Do You Pay Stamp Duty On Land Purchase In Victoria

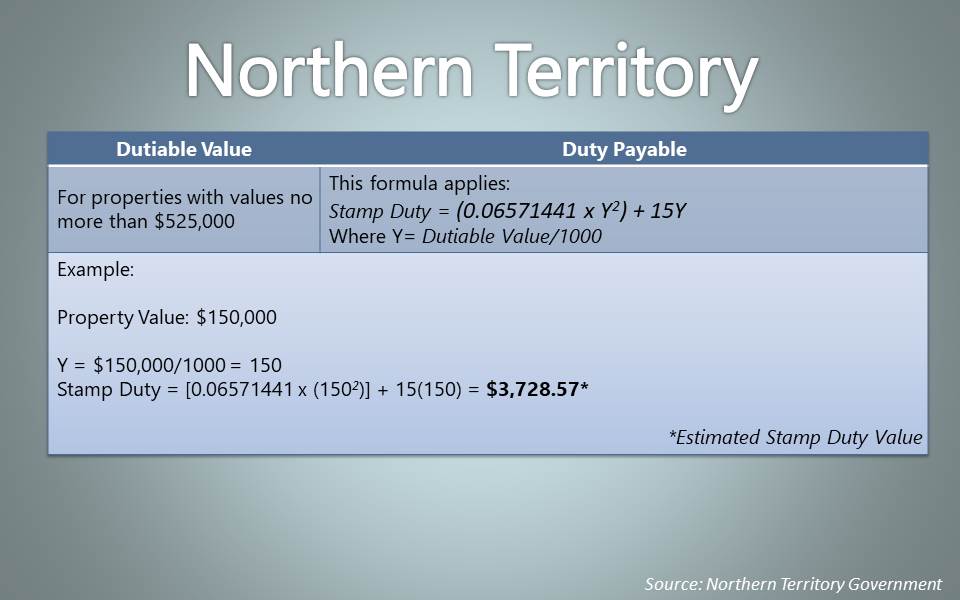

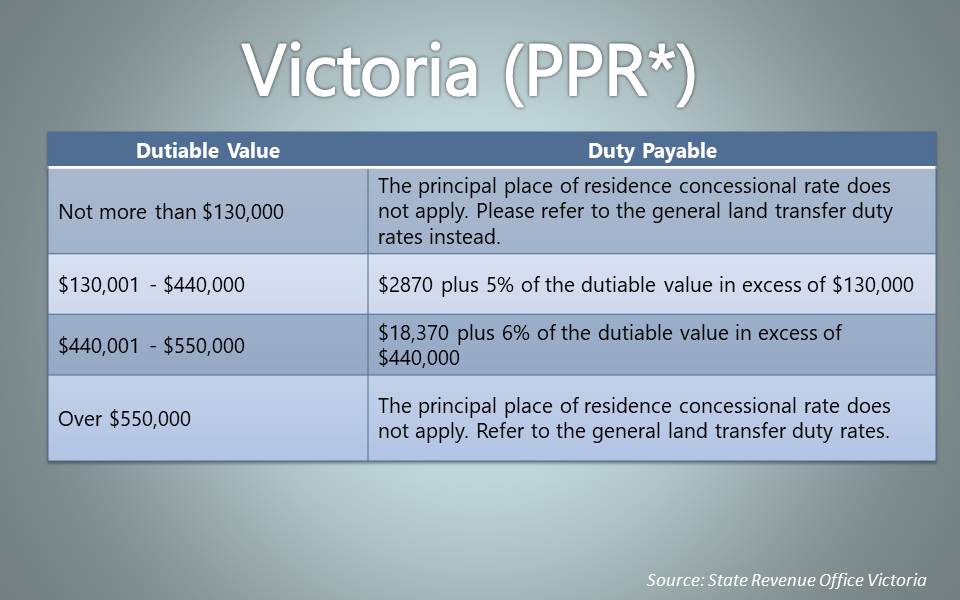

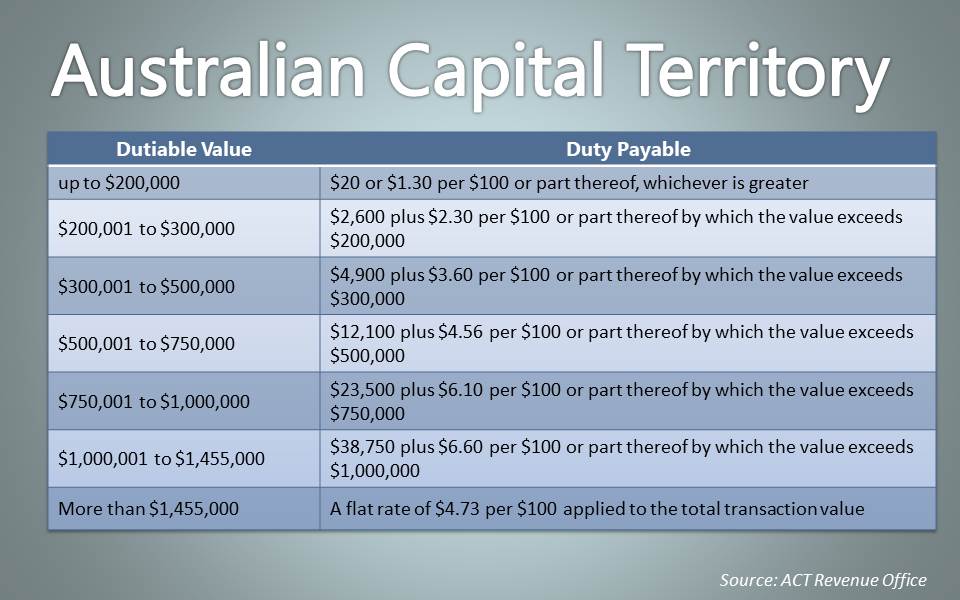

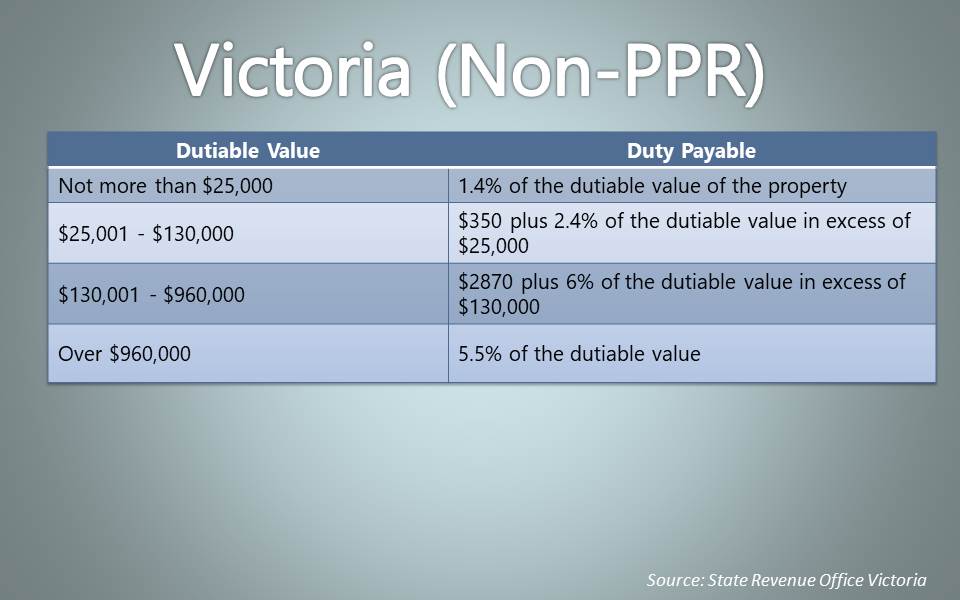

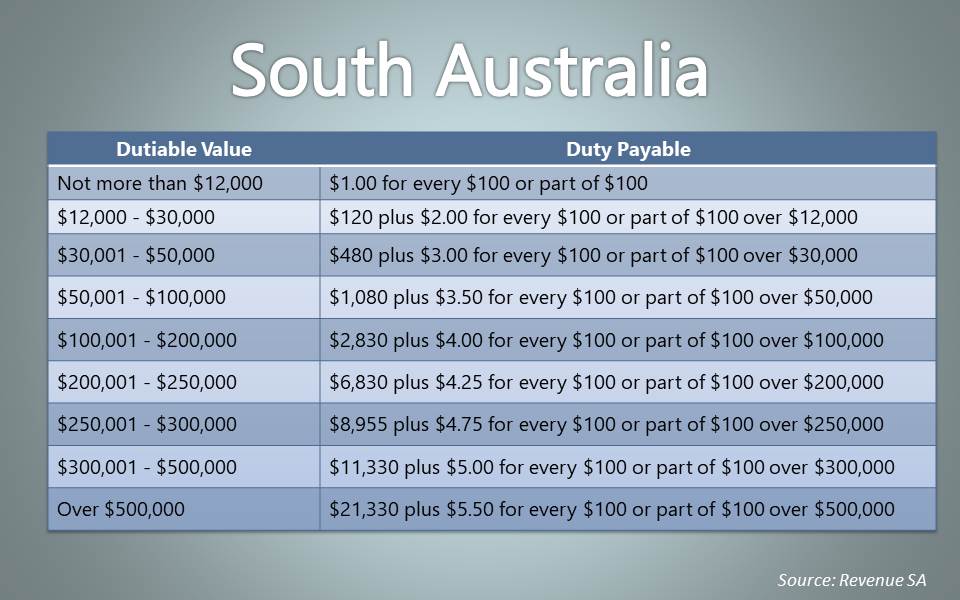

As with income tax stamp duty is not a set percentage or flat fee but is calculated according to a sliding scale. Apply for an off-the-plan concession.

