How Much House Can I Afford Based On My Net Worth

Calculate the price of a house you can buy and the mortgage you must take based on the monthly payments you can afford. Basically the formula is.

This Net Worth By Age Calculator Divides American Wealth Into Percentiles To 1 For Many Age Groups Also Net Worth Paying Off Student Loans Investing Money

This Net Worth By Age Calculator Divides American Wealth Into Percentiles To 1 For Many Age Groups Also Net Worth Paying Off Student Loans Investing Money

Buying a home is a major commitment - and expense.

How much house can i afford based on my net worth. I should be able to afford this says Mary Beth. If youre financing a car the total monthly amount you spend on transportation your car payment gas. This rule asserts that you do not want to spend more than 28 of your monthly income on housing-related expenses and not spend more than 36 of your income against all debts including your new mortgage.

If you have enough for a 20 percent down payment the maximum house you can afford is 300000. Of course huge CC debt load ginormous property taxes and the full 5 car garage needed to maintain your status with the Joneses will rapidly eat into that 500K. Use our calculator to get a sense of how much house you can afford.

The 28 36 rule. For example if your family income is 100000 your total mortgage payments including taxes and insurance should not be over 20000 per year or 1667 per month. This includes your monthly principal and.

Whether youre paying cash or financing the purchase price of your car should be no more than 35 of your annual income. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679. As a general rule you should look at spending no more than a third of your monthly income after tax and deductions towards your monthly bond repayments.

Your debt-to-income ratio DTI should be 36 or less. Total monthly mortgage payments on your home. Your housing expenses should be 29 or less.

Everyone has a net worth and while there are no hard and fast rules for how much of your net worth should lie in home ownership the general rule of thumb is about 20 to 30 percent. Lenders may determine your ability to afford new debt by using the 2836 Rule. Choose mortgage calculations for any number of years months amount and interest rate.

Quickly find the maximum home price within your price range. Make use of a bond affordability calculator to understand what you can afford when buying a property. A prudent income multiplier for home ownership is 3x gross income.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. With these numbers and assuming you have good credit a score of 680 and 67 for a down payment then you should be looking at homes priced around 450000. The above car affordability calculator uses a conservative but solid assumption about how much car you can afford.

Breaking it down this rule of thumb establishes that. Youll need more income for a more expensive home. If your household income is 100000 then you can afford to spend around 2300 on your mortgage principal and interest per month.

A 100K salary puts you in a good position to buy a home. People think Im making really good money. Based on term of your mortgage interest rate loan amount annual taxes and annual insurance.

One of the first questions you ask when you want to buy a home is how much house can I afford. For many Americans owning a home is one of the most direct significant and effective ways to increase net worth. While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes.

The 20 rule of thumb while working When someone is working my general rule of thumb is that a person should not spend more than 20 of their income on a home. Follow the 2836 debt-to-income rule. Thus you should be able to comfortably afford a 15M house.

Your mortgage payment should be 28 or less. Housing expenses should be no more than 28 of your total pre-tax income. Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income.

For example if you have a mortgage on a house with a market value of 200000 and the balance on your loan is 150000 you can add 50000 to your net worth.

What Is My Net Worth And How Do I Calculate It Budget Spreadsheet Net Worth Finance Goals

What Is My Net Worth And How Do I Calculate It Budget Spreadsheet Net Worth Finance Goals

How I Used House Hacking To Grow My Net Worth By 100 000 Mustard Seed Money Seed Money Net Worth Money Basics

How I Used House Hacking To Grow My Net Worth By 100 000 Mustard Seed Money Seed Money Net Worth Money Basics

Recommended Net Worth Allocation By Age And Work Experience

Recommended Net Worth Allocation By Age And Work Experience

How Much Of Net Worth Should Be In Your Home Retire Certain

How Much Of Net Worth Should Be In Your Home Retire Certain

How Much Of Net Worth Should Be In Your Home Retire Certain

How Much Of Net Worth Should Be In Your Home Retire Certain

Homeownership S Impact On Net Worth Keeping Current Matters Home Ownership Real Estate Infographic Florida Real Estate

Homeownership S Impact On Net Worth Keeping Current Matters Home Ownership Real Estate Infographic Florida Real Estate

