Tesla Call Option Prices

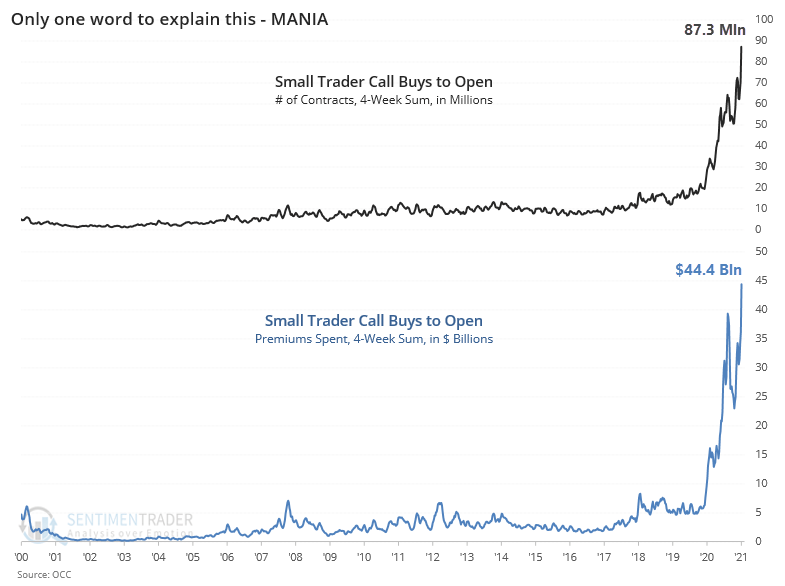

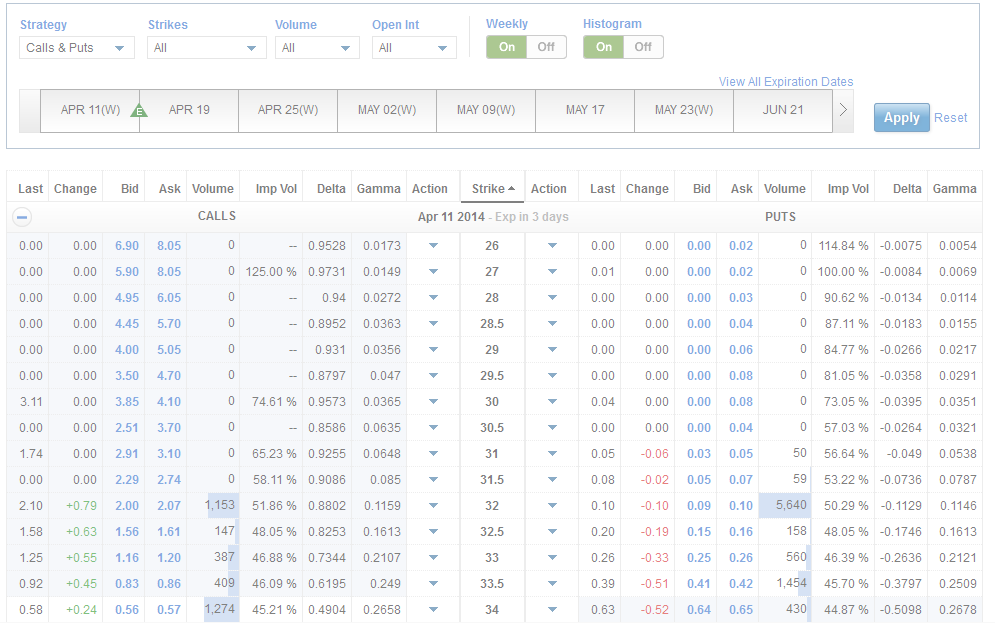

Strike price bid ask volume open interest. Typically there are a hundred shares in a stock option contract.

Draftkings Dkng Stock Price Prediction Stock Prices Stock News Predictions

Draftkings Dkng Stock Price Prediction Stock Prices Stock News Predictions

Last Week SPY closed about 12 higher on the week in line with the 12 move options were pricing.

