How Much Mortgage Can I Afford If I Make 150k

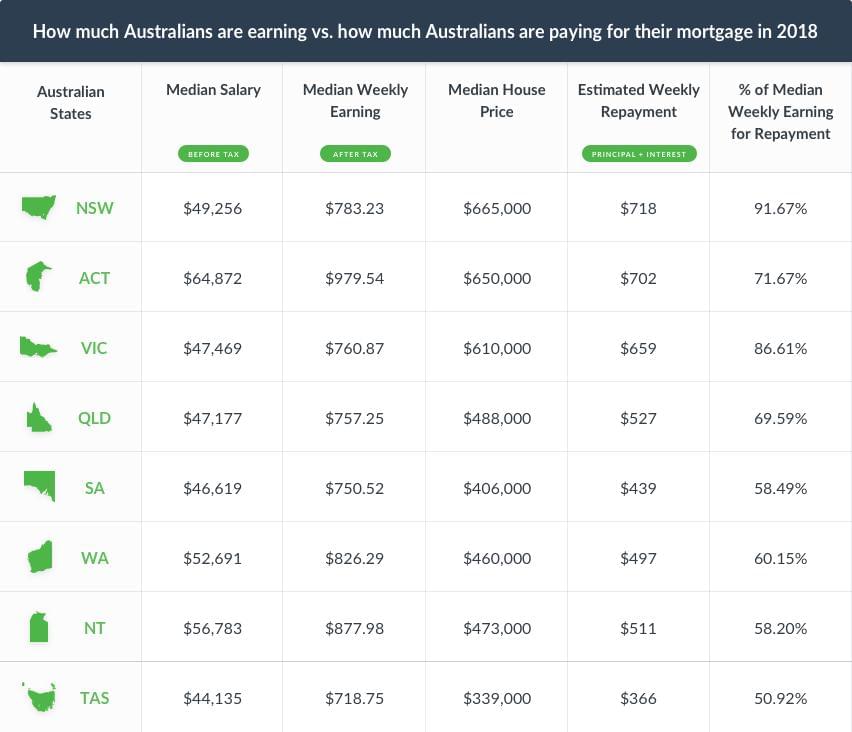

Thus in doing our calculations here we assumed 2 percent for insurance and property tax and 34 percent for principal and interest. This home affordability calculator provides a simple answer to the question How much house can I afford.

The Ideal Mortgage Amount Is 750 000 If You Can Afford It

The Ideal Mortgage Amount Is 750 000 If You Can Afford It

FHA sets the single family forward mortgage limits by Metropolitan Statistical Area and county.

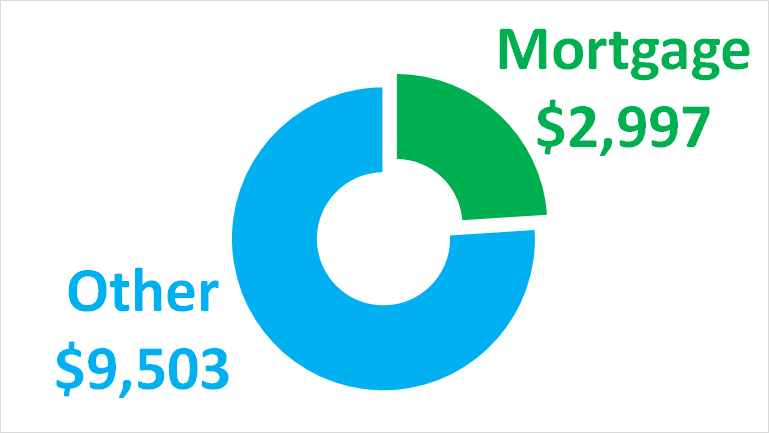

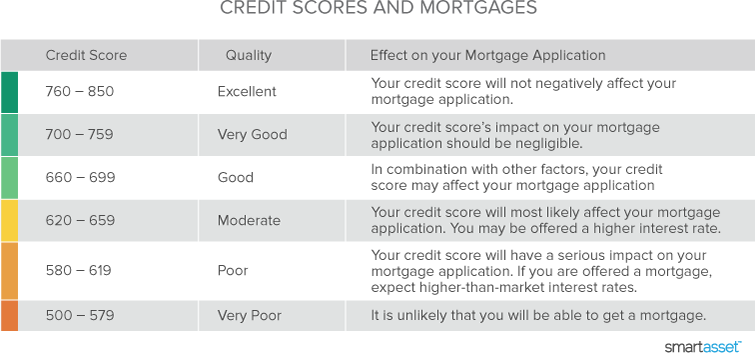

How much mortgage can i afford if i make 150k. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your. After plugging in these numbers HomeLight estimates that you can afford a home that costs 173702 with monthly payments of 1350. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 150000 to cover the total cost of debt payment s insurance and property tax.

Consider all your earnings for the year which could include salary wages tips commission etc. One of the first questions you ask when you want to buy a home is how much house can I afford. This limit differs based on county and the amount you enter may exceed the limit for your area.

Use this calculator to calculate how expensive of a home you can afford if you have 150k in annual income. Your housing expenses should be 29 or less. 51 rows To afford a house that costs 150000 with a down payment of 30000 youd need to earn.

