How Big Of A Mortgage Can I Afford With My Salary

Multiply the years of your. Some experts suggest that you can afford a mortgage payment as high as 28 of your gross income.

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

Before a bank or lender can issue you with a mortgage or home loan product they legally need to assess you on your ability to not only secure a property through the means of a deposit but also on whether your finances will allow you to tend to the entire life of the loan.

How big of a mortgage can i afford with my salary. Youll need more income for a more expensive home. This ensures you have enough money for other expenses. Subject to individual program loan limits.

Mortgage lenders will look at these figures very closely to work out how much theyll offer you. That could translate to a 450000 loan assuming a 45 30- year fixed rate. The mandatory insurance to protect your lenders investment of 80 or more of the homes value.

Lenders want your principal interest taxes and insurance referred to as PITI to be 28 percent or less of your gross monthly income. For example its generally assumed that your monthly mortgage payment principal interest taxes and insurance should be no more than 28 of your gross monthly income. How much can I borrow.

Quickly find the maximum home price within your price range. The rule of thumb is you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load including housing costs is no more than 40 of your gross houshold income. The traditional monthly mortgage payment calculation includes.

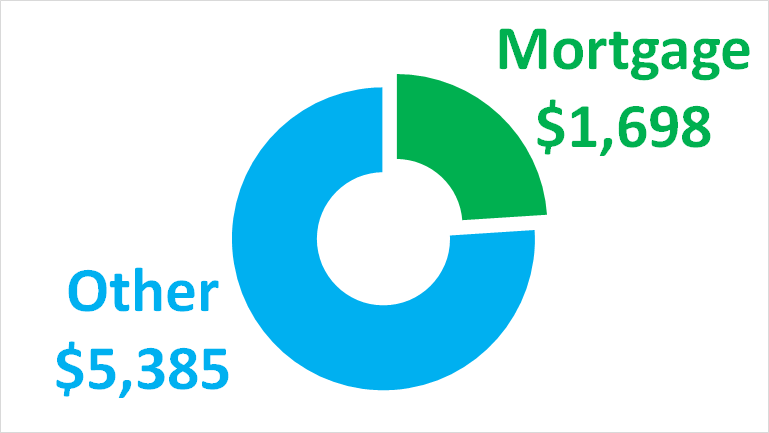

Some programs such as the zero-down USDA mortgage have income limits on who can qualify. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679. While every persons situation is different and some loans may have different guidelines here are the generally recommended guidelines based on your gross monthly income thats before taxes.

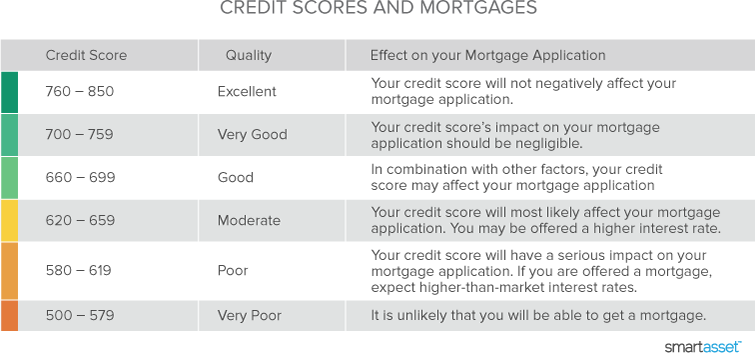

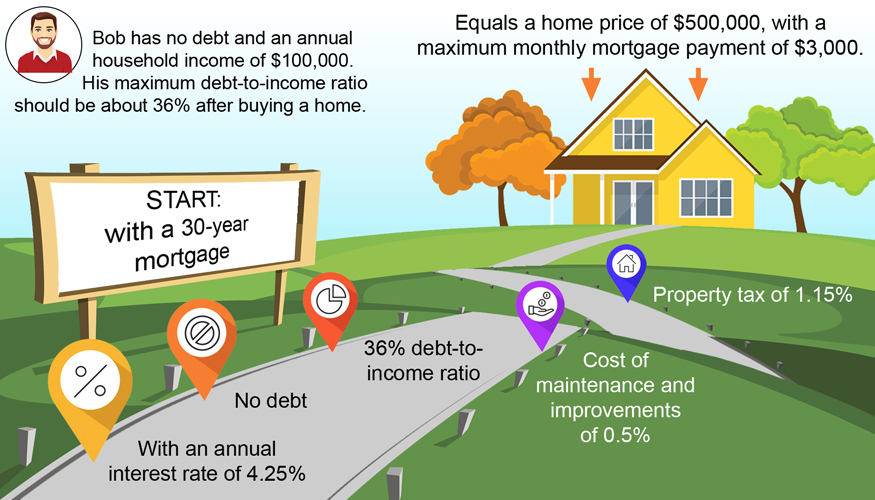

If true a couple who earn a combined annual salary of 100000 can afford a monthly payment of about 2300month. Your debt-to-income ratio DTI should be 36 or less. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow.

