How Much Home Can I Afford Credit Karma

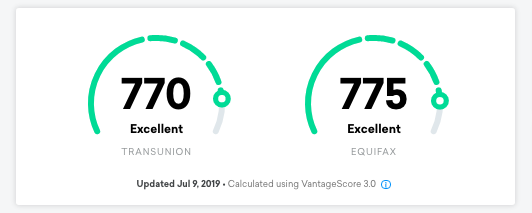

On a 50000 a year salary that puts your total price between 150000 and 250000. Your credit scores are updated weekly and available online and through the Credit Karma app 247.

Credit Karma Review 2021 Is It Accurate Safe Legitimate

Credit Karma Review 2021 Is It Accurate Safe Legitimate

Conventional guidance says that you can afford to pay up to 28 of your gross monthly income on housing.

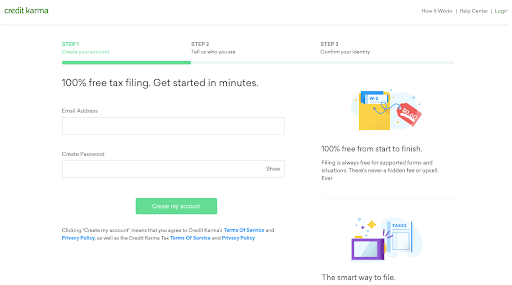

How much home can i afford credit karma. Over the years Credit Karma and Credit Karma Tax has offered multiple free services to our members like Identity Monitoring and DIY tax filing. You can track changes to your home buying power over time learn about the different factors that can influence it and get advice for your home buying journey. NMLS ID 1628077 Licenses NMLS Consumer Access.

If they say you qualify for a 300000 loan that must mean you can afford a 300000 mortgage. If you know people with a similar debt load income Id appreciate anecdotes on how they feelhow its working out for them. Is that too tight of a squeeze.

Use your own stats including your full credit profile to see how much home you can afford. 1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc. Youll need more income for a more expensive home.

Assuming the average household has a monthly debt payment of about 250 and saves 10 of its gross income for five years for a down payment we found that the average household could afford a home worth 97100 about 88 more than the local median home value. Credit Karma is always free. Find your true home buying power.

Credit Karma wont ask you for your credit card number during the registration process or at any other time. We dont ever sell your information. Go to the Credit Karma Home Buying Power experience now.

The total amount repayable will be 676764. Im looking at a 22MM place in SF. Your APR will be determined based on your credit at the time of application.

Log in now Home Affordability Calculator. After all you figure theyre the experts. Using your income and savings information you can estimate your Home Buying Power on Credit Karma.

We do get paid through our partners if you get a product through one of our recommendations. A home priced between three and five times your salary is considered affordable. Credit Karma was founded in 2008 under the belief that access to free credit reports and scores is a fundamental consumer right.

But how much home you can afford also depends on your debts and how much youve saved for a down payment. Credit Karma empowers consumers by arming them with the knowledge and tools they need to make better financial decisions. If you abide by the 28 rule you can afford to spend up to 1120 per month on your house.

NMLS ID 1628077 Licenses NMLS Consumer Access. So lets say 600k down payment. If youre buying a home with someone else the lender will use the lower of your two scores.

This calculator will give you a better idea of how much you can afford to pay for a house and what the monthly payment will be. Multiply 4000 by 028 and your total is 1120. This is the highest percentage of any city in our study.

Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. Were on a mission to make that super easy. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679.

Credit Karma uses your VantageScore 30 credit scores from TransUnion and Equifax but these scores can give you an idea of your credit health. Along the same lines we believe everyone deserves to know how much home they can afford with no impact to their credit and no dollars spent. The total amount repayable will be 676764.

Your APR will be determined based on your credit at the time of application. 1100 Broadway STE 1800 Oakland CA 94607 Credit Karma Offers Inc. Determining What You Can Afford Its tempting to assume that the easiest way to figure out how much house you can afford is to ask your mortgage lender.

13MM I can foot up to a 900k down payment if need be but of course that wouldnt be too smart financially I think. These costs are generally 2 to 5 of the home purchase price or between 4000 and 10000 for a home that costs 200000. CREDIT KARMA OFFERS INC.

Calculate your debt-to-income ratio When assessing your ability to repay your mortgage a lender will consider your debt-to-income ratio along with your credit. CREDIT KARMA OFFERS INC. You can afford 1050 per month including property taxes and insurance You have a down payment of 10000 Your property insurance and.

Quickly find the maximum home price within your price range.

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Overview Credit Karma Karma Chase Freedom

Credit Karma Overview Credit Karma Karma Chase Freedom

Www Creditkarma Com Login Credit Karma Account Sign In Password Recovery Credit Karma Creditkarma Good Credit

Www Creditkarma Com Login Credit Karma Account Sign In Password Recovery Credit Karma Creditkarma Good Credit

How Accurate Is Credit Karma We Tested It Lendedu

How Accurate Is Credit Karma We Tested It Lendedu

Credit Karma Launches High Yield Savings Account The Dough Roller

Credit Karma Launches High Yield Savings Account The Dough Roller

Best Home Buyer Apps For Iphone Imore

Best Home Buyer Apps For Iphone Imore

Credit Karma Credit Karma Credit Score Free Credit Score

Credit Karma Credit Karma Credit Score Free Credit Score

Mint Com Vs Credit Karma Personal Finance Showdown

Mint Com Vs Credit Karma Personal Finance Showdown

Free Credit Score Amp Free Credit Reports With Monitoring Credit Karma Credit Karma Credit Score Free Credit Score

Free Credit Score Amp Free Credit Reports With Monitoring Credit Karma Credit Karma Credit Score Free Credit Score

Credit Karma Score Over Time Credit Karma Karma Business Credit Cards

Credit Karma Score Over Time Credit Karma Karma Business Credit Cards

Credit Factors Credit Karma Credit Score Good Credit Score

Credit Factors Credit Karma Credit Score Good Credit Score

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Creditkarma Review Scam Or Legit Site For Free Credit Scores

Creditkarma Review Scam Or Legit Site For Free Credit Scores

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

Mint Com Vs Credit Karma Personal Finance Showdown Pcmag

![]() How To Dispute An Error On Your Credit Report Credit Karma Credit Karma Credit Report Credit Bureaus

How To Dispute An Error On Your Credit Report Credit Karma Credit Karma Credit Report Credit Bureaus

Credit Karma Tax The Consumer Credit Site Trusted By 60 Million Users Launches Its New Completely Free Tax Filing Service Cardrates Com

Credit Karma Tax The Consumer Credit Site Trusted By 60 Million Users Launches Its New Completely Free Tax Filing Service Cardrates Com

Credit Karma Tax Review My Experience Using Credit Karma Tax

Credit Karma Tax Review My Experience Using Credit Karma Tax

:max_bytes(150000):strip_icc()/credit.karma.logo.cropped-5bfc2e08c9e77c0026b570fb.png)

Post a Comment for "How Much Home Can I Afford Credit Karma"