How Much House Can I Afford Nfcu

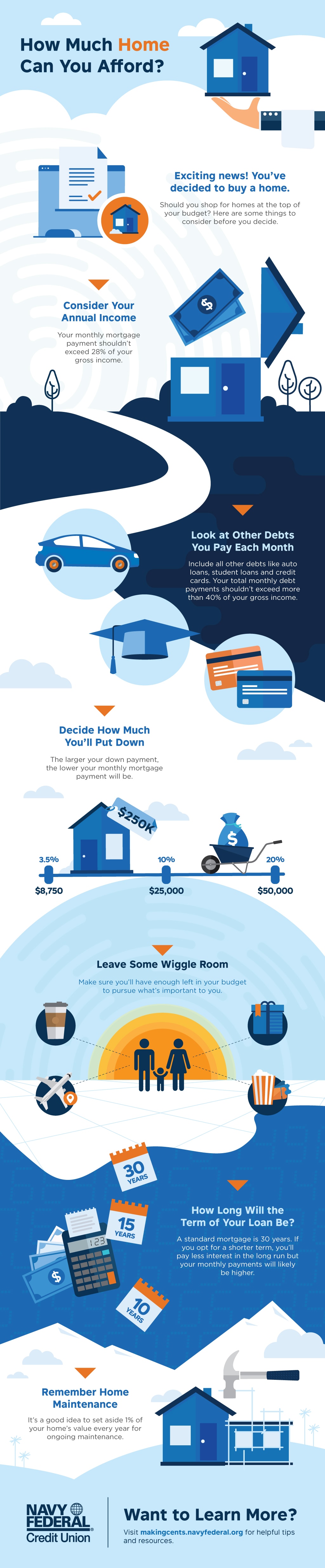

The general rule says home buyers can typically afford a mortgage that is two to two-and-a-half times their gross income. Our calculator can help you determine an affordable home price for you taking into account your other debts such as auto or student loans monthly expenses like utilities and the size of your down payment if any.

Mortgage Qualification Calculator Navy Federal Credit Union

A VA loan calculator can help you determine what your potential VA loan payment might be and in turn what home purchase price you can afford.

How much house can i afford nfcu. It is too general to solely rely on when youre considering a purchase as important as your residence. Explore what you can afford. To Decide How Much Home You Can Afford.

For example a family bringing home 4000 per month after taxes should shoot for a 1000 to 1440 housing cost. Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. It helps to understand how lenders look at applications.

Some loans like VA loans and some USDA loans allow zero down. This calculator is for general education purposes only and is not an illustration of current Navy Federal products and offers. Although some lenders like Navy Federal offer some mortgage options that dont require mortgage insurance.

A 20 percent down payment is ideal because it gives you a number of advantages such as instant equity in your home and avoiding the cost of private mortgage insurance. There can be a lot of uncertainty when you apply for a home loan to buy a home. This is for things like insurance taxes maintenance and repairs.

This guideline however may or may not apply accurately to your situation. A key factor is the loan-to-value ratio which measures the size of your mortgage compared to the market value of the house you. Since 1933 Navy Federal Credit Union has grown from 7 members to over 10 million.

It only comes in a 15-year or 30-year fixed no ARMs are available. From estimating closing costs to deciding how much home you can afford our calculators can help you make decisions about your mortgage. In fact VA mortgage rates today are generally lower than other loan types like conventional and FHA.

A common way to calculate how much house you can afford is to use the 2836 rule looking at both your overall debt and the overall payment for your home. Youll need more income for a more expensive home. To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related.

And since that time our vision statement has remained focused on serving our unique. 5 Sections 22 Articles. Though some mortgage loans may only require as little as 35 percent down or none at all a larger down payment will have a greater impact on your monthly mortgage payment.

The first step in buying a house is determining your budget. Like most other mortgage lenders they offer home purchase loans rate. If you or your family have served in the armed forces find out how Navy Federal Credit Union can.

How much of a down payment do you need for a house. The good news is they will allow up to 1 million loan amounts in certain areas and seller contributions of up to 6. Your housing expenses should be 29 or less.

