How Much Can Afford Mortgage

If your home is valued between 500000 and 1 million the minimum down payment is 5 on the first 500000 and 10 on the anything more than that. If you dont already have one now is the time to create it.

How Much House Can You Afford Money Under 30 Buying Your First Home Home Mortgage Mortgage

How Much House Can You Afford Money Under 30 Buying Your First Home Home Mortgage Mortgage

While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes.

How much can afford mortgage. Youll need to know your take-home income as well as your fixed expenses each month such as your car payment insurance cell. See how much home you can afford in 5 minutes. Some loans like VA loans.

If you have enough for a 20 percent down payment the maximum house. Figure out what you can afford to spend each month. Your debt-to-income ratio DTI should be 36 or less.

This home affordability calculator provides a simple answer to the question How much house can I afford. I Make 78000 a Year How Much Rent Can I Afford. So taking into account homeowners insurance and property taxes youd be better off sticking to a mortgage of 240000 or less.

In order to be approved for a mortgage you will need at least 5 of the purchase price as a down payment if your purchase price is within 500000. How Much House Can I Afford. Save your down payment if needed.

For down payments of less than 20 home buyers are required to purchase mortgage default insurance. The Right Way to Buy a Home. How to calculate mortgage payments Home price.

Paul and Grace can afford to make a down payment of 7000 just over 5 of the home value which means theyll need a mortgage of about 128000. A typical rule of thumb is you should not put more than 36 percent of your income toward debts mortgage payments car payments and credit card payments 31 percent toward taxes and then have 33 percent. For homes that cost over 1000000 the minimum down payment is 20.

Improve your finances andor credit score if necessary. Determine the size of your down payment and where youll get it. Most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36.

For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. Your mortgage payment should be 28 or less. For homes that cost between 500000 and 1000000 the minimum down payment is 5 of the first 500000 plus 10 of the remaining balance.

Heres the right way to buy a home. -- The sum of the monthly mortgage and monthly tax payments must be less than 31 of your gross pre-taxes monthly salary. Your salary must meet the following two conditions on FHA loans.

For a home valued 1 million and above a. You can afford up to 2340 per month on rent. If your purchase price is between 500000 and 1000000 your minimum down payment is 5 of the first 500000 and 10 of the price between 500000 and 1000000.

Some landlords do not accept tenants with more than 13 of gross income on rent which is 2145. In Ann Arbor their mortgage tax and insurance payments will be around 950 dollars a month. Estimate how much home you can afford with our affordability calculator.

Quickly find the maximum home price within your price range. But like any estimate its based on some rounded numbers and rules of thumb. The first step in figuring out how much you can afford is looking at your budget.

APR can help you understand the total cost of a mortgage if you keep it for the entire term. How much do you have left over to put toward a mortgage. -- The sum of the monthly mortgage monthly tax and other monthly debt payments must be less than 43 of your gross pre-taxes monthly salary.

However it is recommended to keep rental fee below 1820 per month. If youre buying a home valued up to 500000 your down payment needs to be at least 5. Adjust the loan terms to see your estimated home price loan amount down payment and monthly payment change as well.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. Simply enter your monthly income expenses and expected interest rate to get your estimate. Most home loans require at least 3 of the price of the home as a down payment.

Keep in mind that the APR is often higher than the interest rate. Combined with their debt payments that adds up to 1200 or around 34 of their income. Your housing expenses should be 29 or less.

The price is either the amount you paid for a home or the amount you may pay for a future home purchase.

How Much House Can I Afford Buying First Home Mortgage Marketing Buying Your First Home

How Much House Can I Afford Buying First Home Mortgage Marketing Buying Your First Home

Mortgage Calculator How Much Should You Spend On Monthly Home Costs Calculate It With This Download Landmark H Buying First Home Home Buying Home Buying Tips

Mortgage Calculator How Much Should You Spend On Monthly Home Costs Calculate It With This Download Landmark H Buying First Home Home Buying Home Buying Tips

How Much House Can I Afford As A Rule Of Thumb Perfection Hangover Saving Money Frugal Living Money Saving Tips Money Makeover

How Much House Can I Afford As A Rule Of Thumb Perfection Hangover Saving Money Frugal Living Money Saving Tips Money Makeover

Wonder How Much Of A Mortgage You Can Afford This Mortgage Affordability Calculator Will Show You How Much You Can Afford Mortgage Mortgage Info Mortgage Tips

Wonder How Much Of A Mortgage You Can Afford This Mortgage Affordability Calculator Will Show You How Much You Can Afford Mortgage Mortgage Info Mortgage Tips

