How Much Car Can I Afford Based On Net Worth

Because new cars depreciate roughly 20 percent once theyre sold putting 20 percent down keeps you from owing more than your car is worth. Unfortunately the path from the sticker price to bottom dollar pricing is often shrouded in mystery.

John Staluppi Net Worth Celebrity Net Worth

John Staluppi Net Worth Celebrity Net Worth

This covers most bases.

How much car can i afford based on net worth. If you earn 5000 per month your monthly budget for a car should add up to 500 or less. The Net Worth Rule For Car Buying The net worth rule for car buying states that you can spend up to 5 of your overall net worth on the purchase price of a car. Spend no more than 20 of your take home pay on a car.

Thats enough to buy a nice car or SUV at. GAP insurance covers the difference between what your car is worth and what you owe. But pricing isnt the only way car dealerships can screw up your finances.

So when pressed I would say spend up to 35 of your annual income on a car. If you only earn 20000 a year it gives you a budget of 7000. Probably not as much as you might think.

The calculator here will help you find the amount you can spend on a car based on your salary and expenses. If you make the median per capita income of about 42000 a year for example you should limit your budget to 4200. Pretax post-tax annual income.

Spend no more than 35 of your pre-tax annual income on a car. That would suggest someone with the US. How much car can I afford based on salary.

How much car can I afford Theres no perfect formula for how much you. The 110th rule only accounts for ones annual income when deciding on how much to spend on a car. To find how much car you can afford you need to first calculate the amount you can pay as your car loan emi.

Rule of thumb. Only you can truly say how a car fits into your household budget after accounting for needs wants and savings but the rule of thumb is to keep total transportation costs to 10 or less of your gross income. Thats a big range we know so if we had to set a rule it would be this.

Lower is better but we recognize personal finance is personal. Thats not a lot but its definitely enough to buy an older yet still reliable used car. You can spend between 10 and 50 of your gross annual income on a car.

Dave doesnt recommend buying a new carever until your net worth is more than 1 million. Perhaps a greater barometer to determine car spending is your overall net worth. If you take home 2500 spend 500 on a car.

The math wouldnt work for that if you were to assign something like car to net worth ratio should be 12 Car price to annual income is a better gauge. If you make the median household income of about 62000 a. If you make 3500 spend 700 on a car.

The rule of thumb among many car-buying experts dictates that your car payment should total no more than 15 of your monthly net income sometimes called your take-home pay some might stretch this to 20 but 15 is more conservative and therefore likely to make budgeting even easier. Being upside down on a loan means you owe more than the car is worth. These terms are enough to make a person ask.

Calculate the car payment you can afford NerdWallet recommends spending no more than 10 of your take-home pay on your monthly auto loan payment. Car Affordability Calculator - Income Based Affordable Car. How much car can I afford is a question shoppers need to answer fully before choosing a new car thats beyond reach financially.

If you cant put much or any money down on a car loan make sure you at least get GAP insurance. Median income of 60336 could afford a car costing 30168. And if youre not careful you can wind up paying more than a car is truly worth or paying more than you can afford.

These tips from Consumer Reports will help you choose a new car. For most salaried individual without substantial net worth the the standard 20410 rule can be. This is a car affordablilty calculator using which you can find out a car that you can afford based on your Salary or Income.

As a general rule of thumb the total value of your vehicles anything with a motor in it should never be more than half of your annual household income.

World S Richest Ceos And Their Cars From Jeff Bezos To Mark Zuckerberg

World S Richest Ceos And Their Cars From Jeff Bezos To Mark Zuckerberg

Rema Net Worth Cars And Houses Of One Of Nigeria S Brightest Future Megastars Naijauto Com

Rema Net Worth Cars And Houses Of One Of Nigeria S Brightest Future Megastars Naijauto Com