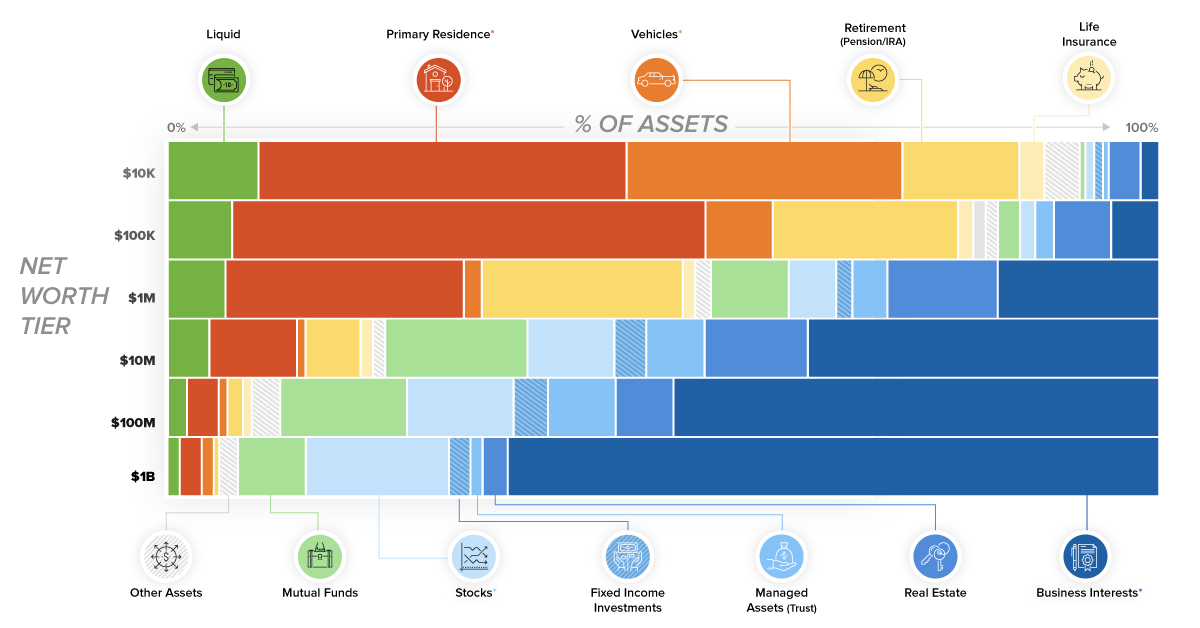

Chart What Assets Make Up Wealth

Chart What Assets Make Up Wealth

The Average Net Worth By Age For The Upper Middle Class

The Average Net Worth By Age For The Upper Middle Class

How Much House Can I Afford As A Rule Of Thumb Perfection Hangover Saving Money Frugal Living Money Saving Tips Money Makeover

How Much House Can I Afford As A Rule Of Thumb Perfection Hangover Saving Money Frugal Living Money Saving Tips Money Makeover