Everything You Need To Know About Stamp Duty In Victoria First Things First

Everything You Need To Know About Stamp Duty In Victoria First Things First

You have five years from the date the duty was.

Do you pay stamp duty on land purchase in victoria. As a general rule of thumb though its a good idea to budget at least 4 of the purchase price of your property. To qualify for this stamp duty exemption you need to be able to fulfil the following requirements. The dutiable value of the property generally the purchase price or market value at time of contract.

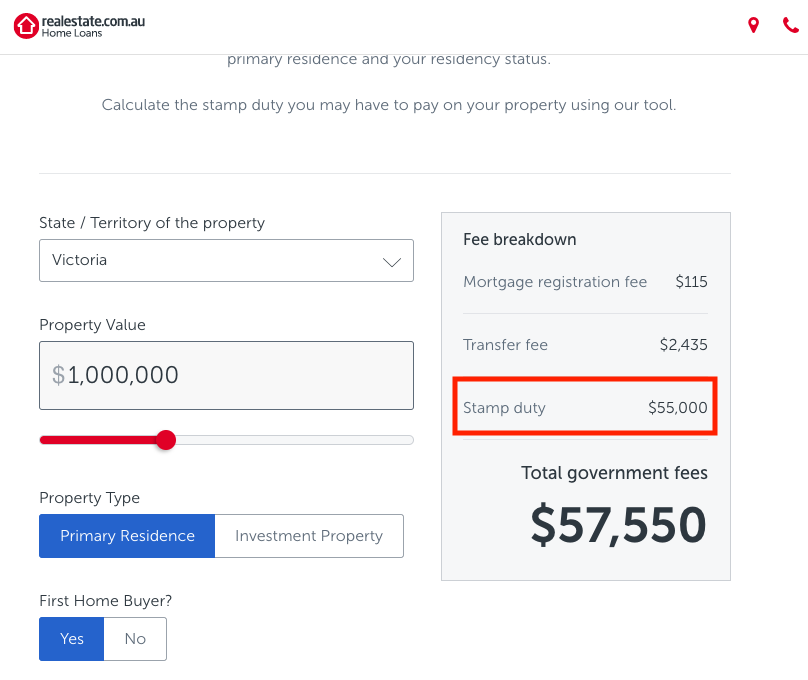

State Territory of the property. The amount of duty you pay depends on the value of your property and whether you are eligible for any exemptions or concessions or if you are a foreign purchaser. Lodge your documents for a duty assessment or duty refund.