The Average Net Worth By Age For The Upper Middle Class

The Average Net Worth By Age For The Upper Middle Class

Thestradman S Net Worth Is Growing Fast Driveandreview

Thestradman S Net Worth Is Growing Fast Driveandreview

Should I Buy My 150 000 Dream Car If My Net Worth Is 700 000 Quora

Should I Buy My 150 000 Dream Car If My Net Worth Is 700 000 Quora

Here S How Chris Evans Spends His Massive Net Worth Thethings

Here S How Chris Evans Spends His Massive Net Worth Thethings

Your Net Worth What It Is And Why It Matters

Your Net Worth What It Is And Why It Matters

The Net Worth Rule For Car Buying Guideline Financial Samurai

The Net Worth Rule For Car Buying Guideline Financial Samurai

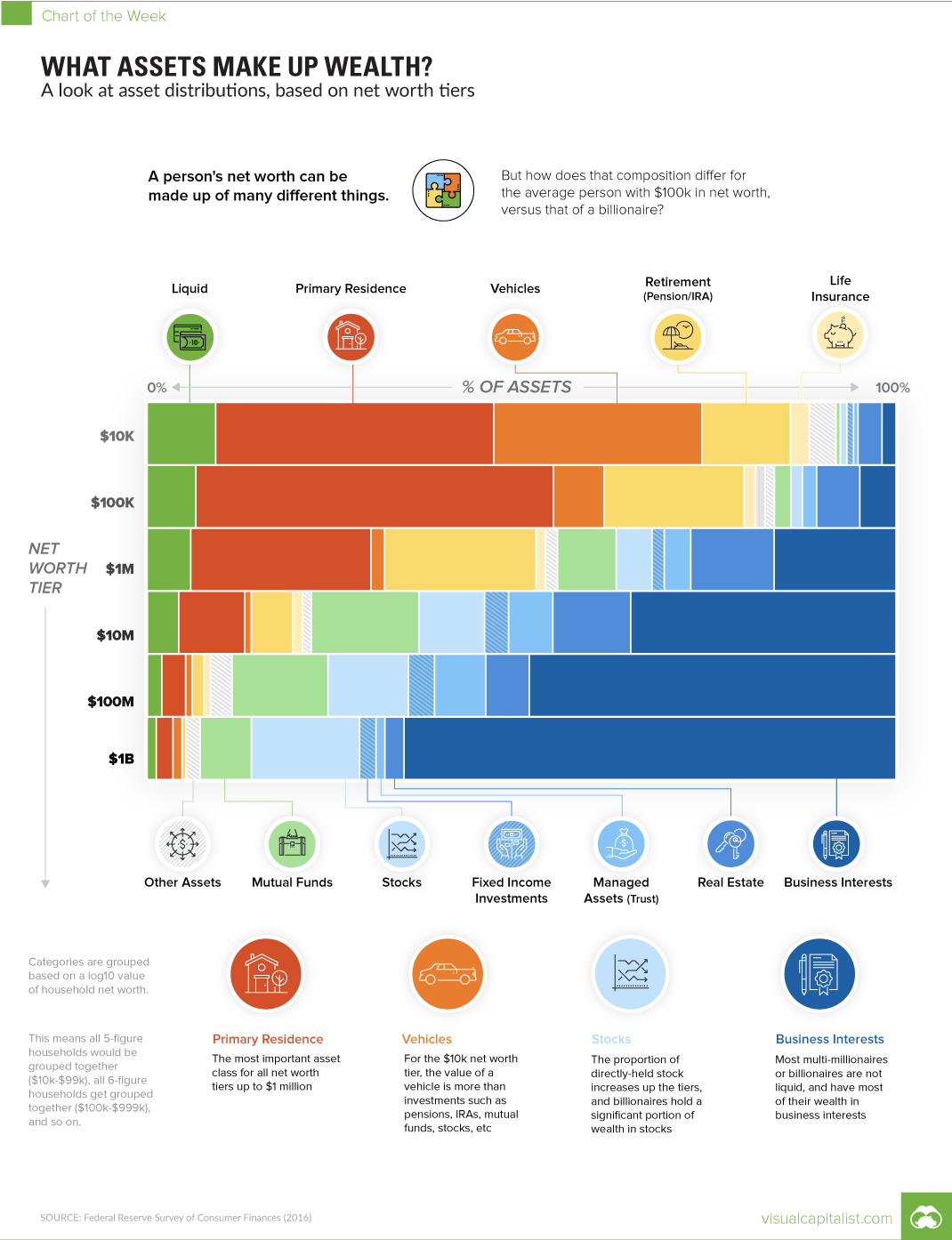

Chart What Assets Make Up Wealth

Chart What Assets Make Up Wealth

What Is Net Worth Forbes Advisor

What Is Net Worth Forbes Advisor

The Net Worth Rule For Car Buying Guideline Financial Samurai

The Net Worth Rule For Car Buying Guideline Financial Samurai

The 1 10th Rule For Car Buying Everyone Must Follow

The 1 10th Rule For Car Buying Everyone Must Follow

Is My Car An Asset Or A Liability

Is My Car An Asset Or A Liability

The Net Worth Rule For Car Buying Guideline Financial Samurai

The Net Worth Rule For Car Buying Guideline Financial Samurai

The Average Net Worth For The Above Average Married Couple

The Average Net Worth For The Above Average Married Couple

How To Calculate Net Worth The Simple Dollar

How To Calculate Net Worth The Simple Dollar

The No 1 Mistake Car Buyers Make According To Millionaire Money Expert

The No 1 Mistake Car Buyers Make According To Millionaire Money Expert

The Top 1 Net Worth Amounts By Age Financial Samurai

The Top 1 Net Worth Amounts By Age Financial Samurai

The Net Worth Rule For Car Buying Guideline Financial Samurai

The Net Worth Rule For Car Buying Guideline Financial Samurai

Post a Comment for "How Much Car Can I Afford Based On Net Worth"