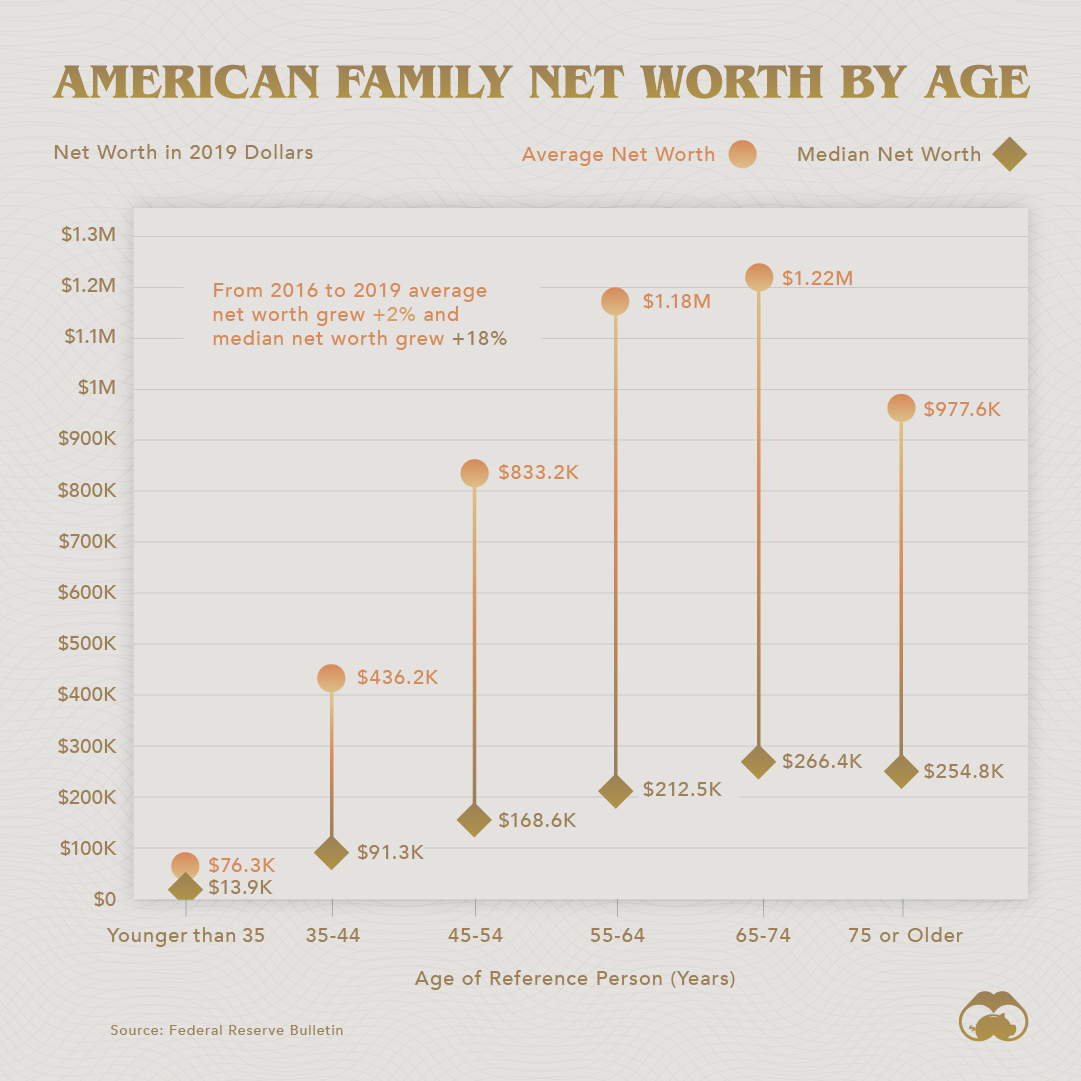

Charted Visualizing Net Worth By Age In The United States

Charted Visualizing Net Worth By Age In The United States

Charted Visualizing Net Worth By Age In The United States

Charted Visualizing Net Worth By Age In The United States

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Money Saving Tips Finance Bloggers

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Money Saving Tips Finance Bloggers

Can I Afford My Dream House Money Advice Budget Vacation Personal Finance

Can I Afford My Dream House Money Advice Budget Vacation Personal Finance

What Is Liquid Net Worth Meaning Calculating And Tracking

What Is Liquid Net Worth Meaning Calculating And Tracking

Recommended Net Worth Allocation By Age And Work Experience

Recommended Net Worth Allocation By Age And Work Experience

How Does Net Worth Work A Guide Step By Step Entrepreneur Net Worth Upper Middle Class Net

How Does Net Worth Work A Guide Step By Step Entrepreneur Net Worth Upper Middle Class Net

Average Net Worth By Age And 10 Celebrity Net Worth Revealed Net Worth Worth My Love

Average Net Worth By Age And 10 Celebrity Net Worth Revealed Net Worth Worth My Love

How Much House Can I Afford Eat Money Homeowners Insurance Home Buying Mortage

How Much House Can I Afford Eat Money Homeowners Insurance Home Buying Mortage

The Top 1 Net Worth Amounts By Age Financial Samurai

The Top 1 Net Worth Amounts By Age Financial Samurai

Post a Comment for "How Much House Can I Afford Based On My Net Worth"