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Tools Mortgage Payoff Mortgage Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Tools Mortgage Payoff Mortgage Calculator

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Top Mortgage Lenders Mortgage Lenders

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Top Mortgage Lenders Mortgage Lenders

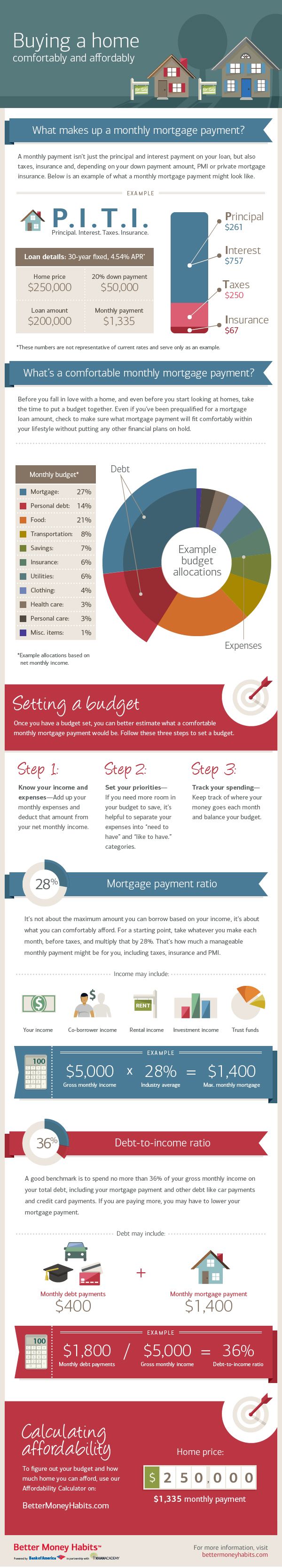

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

How Much House Can I Afford Home Buying This Or That Questions Affordable

How Much House Can I Afford Home Buying This Or That Questions Affordable

Mortgage Affordability Calculator How Much House Can I Afford In 2021 Buying Your First Home Home Buying Tips Mortgage

Mortgage Affordability Calculator How Much House Can I Afford In 2021 Buying Your First Home Home Buying Tips Mortgage

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Interest Only Mortgage Smart Money

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Interest Only Mortgage Smart Money

How Much House Can You Afford Mortgage Loans Mortgage Marketing Mortgage Quotes

How Much House Can You Afford Mortgage Loans Mortgage Marketing Mortgage Quotes

How Much Home Can I Afford Mortgage Affordability Calculator Free Mortgage Calculator Mortgage Mortgage Payment Calculator

How Much Home Can I Afford Mortgage Affordability Calculator Free Mortgage Calculator Mortgage Mortgage Payment Calculator

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

How Much House Can I Afford Insider Tips And Home Affordability Calculator Buying First Home Home Buying Process Home Buying Tips

How Much House Can I Afford Insider Tips And Home Affordability Calculator Buying First Home Home Buying Process Home Buying Tips

How Much Mortgage Can I Afford Based On Rent Calculator Freeandclear Mortgage Calculator Mortgage Payment Calculator Mortgage

How Much Mortgage Can I Afford Based On Rent Calculator Freeandclear Mortgage Calculator Mortgage Payment Calculator Mortgage

How Much Can You Afford Bmp Kellerwilliams Kingman Lakehavasu Bhc Vegas Bmp Bmpnetwork Reales How To Find Out Home Buying Mortgage Loan Originator

How Much Can You Afford Bmp Kellerwilliams Kingman Lakehavasu Bhc Vegas Bmp Bmpnetwork Reales How To Find Out Home Buying Mortgage Loan Originator

How Much House Can I Afford Home Affordability Calculator Zillow Mortgage Loan Calculator Mortgage Amortization Calculator Online Mortgage

How Much House Can I Afford Home Affordability Calculator Zillow Mortgage Loan Calculator Mortgage Amortization Calculator Online Mortgage

Mortgage Affordability Calculator How Much House Can I Afford Buying Your First Home Mortgage Home Buying Tips

Mortgage Affordability Calculator How Much House Can I Afford Buying Your First Home Mortgage Home Buying Tips

How Much House Can You Afford Bankrate Com Offers A New House Calculator To Help You Determine What Monthly Payment You Ca Bankrate Com New Homes Good To Know

How Much House Can You Afford Bankrate Com Offers A New House Calculator To Help You Determine What Monthly Payment You Ca Bankrate Com New Homes Good To Know

Post a Comment for "How Much Can Afford Mortgage"