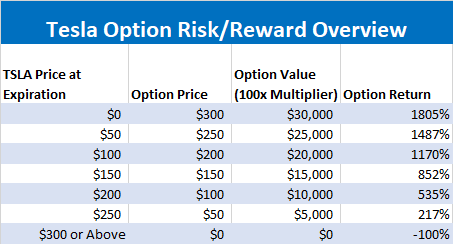

Tesla call option prices. An option investor has purchased one call option with a strike price of 35 for a premium of 050 and sold one call option with a strike price of 30 for a premium of 250. The opposite applies to bearish trades. February 20 th expiration gives you about 50 days for the stock to move higher in your favor.

This happens by simply multiplying the 100 shares by the split ratio and dividing the strike price by the same ratio. Option Chain Greeks Live Call and put options are quoted in a table called a chain sheet. With the 225 calls in February costing 13 a piece you may want to look at the 240 calls instead.

Theyre about half the cost at around 7 and arent too far out of the money. If the price of the underlying asset closes below 30 upon expiration then the investor collects 200 250 -. Short term calls have asking prices around like 40-60 for anything semi-reasonable like being up 100 which from my understanding translates to 4000 to 6000 a contract.

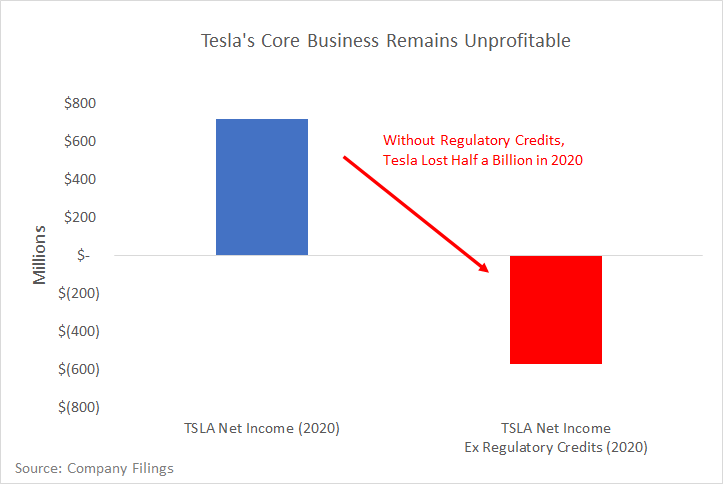

The current stock price is 580 and over the next period can either fall to 500 or rise to 720 while the strike price of the call is 468. Transcribed image text. An American call option on Tesla is deeply in-the-money.