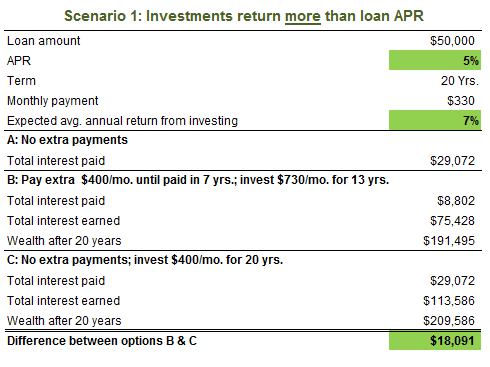

But like any estimate its based on some rounded numbers and rules of thumb. A typical rule of thumb is you should not put more than 36 percent of your income toward debts mortgage payments car payments and credit card payments 31 percent toward taxes and then have 33 percent for everything else including savings or investments. A mortgage payment calculator is a powerful real estate tool that can help you do more than just estimate your monthly payments.

You also have to be able to afford the monthly mortgage payments however. Depending on these factors you might afford a. Make sure to consider property taxes home insurance and your other debt payments.

Use our home affordability calculator with amortization schedule below to get a more accurate estimate. Your debt-to-income ratio DTI should be 36 or less. Your mortgage payment should be 28 or less.

Assess down payment scenarios. Thats a 120000 to 150000 mortgage at 60000. How to CalculateOn this video I cover a few simple calculations to help you determine how much of a mortgage you can afford.

- If you make 60000 a year you can afford a house around 335307 not including taxes and insurance. Adjust your down payment size to see how much it. Lets break down how everything factors in.

In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes. The amount you can afford doesnt just depend on your salary but on your mortgage rate down payment and more. The house affordability calculator will estimate how much home you can afford if you make 60000 a year with options to include property.

Here are some additional ways to use our mortgage calculator. While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes. FHAs 2019 floor of 314827 is set at 65 of the national conforming loan limit of 484350.

Some lenders will accept 30000 and a minority of them will offer you a loan of this amount if you earn 25000. A 100K salary puts you in a good position to buy a home. Quickly find the maximum home price within your price range.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. So to borrow 150000 at most lenders the combined salary of everyone who is going on the mortgage would need to be 37500. Your total mortgage payment should be no more than 28 of your gross monthly income Your total debt payments existing plus the new mortgage should be no more than 40 of your gross monthly income.

How Much Mortgage Can I Afford.

What Mortgage Can I Afford On 150k Online

150k Mortgage Mortgage On 150k Bundle

150k Mortgage Mortgage On 150k Bundle

Can You Get A 200 000 Mortgage With 20 000 Income Quora

How Much Mortgage Can I Afford Smartasset Com

How Much Mortgage Can I Afford Smartasset Com

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

Should You Pay Off Student Loans Early Money Under 30

Should You Pay Off Student Loans Early Money Under 30

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

How Much To Save For A House What You Need To Know Credit Com

How Much To Save For A House What You Need To Know Credit Com

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

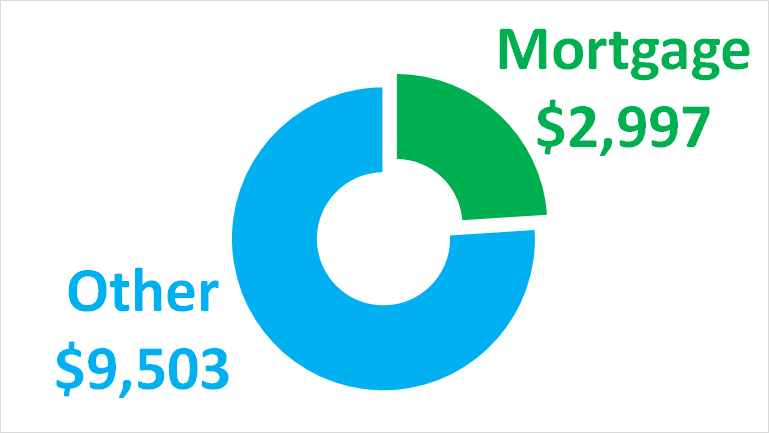

Here S The Budget Of A Couple Who Earns 150 000 And Tithes

I M A First Time Buyer Do I Earn Enough To Get A Mortgage Help To Buy Scheme The Guardian

I M A First Time Buyer Do I Earn Enough To Get A Mortgage Help To Buy Scheme The Guardian

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

Why Households Need 300 000 To Live A Middle Class Lifestyle

Why Households Need 300 000 To Live A Middle Class Lifestyle

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

How Much House Can I Afford Do The Math To Find Out The Truth About Mortgage

How Much House Can I Afford Do The Math To Find Out The Truth About Mortgage

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

The Ideal Mortgage Amount Is 750 000 If You Can Afford It

The Ideal Mortgage Amount Is 750 000 If You Can Afford It

I Make 150 000 A Year How Much House Can I Afford Bundle

I Make 150 000 A Year How Much House Can I Afford Bundle

Post a Comment for "How Much Mortgage Can I Afford If I Make 150k"