How Much House Can I Afford Credit Karma

How Much House Can I Afford. With over 85 million users its best known for offering all its services free-of-charge.

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Your total monthly debt payments student loans credit card car note and more as well as your projected mortgage homeowners insurance and property taxes should never add up to more than 36 of your gross income ie.

How much house can i afford credit karma. Swingbatta 5h 24 Comments Bookmark. How much money should you spend on a car based on your salary. AirBnB trades on the Nasdaq exchange under the ticker symbol ABNB and can be purchased online through a broker.

Property prices will always fluctuate but its up to you to decide how much house you can afford. These costs are generally 2 to 5 of the home purchase price or between 4000 and 10000 for a home that costs 200000. Credit Karma is a personal finance company whose mission is to provide tools and education to help people make financial progress.

If you abide by the 28 rule you can afford to spend up to 1120 per month on your house including your mortgage interest property taxes homeowners insurance and homeowners association dues. When determining what home price you can afford a guideline thats useful to follow is the 36 rule. So lets say 600k down payment.

Over the years Credit Karma and Credit Karma Tax has offered multiple free services to our members like Identity Monitoring and DIY tax filing. Conventional guidance says that you can afford to pay up to 28 of your gross monthly income on housing. On a 50000 a year salary that puts your total price between 150000 and 250000.

So if you make 165000 in household income a 500000 house is the very most you should get. Heres what that might look like. How much house can I afford.

Some people recommend that it shouldnt be more than 25 times your annual income which yields a house price of about 412000. Along the same lines we believe everyone deserves to know how much home they can afford with no impact to their credit and no dollars spent. A generally accepted rule of thumb is that your mortgage shouldnt be more than three times your annual income.

How to Buy AirBnB Stock With a Brokerage Account. Calculate your debt-to-income ratio When assessing your ability to repay your mortgage a lender will consider your debt-to-income ratio along with your credit. Were on a mission to make that super easy.

If they say you qualify for a 300000 loan that must mean you can afford a 300000 mortgage. You can afford 1050 per month including property taxes and insurance You have a down payment of 10000 Your property insurance and. Its tempting to assume that the easiest way to figure out how much house you can afford is to ask your mortgage lender.

Just because a bank will loan you X amount doesnt mean you should. The general rule of thumb is that you should spend no more than 30 of your gross income that is your income before taxes on housing per year. Rent trends in the US.

But how much home you can afford also depends on your debts and how much youve saved for a down payment. 13MM I can foot up to a 900k down payment if need be but of course that wouldnt be too smart financially I think. The rule of thumb among many car-buying experts dictates that your car payment should total no more than 15 of your monthly net income sometimes called your take-home pay some might stretch this to 20 but 15 is more conservative and therefore likely to make budgeting even easier.

Anyone whos seen a housing bubble can attest to that. After all you figure theyre the experts. Quickly find the maximum home price within your price range.

If you dont have a brokerage account already youll need to set one upThere are plenty of broker options and robo-advisors to choose from so its important to do your research and understand how fees and. Founded in 2007 and based in San Francisco it now has over 800 employees across its three offices. Determining What You Can Afford.

Whether youre approaching retirement or not its never a prudent choice to buy more house than you can afford. A home priced between three and five times your salary is considered affordable.

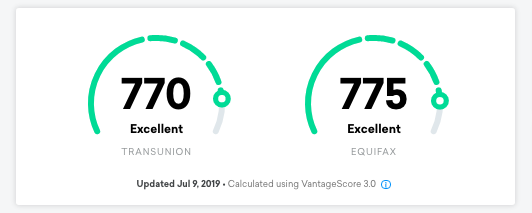

How Accurate Is Credit Karma We Tested It Lendedu

How Accurate Is Credit Karma We Tested It Lendedu

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Credit Karma Email Credit Karma Karma Calendar Reminder

Credit Karma Email Credit Karma Karma Calendar Reminder

Credit Karma Score Over Time Credit Karma Karma Business Credit Cards

Credit Karma Score Over Time Credit Karma Karma Business Credit Cards

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Mint Com Vs Credit Karma Personal Finance Showdown

Mint Com Vs Credit Karma Personal Finance Showdown

Credit Karma Tax Review My Experience Using Credit Karma Tax

Credit Karma Tax Review My Experience Using Credit Karma Tax

Creditkarma Review Scam Or Legit Site For Free Credit Scores

Creditkarma Review Scam Or Legit Site For Free Credit Scores

Free Credit Score Amp Free Credit Reports With Monitoring Credit Karma Credit Karma Credit Score Free Credit Score

Free Credit Score Amp Free Credit Reports With Monitoring Credit Karma Credit Karma Credit Score Free Credit Score

Credit Karma Credit Karma Credit Score Free Credit Score

Credit Karma Credit Karma Credit Score Free Credit Score

![]() How To Dispute An Error On Your Credit Report Credit Karma Credit Karma Credit Report Credit Bureaus

How To Dispute An Error On Your Credit Report Credit Karma Credit Karma Credit Report Credit Bureaus

Credit Karma Koodo Payment History Some Months Are Marked X Even Though No Payments Are Missed And Are Always Payed On Time Anyone Has The Same Issue Will This Lower My Credit

Credit Karma Koodo Payment History Some Months Are Marked X Even Though No Payments Are Missed And Are Always Payed On Time Anyone Has The Same Issue Will This Lower My Credit

Credit Factors Credit Karma Credit Score Good Credit Score

Credit Factors Credit Karma Credit Score Good Credit Score

Best Home Buyer Apps For Iphone Imore

Best Home Buyer Apps For Iphone Imore

Credit Karma Free Credit Scores Reports Overview Google Play Store Us

See My New Video I Made Today Credit Karma How To Get Credit Card Limit

See My New Video I Made Today Credit Karma How To Get Credit Card Limit

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Post a Comment for "How Much House Can I Afford Credit Karma"