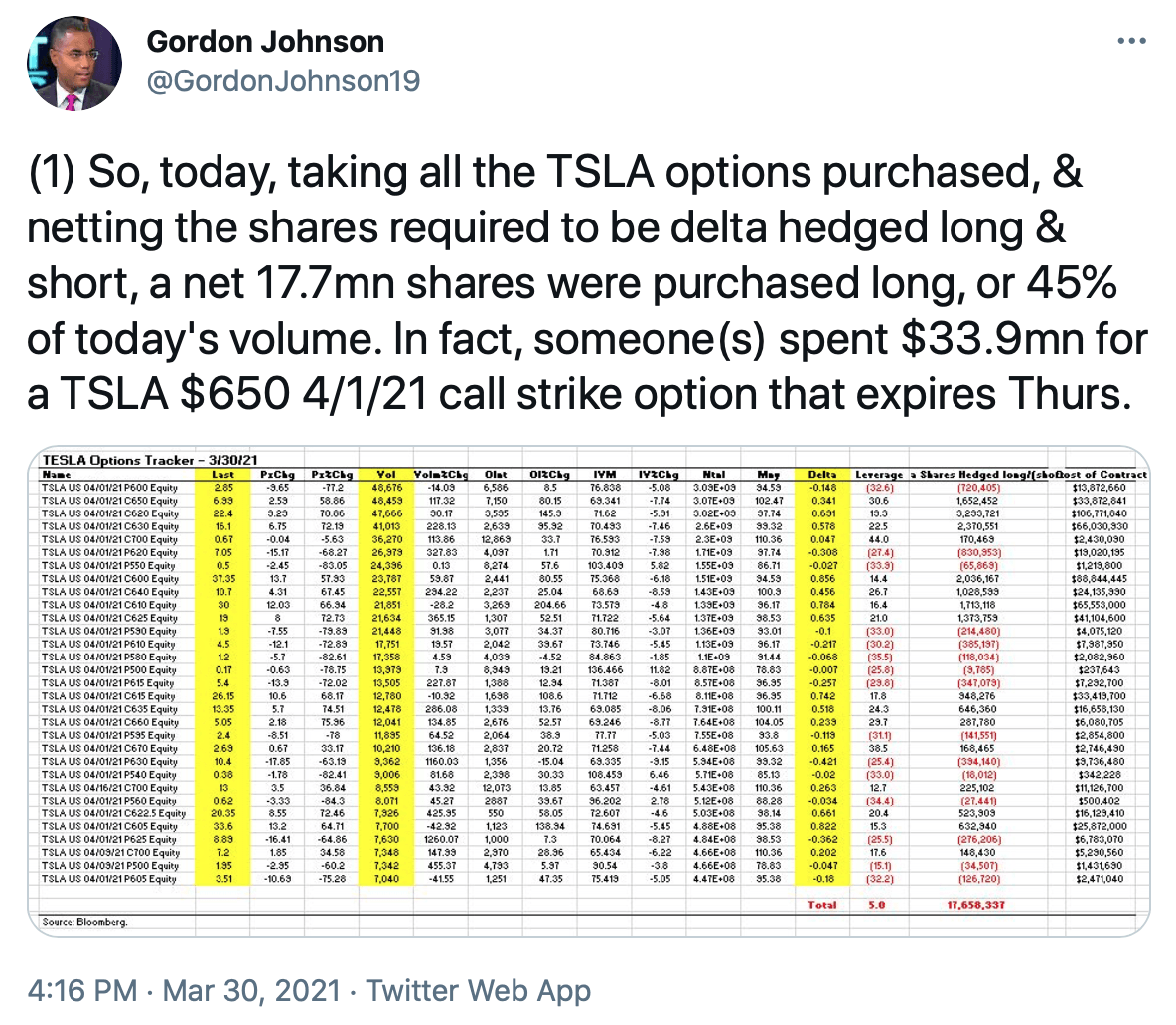

TSLA had 30-Day Put-Call Ratio Open Interest of 09688 for 2021-05-12. For instance March 18 2022 calls at. For call options the strike price is where the shares can be bought up to the expiration date while for put options the strike price is the price at which shares can be sold.

View the basic TSLA option chain and compare options of Tesla Inc. Stocks Option prices for Tesla Inc with option quotes and option chains. So I was curious what tesla calls were at since its one of the stocks Ive been eyeing.

Call options pay out if the share price exceeds the strike price at the expiration date. Put-Call Ratio Open Interest. Options data by MarketWatch.

Get free option chain data for TSLA. Now TSLA call options tend to be expensive but you still want to buy some time. The chain sheet shows the price volume and open interest for each option strike price and expiration month.

But am I understanding this right. Set Alert Options Streaming Charts. TSLA May 21 2021 59000 call.

Quotes Snapshot TSLA. View TSLA option chain data and pricing information for given maturity periods. Put options bought on or above the ask OR call options sold at or below the bid price.

Get Options quotes for Tesla Inc. Get free options prices and option chains for Tesla Inc TSLA at Ally Invest. 270 rows Are you trading options on Tesla NASDAQTSLA.

The buyers and sellers of options on TSLA are placing bets on the probabilities of the price rising above call options or falling below put options a specific price. The VIX closed lower on the week down to 1670 from 1860. The difference between the underlying contracts current market price and the options.

With Tesla you have a 51 split. Tesla NASDAQTSLA. This Week SPY options are pricing a 1 move in either direction for the upcoming week.

