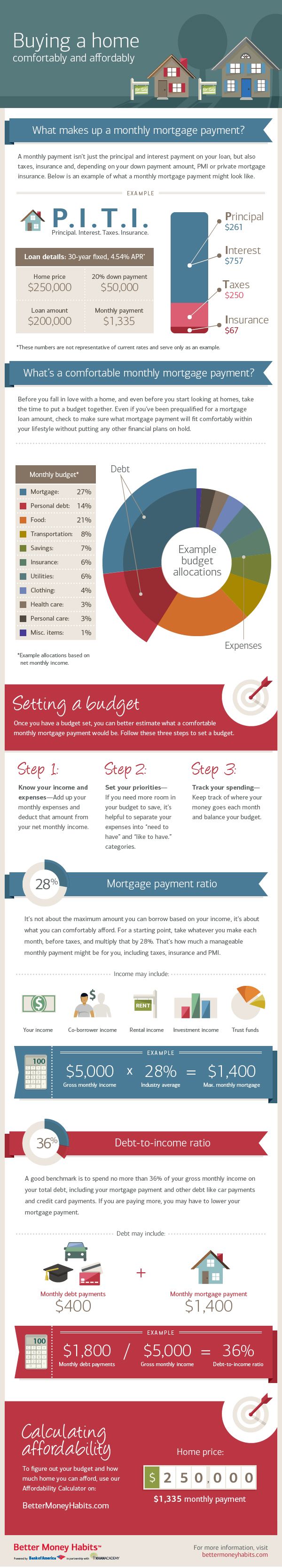

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Check Out This Great Infographic From Chase Bank About Mortgage Math Mortgage Loan Credit Refinance Loans Finan Mortgage Tips Mortgage Loans Home Buying

Check Out This Great Infographic From Chase Bank About Mortgage Math Mortgage Loan Credit Refinance Loans Finan Mortgage Tips Mortgage Loans Home Buying

Mortgage Refinance Calculator Should You Refi Freeandclear Mortgage Refinance Calculator Refinance Mortgage Refinance Calculator

Mortgage Refinance Calculator Should You Refi Freeandclear Mortgage Refinance Calculator Refinance Mortgage Refinance Calculator

Should You Refinance Your Mortgage Mortgage Tips Refinance Mortgage Mortgage Marketing

Should You Refinance Your Mortgage Mortgage Tips Refinance Mortgage Mortgage Marketing

Mortgage Calculator How Much House Can I Afford Fha Loans Home Loans Home Improvement Loans

Mortgage Calculator How Much House Can I Afford Fha Loans Home Loans Home Improvement Loans

5 Tips To Keep Your Mortgage Loan On Track Mortgage Loans Mortgage Payoff Mortgage Tips

5 Tips To Keep Your Mortgage Loan On Track Mortgage Loans Mortgage Payoff Mortgage Tips

Mortgage Rates Are Still Low Find What You Can Really Afford With This Mortgag Mortgage Loan Payment Mortgage Loan Calculator Loan Calculator Mortgage Loans

Mortgage Rates Are Still Low Find What You Can Really Afford With This Mortgag Mortgage Loan Payment Mortgage Loan Calculator Loan Calculator Mortgage Loans

Home Loan Refinance Calculator Should I Refinance Save Amount Mortgage Refinance Calculator Refinance Calculator Refinance Mortgage

Home Loan Refinance Calculator Should I Refinance Save Amount Mortgage Refinance Calculator Refinance Calculator Refinance Mortgage

I Want Your Fixer Upper Cash Out Refinance Cash Out Refinance Mortgage

I Want Your Fixer Upper Cash Out Refinance Cash Out Refinance Mortgage

How To Qualify For Fha Refinance Mortgage Loans Mortgage Loans Refinance Mortgage Fha Refinance

How To Qualify For Fha Refinance Mortgage Loans Mortgage Loans Refinance Mortgage Fha Refinance

Reasons To Refinance Your Mortgage Freeandclear Home Equity Loan Refinance Mortgage Cash Out Refinance

Reasons To Refinance Your Mortgage Freeandclear Home Equity Loan Refinance Mortgage Cash Out Refinance

Pros And Cons Of Remortgaging You Should Know Refinance Mortgage Mortgage Refinance Calculator Refinancing Mortgage

Pros And Cons Of Remortgaging You Should Know Refinance Mortgage Mortgage Refinance Calculator Refinancing Mortgage

Is It Time To Refinance Infographic For Newcastle Loans By Michelle Leatherby Business Proposal Template Real Estate Infographic Save For House

Is It Time To Refinance Infographic For Newcastle Loans By Michelle Leatherby Business Proposal Template Real Estate Infographic Save For House

Preparing For A Refinance Mortgage Mortgage Tool Refinance Options Refinance Mortgage Refinancing Mortgage

Preparing For A Refinance Mortgage Mortgage Tool Refinance Options Refinance Mortgage Refinancing Mortgage

Mortgage Refinance Calculator Should You Refinance Mortgage Refinance Calculator Refinance Mortgage Refinancing Mortgage

Mortgage Refinance Calculator Should You Refinance Mortgage Refinance Calculator Refinance Mortgage Refinancing Mortgage

Post a Comment for "Can I Afford To Refinance"