How Much House Can I Afford 45 Dti

Your actual qualifying loan amount will depend on your financial profile and your lender. You should have three months of housing payments and expenses saved up.

Home Buying Mythis Vs Facts Titlemax

Home Buying Mythis Vs Facts Titlemax

Even if a lender says you can afford a certain amount however you shouldnt borrow more than you are comfortable repaying.

How much house can i afford 45 dti. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679. If you have an average US. Or better yet 25 just like the olden days.

Household income of around 75000 a 36 DTI ratio would lead you to budget 2250 per month for housing assuming you have no other debt. Your down payment is 1578 of the homes value. The cost of the loan.

According to the results your maximum qualifying loan amount would be 34703302 which is based on a home price of 412033. 41 DTI for USDA Loans USDA Rural Development. 45-50 Debt to Income for Conforming 50 DTI with strong compensating factors otherwise 45 DTI is more common 55 DTI for a FHA Loan.

The ideal DTI ratio is around 36. Some lenders depending on the type of mortgage approve mortgages up to 45 percent DTI and some Federal Housing Administration FHA loans allow a DTI of 50 percent. This will give you the monthly payment that you can afford.

The monthly cost of property taxes HOA dues and homeowners insurance. If your current rent is. Multiply the years of your loan by 12 months to.

Your debt-to-income ratio DTI should be 36 or less. To determine how much you can afford for your monthly mortgage payment just multiply your annual salary by 028 and divide the total by 12. Youll need more income for a more expensive home.

For manually underwritten loans the maximum front-end DTI is 36 and back-end is 43. In 2017 regulators are more concerned with your bottom Debt to Income Percentage. Your debt to income ratio or DTI tells lenders how much house you can afford and how much youre eligible to you borrow.

Knowing your DTI provides a good indication of what to expect from. Your housing expenses should be 29 or less. This is for things like insurance taxes maintenance and repairs.

The Debt-to-Income Ratio In most instances your combined debt credit cards student loans alimony child support car loans and housing expenses should be less than 45 of your monthly gross income. Prequalify for a home mortgage with Wells Fargo to find out how much you may be able to borrow. Many lenders place more emphasis on the back-end ratio than the front-end ratio.

If the borrower has a strong credit score or lots of cash in reserve sometimes exceptions can be made for DTIs as high as 45 for manually underwritten loans. Quickly find the maximum home price within your price range. Find your price range and search for your dream home.

For example if you have a pre-tax monthly income of. The amount of money you borrowed. The mandatory insurance to protect your lenders investment of 80 or more of the homes value.

Wondering how much house you can afford. If your DTI is 36 percent or lower however youll have more flexibility in qualifying for different types of mortgages. In 2017 the mortgage loan company Fannie Mae increased its DTI ratio limit from 45 percent to 50 percent while the US.

In addition to these key ratios all the following will play a role. The traditional monthly mortgage payment calculation includes. Although the FHAs standard DTI maximum is usually 43.

Your DTI ratio is an important part of the how much house can I afford decision. Below are the maximum DTI Ratios the different regulators allow. Instead of basing your home-buying budget on a 36 front-end DTI ratio consider dropping that to 28.

While the maximum DTI varies by lender and mortgage type most lenders require a DTI of 36 or lower. Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. Governments Federal Housing Administration FHA offers loan programs for first-time homebuyers that require as little as a 35 percent down payment even for individuals with below-average credit scores.

The maximum DTI for a conventional loan through an Automated Underwriting System AUS is 50.

What S The Most Reliable Way To Determine How Much Mortgage Someone Can Afford Quora

What S The Most Reliable Way To Determine How Much Mortgage Someone Can Afford Quora

