How Much Mortgage Can I Get In Germany

You are eligible for more than 100 financing if you live and work in Germany. Moreover the German mortgage system is very different from.

Germany Long Term Interest Rate 1993 2021 Data

It is possible to get a mortgage to buy property in Germany.

How much mortgage can i get in germany. How much loan mortgage can I afford. Find out how much you can borrow. So if you get a mortgage to buy real estate in Germany approved by a bank you can be sure you really can afford it.

Although some lenders will allow you to borrow up to 100 of the property value if youre not a German citizen. The purchase fees notary purchase tax and property agent fee should be available in cash. However if youre not an official resident you might find that youre only offered a relatively low mortgage amount in the region of 60 of the property price.

7 rows In many cases KfWs home loan programs offer a lower interest rate in Germany which can lower. While some German banks will be willing to finance the full amount loans of around 80 are more common. Mortgages for EU citizens.

Reducing your mortgage payments. Over 90 of mortgages in Germany are fixed interest mortgages whilst the default length is 10 years most Germans prefer longer fixed interest periods to accommodate their risk aversion. Some lenders however might ask you for a larger upfront deposit.

The borrowing amount we show in our mortgage calculator is based on 4x income. 119 loan to value mortgages are obtainable with the right circumstances. In Germany it is much more common to lock in a mortgage for a longer term period.

It is quite normal for German lenders to expect you to pay around 20 of the purchase out of your own pocket. Mortgages in Germany tend to have longer fixed periods than some European countries with 10 and 15-year terms being the most common. Your residency status has an impact on the maximum loan amount you can borrow from German lenders.

Why refinance your mortgage in Germany. For this reason to get a mortgage you have to apply with documents making clear you have enough household income a stable financial history and so forth and are very likely to be able to afford your mortgage rates in the future. This of course does not include closing costs.

This amount can be 100 of the purchase price. As a rule of thumb you just have to multiply your monthly net income times 100 and you have the maximum loan amount most banks will provide to you. For others the only additional paper to bring to the table is a residency permit which runs longer than the full duration of the loan.

The most common type of home loans in the German market tend to have a fixed interest rate for 10 years although 15 or even 20 years are also readily available. If you are an EU national you can generally expect the same borrowing limits as German citizens ie. However 100 plus max.

If you were using a mortgage lender in Germany most lenders will offer loans at 80. There are several reasons why homeowners in Germany look to refinance their mortgages. However if you are non-resident you can only borrow up to 60 of the total value of the loan in Germany instead up to 80 for residents.

And if you live and work abroad you may receive financing of up to 70 to 80 of the property value. You can use the fund to cover land acquisition construction costs and ancillary costs or purchase cooperative shares to obtain membership of a housing cooperative. This will mean that you may need to pay up to 40 of the purchase price upfront as a deposit which is a hefty amount.

You can borrow up to 50000 at a discount interest rate that is usually lower than what most mortgage lenders offer. Here are the main ones. Mortgage lenders in Germany allow you to borrow up to 100 of the property value although you will have to cover some other costs of buying a house such as purchase fees with your own equity.

Some lenders will allow you to borrow multipliers of your salary slightly lower or higher than this but we think this represents a mid-point to give you a good indication of how much you may be able to borrow. The shortest possible option is normally 5 years. Up to 100 of the property value.

Germany Manufacturing Britannica

Germany Manufacturing Britannica

Map Of Divided Germany Berlin Germany Map Divided Germany East Germany

Map Of Divided Germany Berlin Germany Map Divided Germany East Germany

City Maps Stadskartor Och Turistkartor Travel Portal City Maps Germany Map Germany Travel

City Maps Stadskartor Och Turistkartor Travel Portal City Maps Germany Map Germany Travel

Pin On Test Manager Infographics

Pin On Test Manager Infographics

Real Estate In Germany For Sale Tranio

Real Estate In Germany For Sale Tranio

A Week In Munich Germany On A 50 645 Salary Refinery29 Germany Munich Munich Germany

A Week In Munich Germany On A 50 645 Salary Refinery29 Germany Munich Munich Germany

The Eurozone Crisis Germany S Folly Germany Ireland Greece Iceland Usa By The Sun Is Up Polandball Coun Funny Art Memes Country Jokes Funny Scenes

The Eurozone Crisis Germany S Folly Germany Ireland Greece Iceland Usa By The Sun Is Up Polandball Coun Funny Art Memes Country Jokes Funny Scenes

Great To Get Nice Feedback Happy Forsale Realty Realestate Househunting Real Luxury Real Estate Realty Germany Travel

Great To Get Nice Feedback Happy Forsale Realty Realestate Househunting Real Luxury Real Estate Realty Germany Travel

One Day Itinerary For Heidelberg Germany All About Rosalilla Germany Travel Europe Trip Itinerary Europe Travel Guide

One Day Itinerary For Heidelberg Germany All About Rosalilla Germany Travel Europe Trip Itinerary Europe Travel Guide