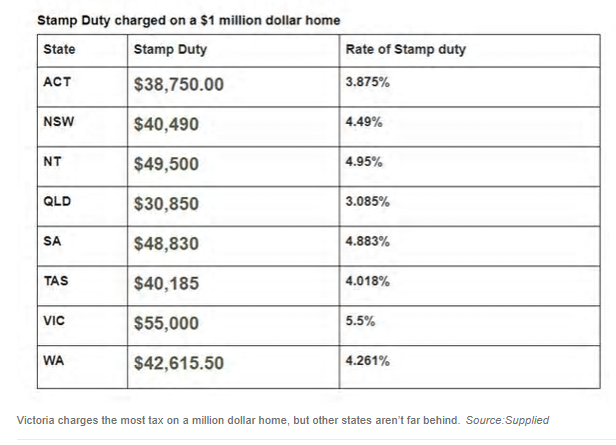

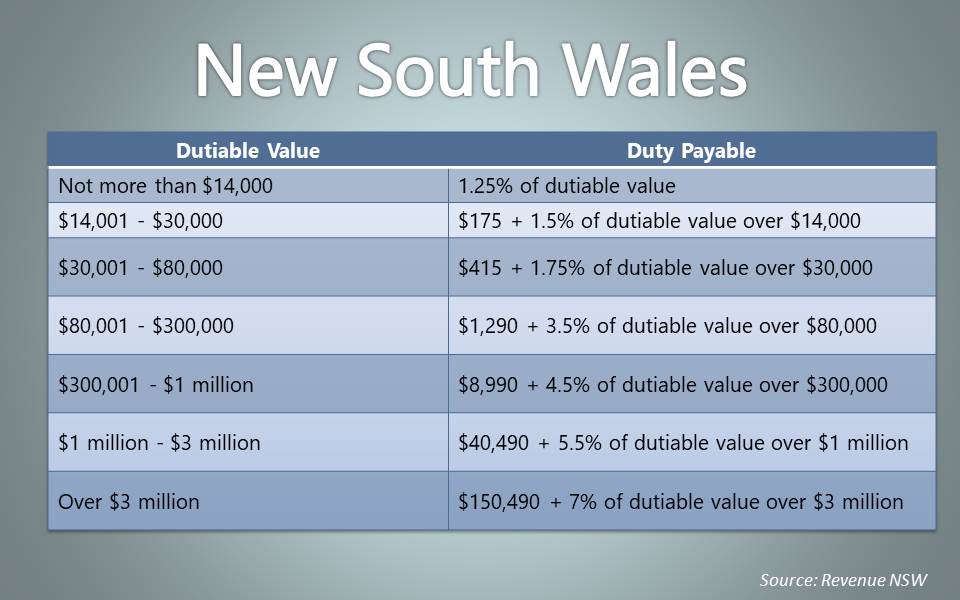

The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status. For an 800000 property in Victoria the normal stamp duty is 43070. For instance in Victoria where DCruz is based stamp duty on a property between130001 and 960000 will cost 2870 plus 6 of the value above 130000.

Stamp Duty Victoria All transfers of land including gifts attract stamp duty in Victoria. Complete a Digital Duties Form. When you buy or acquire property in Victoria including your home you pay duty on your purchase.

You pay stamp duty on your purchase. For foreigners and certain visa holders your stamp duty now shoots up to 107070 for the same property. When does it apply.

Apply for a first home buyer duty exemption concession or reduction including the 50 duty waiver. This will see stamp duty payable increase to 110000 plus 65 percent of the dutiable value in excess of 2 million. In NSW stamp duty on a property between 300001 and 1 million will.

You must pay at least the market value for your property. See VIC calculator above. Complete a purchaser statement.

Generally this means you must pay the duty within 30 days of settlement on the land and apply for a refund if your home is constructed within three-years of buying the land. This is simply the purchase price or the propertys value on the open market whichever is greatest. Land must be primarily used for primary production purposes The exemption is only available with respect to land that is deemed to be farming land.

Stamp duty will rise from 55 per cent to 65 per cent for those purchasing any property over 2 million and a land tax increase from 225 per cent to 255 per cent for properties valued over 3 million. The date of the contract for your property purchase or if there is no contract the date it is transferred. 2 hours agoIt was announced over the weekend that the Victorian Government will seek to increase stamp duty and land tax from July 1.

Contracts signed on or after 1 July 2017. Unless an exemptions or concession applies the transaction is charged with land transfer duty based on the greater of the market value of the property or the consideration price paid - including any GST. Calculate the stamp duty you may have to pay on your property using our tool.