8 Definitive Steps To Buying A House In Maryland

8 Definitive Steps To Buying A House In Maryland

How Much House Can I Afford Based On Monthly Payment Online

How Much House Can I Afford Based On Monthly Payment Online

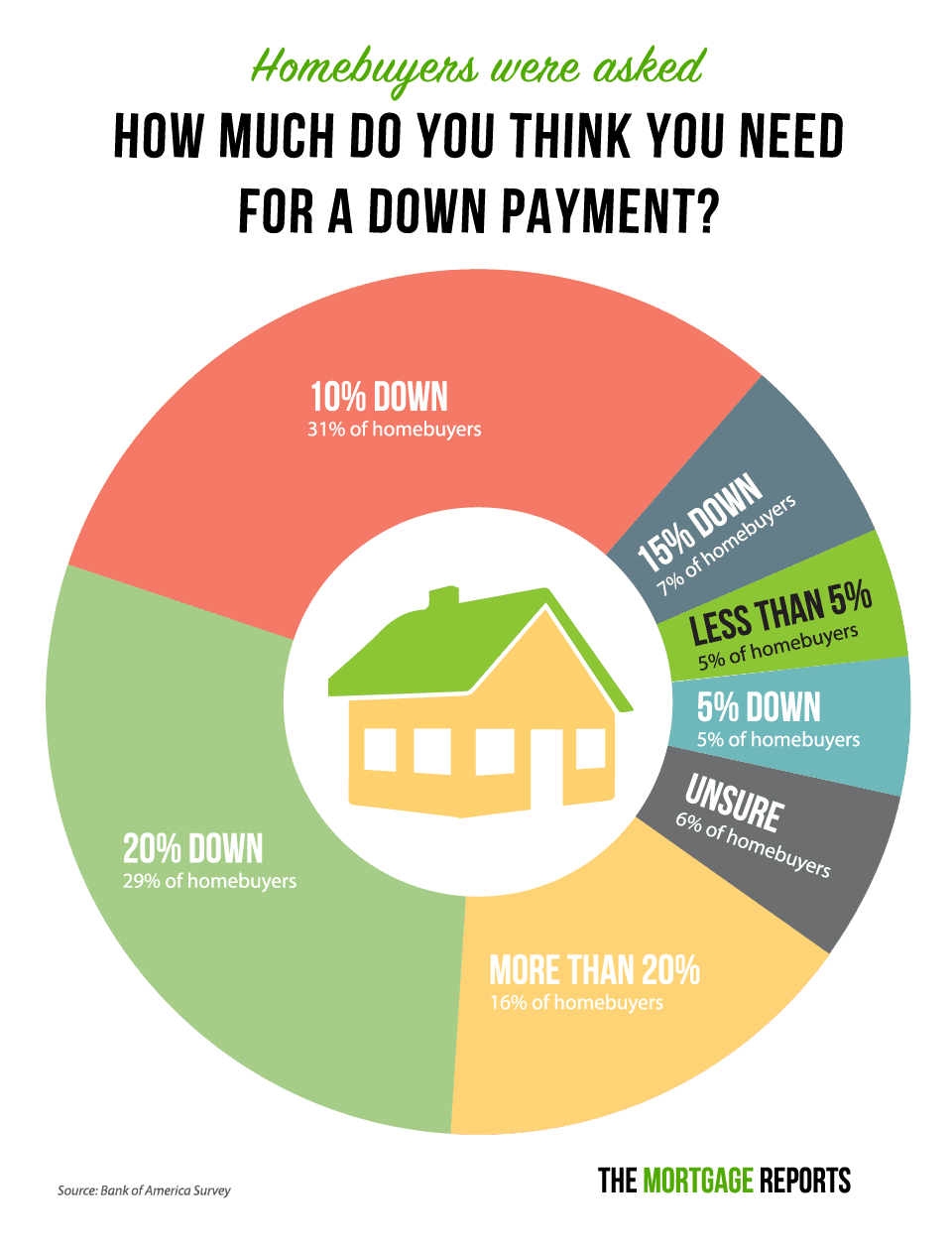

Low Down Payment Mortgage Options You Ve Never Heard Of Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Low Down Payment Mortgage Options You Ve Never Heard Of Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Housing Expense Guideline For Financial Independence

Housing Expense Guideline For Financial Independence

Two Ways To Determine How Much House You Can Afford Nerdwallet

Two Ways To Determine How Much House You Can Afford Nerdwallet

How Much House Can I Afford Forbes Advisor

How Much House Can I Afford Forbes Advisor

Closing On A House Here S How Long It Takes Forbes Advisor

Closing On A House Here S How Long It Takes Forbes Advisor

Articles By Tag North Canton Oh Real Estate For Sale Dehoff Realtors Dehoff Blog

Articles By Tag North Canton Oh Real Estate For Sale Dehoff Realtors Dehoff Blog

How Much House Can I Afford Home Affordability Spreadsheet Youtube

How Much House Can I Afford Home Affordability Spreadsheet Youtube

12 Ways To Get The Lowest Mortgage Refinance Rates

12 Ways To Get The Lowest Mortgage Refinance Rates

How To Buy A House In 11 Steps 2021 Guide

How To Buy A House In 11 Steps 2021 Guide

Dre Admin Author At Homestead Financial Mortgage

Dre Admin Author At Homestead Financial Mortgage

How Much House Can I Afford Home Affordability Spreadsheet Youtube

How Much House Can I Afford Home Affordability Spreadsheet Youtube

Debt To Income Dti Ratio And Its Importance Stem Lending

Debt To Income Dti Ratio And Its Importance Stem Lending

Post a Comment for "How Much House Can I Afford 45 Dti"