Major German Coop Bank Passes Negative Interest Rates To Customers Read Here Http Bit Ly 35k4rd6 Life Insurance Companies Bitcoin Business Best Insurance

Major German Coop Bank Passes Negative Interest Rates To Customers Read Here Http Bit Ly 35k4rd6 Life Insurance Companies Bitcoin Business Best Insurance

What Not To Do In Germany Simple Survival Tips For Enjoying German Culture Primitive Survival Germany Survival

What Not To Do In Germany Simple Survival Tips For Enjoying German Culture Primitive Survival Germany Survival

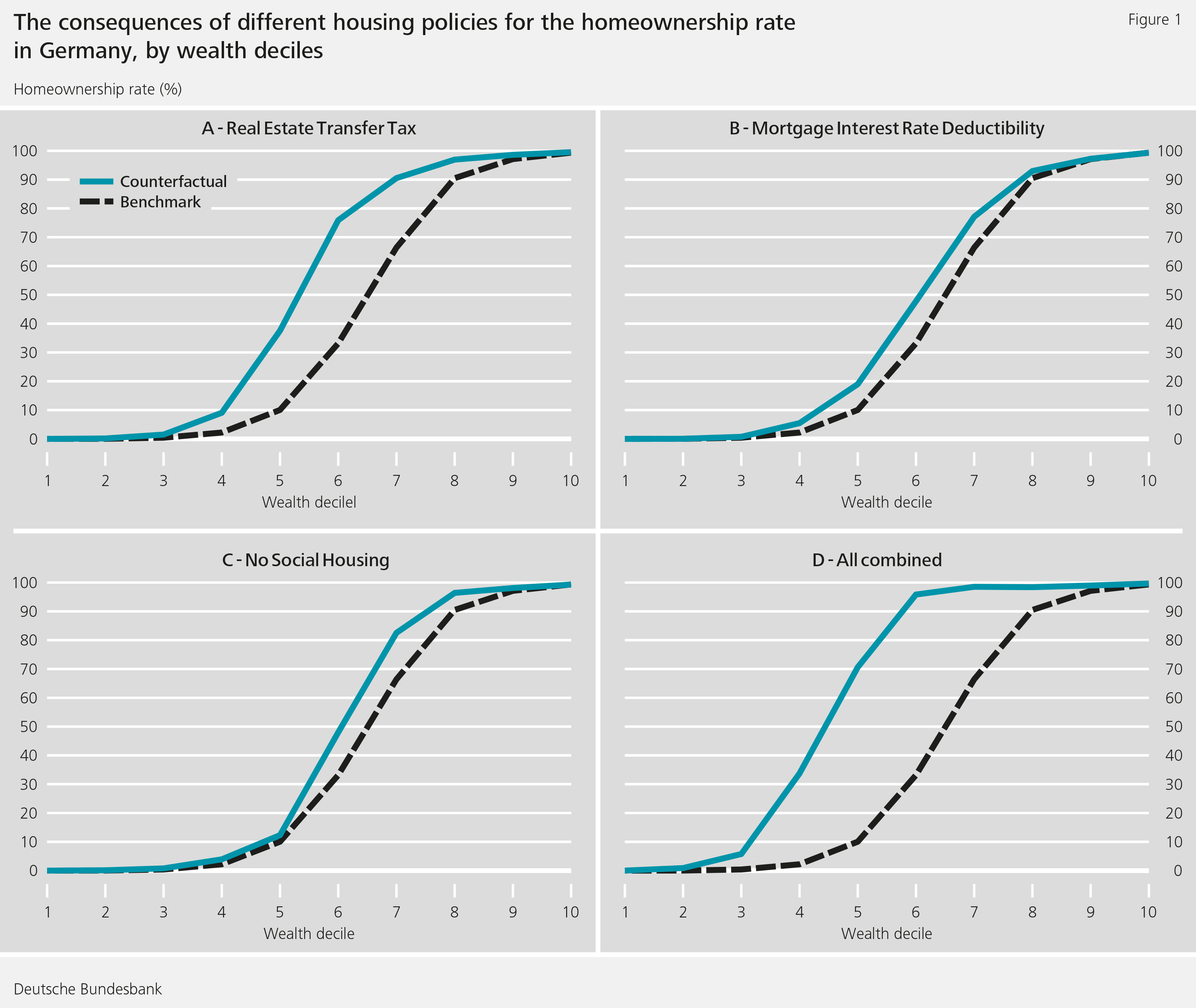

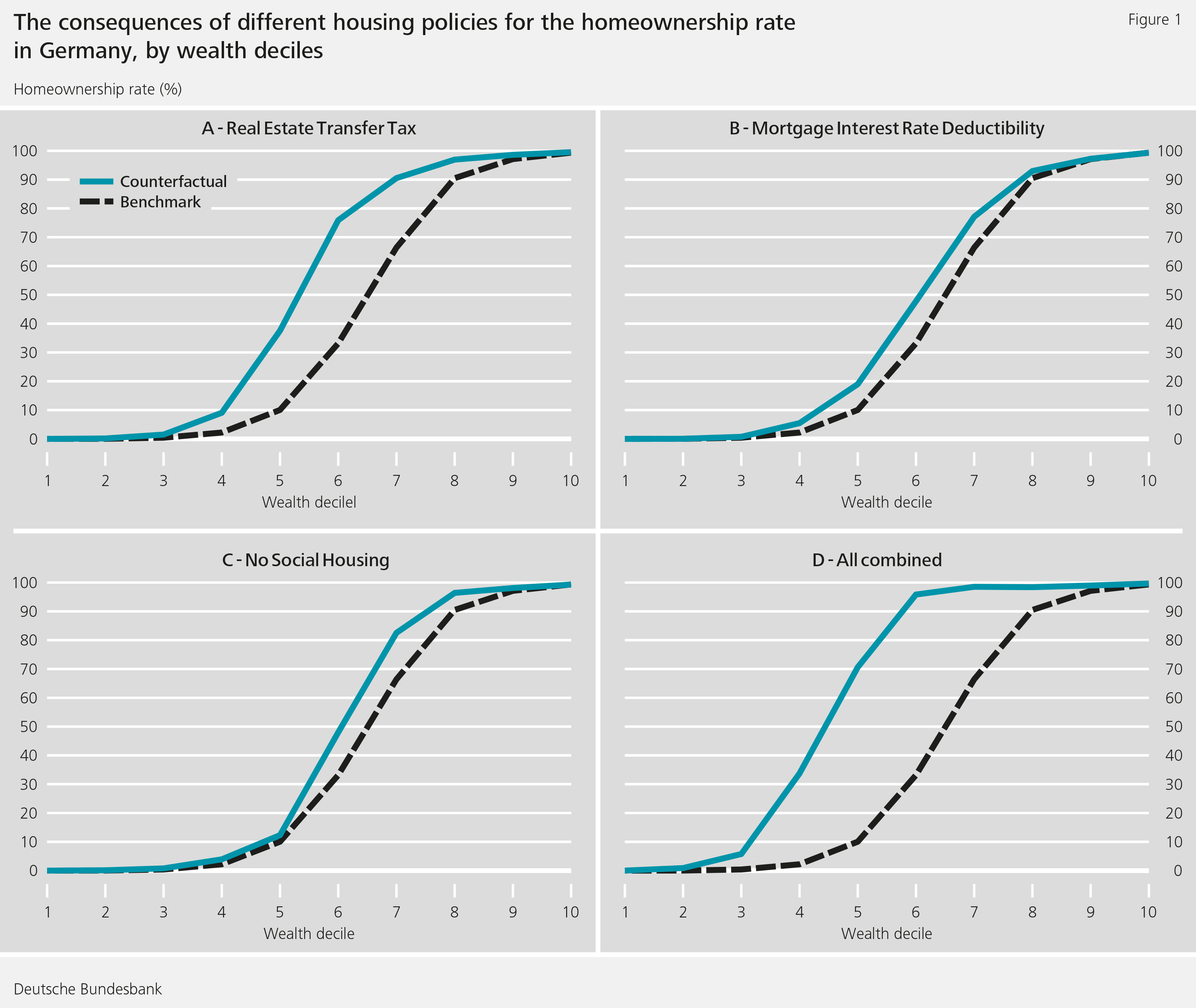

Reasons For The Low Homeownership Rate In Germany Deutsche Bundesbank

Reasons For The Low Homeownership Rate In Germany Deutsche Bundesbank

In The News Top Stories On Point2 Homes House Prices Property Marketing Mortgage Advice

In The News Top Stories On Point2 Homes House Prices Property Marketing Mortgage Advice

What Not To Do In Germany Simple Survival Tips For Enjoying German Culture Moving To Germany Survival Tips Germany

What Not To Do In Germany Simple Survival Tips For Enjoying German Culture Moving To Germany Survival Tips Germany

Trafficguru24 I Will Send Website Visitors From Germany For 10 On Fiverr Com Website Traffic Web Traffic Germany

Trafficguru24 I Will Send Website Visitors From Germany For 10 On Fiverr Com Website Traffic Web Traffic Germany

Germany Leading Insurance Companies By Revenue In Gross Written Premiums 2019 Statista

Germany Leading Insurance Companies By Revenue In Gross Written Premiums 2019 Statista

By 1923 It Took 4 2 Trillion German Marks To Buy One American Dollar German Paper Money Was Only Useful For Kindling Orte Zum Besuchen Alte Bilder Geschichte

By 1923 It Took 4 2 Trillion German Marks To Buy One American Dollar German Paper Money Was Only Useful For Kindling Orte Zum Besuchen Alte Bilder Geschichte

Post a Comment for "How Much Mortgage Can I Get In Germany"