Land transfer stamp duty calculator. To get a sense of how much youll need to pay in Victoria use the Victorian State Revenue Office Land Transfer Stamp duty calculator. In Victoria you will pay stamp duty known as land transfer duty when you purchase a home or investment property.

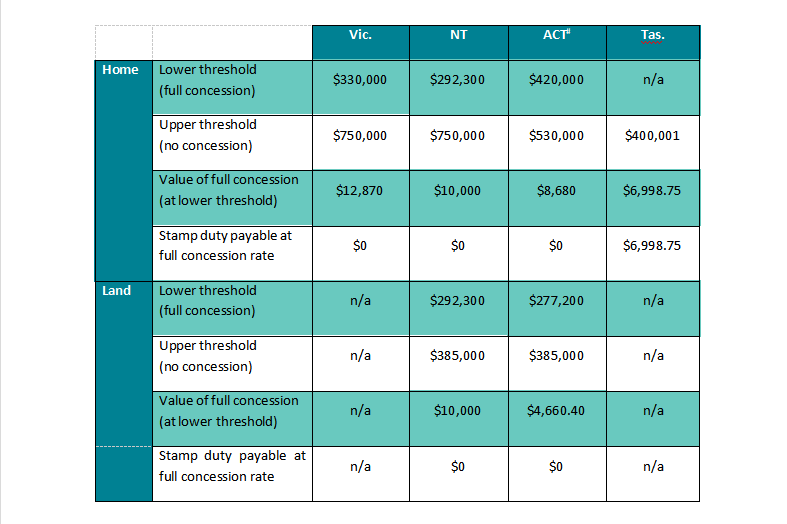

Stamp duty will not be payable when the family farm is transferred between family members. This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. In November 2020 changes to Victorian stamp duty were introduced that meant that buyers can now access discounts of up to 27500.

Stamp duty or land transfer duty as its often known in Victoria is calculated on the dutiable value of your property. If your contract price is less than market value the concession does not apply and duty will be assessed on the propertys value at the time you entered into the contract. 1 hour agoAlong with the changes to the land tax the Victoria government will introduce a premium stamp duty rate for property transactions exceeding 2 million.

Fortunately there are concessions and exemptions to help keep costs down for first home buyers. When you buy or acquire a property you will most likely have to pay land transfer duty commonly called stamp duty. On a property like this the stamp duty and land tax increase would make a massive difference Ms Wallace said.

From July 1 a buyer spending 247m would pay an additional 24700 in stamp duty compared to those who buy before then.

Stamp Duty Calculator Vic Stamp Duty Rates Mozo

Stamp Duty Calculator Vic Stamp Duty Rates Mozo

A Guide To Stamp Duty In Victoria A Guide To Stamp Duty In Victoria

A Guide To Stamp Duty In Victoria A Guide To Stamp Duty In Victoria

Stamp Duty Concessions Across Australia National Seniors Australia

Stamp Duty Concessions Across Australia National Seniors Australia

First Home Buyer Stamp Duty Hunter Galloway

First Home Buyer Stamp Duty Hunter Galloway

Nsw Vic Caught In Stamp Duty Doom Loop Macrobusiness

Nsw Vic Caught In Stamp Duty Doom Loop Macrobusiness

Discretionary Family Trust Buying Residential Property Victoria Stamp Duty

Discretionary Family Trust Buying Residential Property Victoria Stamp Duty

Victorian First Home Buyers Information Hfinance

Victorian First Home Buyers Information Hfinance

Eye Tee Excel Formula For Calculating Stamp Duty In Victoria Australia That D Be Where Melbourne And Good Coffee Is

Eye Tee Excel Formula For Calculating Stamp Duty In Victoria Australia That D Be Where Melbourne And Good Coffee Is

Vic Stamp Duty Calculator 2020 Land Transfer Duty

Vic Stamp Duty Calculator 2020 Land Transfer Duty

What Do I Need To Know About Stamp Duty Before I Buy A Home In Victoria Wakefield Vogrig Boote Lawyers

What Do I Need To Know About Stamp Duty Before I Buy A Home In Victoria Wakefield Vogrig Boote Lawyers

Stamp Duty Victoria Vic Stamp Duty Calculator

Stamp Duty Victoria Vic Stamp Duty Calculator

Post a Comment for "Do You Pay Stamp Duty On Land Purchase In Victoria"