Call option contracts are ones that are bought on or above the markets asking price OR put option contracts that are sold on or less than the markets bid price - expecting a move to the upside. Last Price 57206 Cboe Real-Time Last Sale as of 333PM ET 51321 Cboe Real-Time Quotes. Find Call and Put Strike Prices Last Price Change Volume and more for Tesla stock options.

The ratio of outstanding put contracts to outstanding call contracts at the close of the trading day for options with the relevant expiration date. So if you had the Sept. You own exactly one share of Tesla in your portfolio therefore to replicate the option you only need to borrow.

Yours in Profit Gordon Lewis Options.

How To Buy And Trade Tesla Options Calls And Puts Ig En Ig En

How To Buy And Trade Tesla Options Calls And Puts Ig En Ig En

Apple Tesla Keep On Winning With No End In Sight Theo Trade Delayed Quote Tesla Keep On

Apple Tesla Keep On Winning With No End In Sight Theo Trade Delayed Quote Tesla Keep On

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

Tesla Model 3 Sr Range Price Increases 100 Non Refundable Order Fee In Effect Tesla Tesla Model Tesla Model X

Tesla Model 3 Sr Range Price Increases 100 Non Refundable Order Fee In Effect Tesla Tesla Model Tesla Model X

Option Chain Fidelity Investments

Option Chain Fidelity Investments

Why Netflix Options Are A Better Buy Than Nflx Stock Investing Investment Firms Netflix Options

Why Netflix Options Are A Better Buy Than Nflx Stock Investing Investment Firms Netflix Options

Tesla Introduces The New Model Y 20 Winter Wheels And Tire Package Wheels And Tires Wheel And Tire Packages Tesla

Tesla Introduces The New Model Y 20 Winter Wheels And Tire Package Wheels And Tires Wheel And Tire Packages Tesla