The usual rule of thumb is that you can afford a mortgage two to 25 times your annual income. Thats a 120000 to 150000 mortgage at 60000. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteria.

The amount of money you borrowed. We calculate this based on a simple income multiple but in reality its much more complex. This tool will help you estimate how much you can afford to borrow to buy a home.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of. Is 70000 a good salary for a single person. In most parts of the country income cannot be more than 86850 to take out a USDA loan.

How much do I need to make to afford a 250k house. Also your total monthly debt obligations debt-to-income ratio should be 43 or lower. In general your mortgage payment should be no more than 28 percent of your monthly income.

How much can I borrow from a bank or lender in Australia. The cost of the loan. Based on your DTI and depending on your other debts you could be approved for a.

In some cases you could find lenders willing to go up to 5 times income. 614K minus the 50K down payment. Lets say you and your spouse make a combined annual income of 90000 or about 5600 per month after taxes.

Your housing expenses should be 29 or less. Your debt-to-income ratio is calculated by adding up all of your monthly debt payments and dividing them by your gross monthly income. You should review your personal situation and work with your financial advisor to decide how much you can comfortably afford to borrow.

However if you have a lot of other debt -- credit card bills student loans and car loans for example -- that percentage may decrease. Your total debt including mortgage should be no more than 36 percent of your gross income. The monthly cost of property taxes HOA dues and homeowners insurance.

Well work it out by looking at your income and your outgoings. Your mortgage payment should be 28 or less. In a few exceptional cases you might be able to borrow as much as 6 or 7 times your income.

Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. When You Have Two Incomes. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

How Much Mortgage Can I Afford Smartasset Com

How Much Mortgage Can I Afford Smartasset Com

What Percentage Of Your Income Can You Afford For Mortgage Payments Mortgage Payment Mortgage Payoff Mortgage

What Percentage Of Your Income Can You Afford For Mortgage Payments Mortgage Payment Mortgage Payoff Mortgage

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford Rocket Mortgage

I Make 85 000 A Year How Much House Can I Afford Bundle

I Make 85 000 A Year How Much House Can I Afford Bundle

Can You Get A 200 000 Mortgage With 20 000 Income Quora

Home Affordability Calculator Money

Home Affordability Calculator Money

How Much House Can I Afford The Simple Dollar

How Much House Can I Afford The Simple Dollar

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Tools Mortgage Payoff Mortgage Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Tools Mortgage Payoff Mortgage Calculator

Physician Mortgage How Much Can I Afford Financial Residency

Physician Mortgage How Much Can I Afford Financial Residency

Home Affordability Calculator For Excel

Home Affordability Calculator For Excel

How Much A 200 000 Mortgage Will Cost You

How Much A 200 000 Mortgage Will Cost You

How Much House Can You Afford Money Under 30 Buying Your First Home Home Mortgage Mortgage

How Much House Can You Afford Money Under 30 Buying Your First Home Home Mortgage Mortgage

Can I Afford To Buy A Home Mortgage Affordability Calculator

Can I Afford To Buy A Home Mortgage Affordability Calculator

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Forbes Advisor

How Much House Can I Afford Forbes Advisor

How Much House Can I Afford Home Affordability Calculator Zillow Mortgage Loan Calculator Mortgage Amortization Calculator Online Mortgage

How Much House Can I Afford Home Affordability Calculator Zillow Mortgage Loan Calculator Mortgage Amortization Calculator Online Mortgage

How Much House Can I Afford Fidelity

How Much House Can I Afford Fidelity

How Much House Can I Afford Credit Com

How Much House Can I Afford Credit Com

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Interest Only Mortgage Smart Money

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Interest Only Mortgage Smart Money

Post a Comment for "How Big Of A Mortgage Can I Afford With My Salary"