Navy Federal Credit Union guarantees its borrowers the lowest mortgage rates. The start of your homebuying journey is a great time to get prequalified provide some basic information to get an idea of your home price range and how much you might be able to borrow. This rule states your total housing expenses should be less than 28 of your gross monthly income.

You should have three months of housing payments and expenses saved up. Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Most home loans require at least 3 of the price of the home as a down payment.

A 20 down payment is standard if you can afford it. Since 1933 Navy Federal Credit Union has grown from 7 members to over 10 million members. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679.

A general rule is to keep home costs which includes mortgage payment property taxes and insurance to 25-36 of your take-home pay. Find out how much you can qualify to borrow based on your annual income savings and other debts. Your debt-to-income ratio DTI should be 36 or less.

Mortgage rates for VA home loans are currently at historic lows. VA home loan rates for 2021. From preapproval to closing know what goes into buying a home so that you can be confident about the process each and every step of the way.

Navy Federal Credit Union Mortgage Review 2021 Us News

Navy Federal Credit Union Mortgage Review 2021 Us News

Coloradospringsishome Colorado Springs Navy Federal Credit Union First Time Home Buyers

Coloradospringsishome Colorado Springs Navy Federal Credit Union First Time Home Buyers

Navy Federal Credit Union Homebuyers Choice No Money Down Loan Explained Perfection Hangover In 2021 Navy Federal Credit Union Home Buying Home Buying Process

Navy Federal Credit Union Homebuyers Choice No Money Down Loan Explained Perfection Hangover In 2021 Navy Federal Credit Union Home Buying Home Buying Process

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Navy Federal Credit Union Student Loan Refinancing Review 2021 Credible

Navy Federal Routing Number Nfcu Navy Federal Credit Union Number

Navy Federal Power Of Attorney Fill Online Printable Fillable Blank Pdffiller

Navy Federal Power Of Attorney Fill Online Printable Fillable Blank Pdffiller

Military Pay Chart How Much House Can I Afford In 2021 Military Pay Chart Military Pay Apply For A Loan

Military Pay Chart How Much House Can I Afford In 2021 Military Pay Chart Military Pay Apply For A Loan

The Home Buying Journey Navy Federal Credit Union

Navy Federal Credit Union Savings Account Rates Bankrate

Navy Federal Credit Union Savings Account Rates Bankrate

Mortgage Qualification Calculator Navy Federal Credit Union

Navy Federal Go Rewards Review Nerdwallet

Navy Federal Go Rewards Review Nerdwallet

The Home Buying Journey Navy Federal Credit Union

We Customize Navy Federal Cu Statement To Your Specifications Including Direct Deposits Credits O Bank Statement Navy Federal Credit Union Income Statement

We Customize Navy Federal Cu Statement To Your Specifications Including Direct Deposits Credits O Bank Statement Navy Federal Credit Union Income Statement

Va Loan Process Makingcents Navy Federal Credit Union

Va Loan Process Makingcents Navy Federal Credit Union

Navy Federal Auto Loans May 2021 Review Finder Com

Navy Federal Auto Loans May 2021 Review Finder Com

Navy Federal Credit Union Review Smartasset Com

Navy Federal Credit Union Review Smartasset Com

Va Home Loans Have Benefits You Can T Get With Other Home Loans Navy Federal Credit Union Explains The Pro Home Improvement Loans Home Equity Line Home Buying

Va Home Loans Have Benefits You Can T Get With Other Home Loans Navy Federal Credit Union Explains The Pro Home Improvement Loans Home Equity Line Home Buying

How Much Home Can You Afford Makingcents Navy Federal Credit Union

How Much Home Can You Afford Makingcents Navy Federal Credit Union

Pending Stimulus Check With Navy Fed Filed My Taxes In February Ama Povertyfinance

Pending Stimulus Check With Navy Fed Filed My Taxes In February Ama Povertyfinance

Post a Comment for "How Much House Can I Afford Nfcu"