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

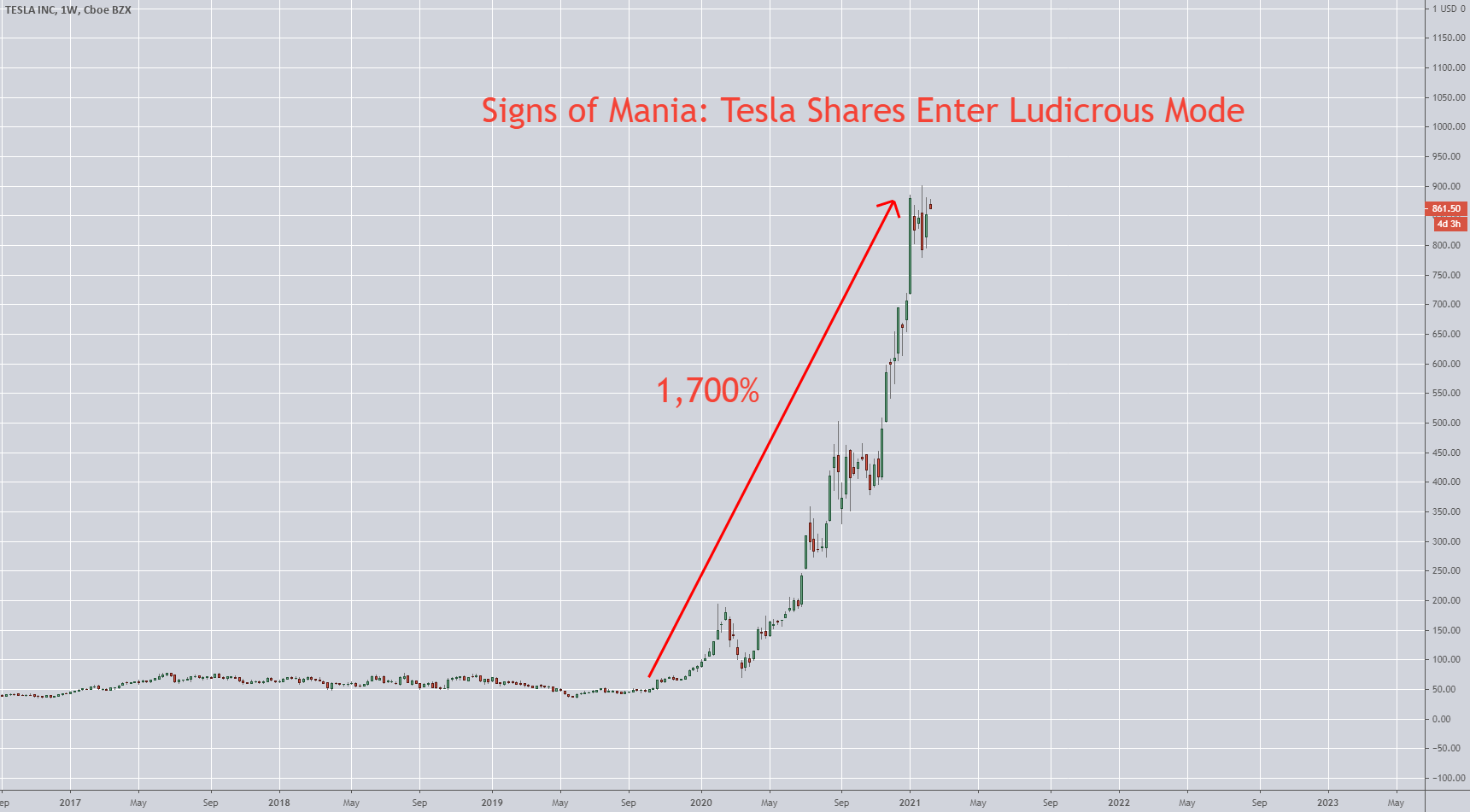

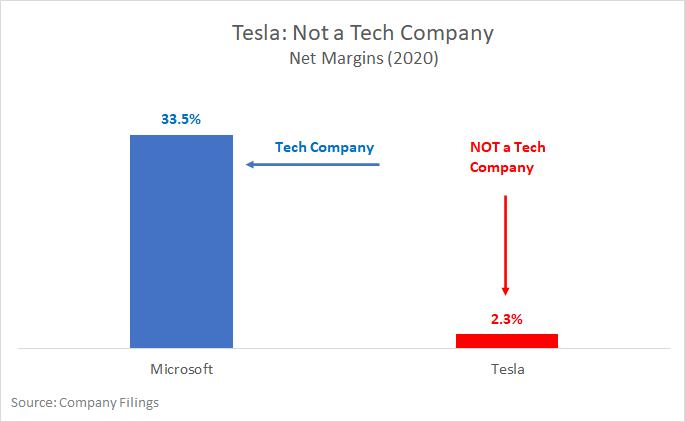

Tesla Stock Forecast Too Risky To Bet On Tsla Rising Again Seeking Alpha

Tesla Stock Forecast Too Risky To Bet On Tsla Rising Again Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

Sluggish Jobs Report A Head Scratcher For Fed Volatile Markets Stock Market Chart Tool Options Trading Strategies

Sluggish Jobs Report A Head Scratcher For Fed Volatile Markets Stock Market Chart Tool Options Trading Strategies

Tesla Be Ready For A Big Q1 Miss Tesla Inc Nasdaq Tsla Seeking Alpha Nasdaq Tesla Shares Outstanding

Tesla Be Ready For A Big Q1 Miss Tesla Inc Nasdaq Tsla Seeking Alpha Nasdaq Tesla Shares Outstanding

Hegic A New Age Options Trading Protocol Option Trading Implied Volatility New Age

Hegic A New Age Options Trading Protocol Option Trading Implied Volatility New Age

What A Option Straddle In Tesla Will Bring Options Analysis

What A Option Straddle In Tesla Will Bring Options Analysis

Cheddar Flow Vs Flow Algo Online Stock Trading Option Trader Online Trading

Cheddar Flow Vs Flow Algo Online Stock Trading Option Trader Online Trading

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

How To Buy And Trade Tesla Options Calls And Puts Ig En Ig En

How To Buy And Trade Tesla Options Calls And Puts Ig En Ig En

Post a Comment for "Tesla Call Option Prices"