How Much Home Can I Afford For 2000 A Month

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. Lets also say that your projected housing costs PITI are 2000 a month.

How Much House Can I Afford Best Mortgage Rates Today Best Investments Investing

How Much House Can I Afford Best Mortgage Rates Today Best Investments Investing

A good way to look at how much house you can forward is to use the popular 2836 rule.

How much home can i afford for 2000 a month. By dragging the slider across the range you can see the home prices youd be able to afford comfortably the prices that would stretch your budget and those that would involve more risk. Youll need more income for a more expensive home. 1500 100 400 2000 If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent 2000 is 33 of 6000.

Youll have 4600 disposable every month. The rule is simple stating that your maximum household expenses should not exceed 28 of. If youre a renter thats the most you should spend on your lease to maintain good financial health.

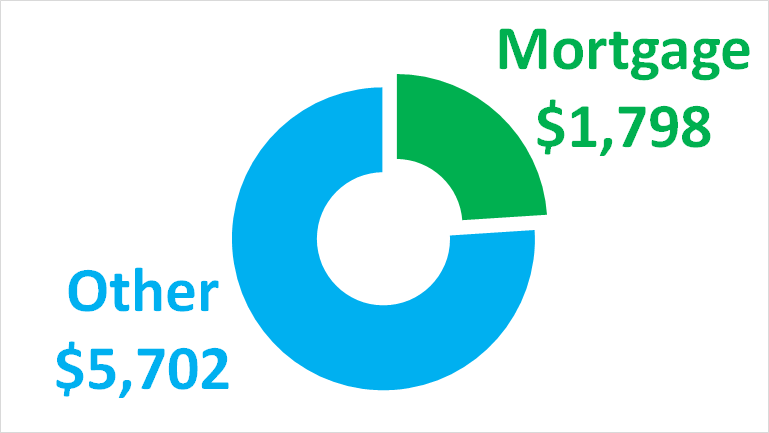

In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes. Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. Factors that affect your affordability.

You can use the slider to change the percentage of your income you want spend on housing. The 28 rule is a widely accepted rule of thumb for determining your ideal mortgage payment. Total monthly mortgage payments on your home.

For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt payments are 2000. With monthly rents continuing to rise in most parts of California home ownership is looking like a much better investment for renters. Choose mortgage calculations for any number of years months amount and interest rate.

To calculate how much rent you can afford we multiply your gross monthly income by 20 30 or 40 based on how much you want to spend. Youll be presented with a range of home prices that are recommended based on your financial circumstances. Calculate the price of a house you can buy and the mortgage you must take based on the monthly payments you can afford.

How much you can afford to spend on a home depends on several factors including these primary factors. If you buy a 200000 house your private mortgage insurance will cost roughly 2000 annually or 14000 over the course of seven yearsDeciding whether or not PMI is right for you depends on a few different. I wanted to share a Own vs Rentanalysis report that shows how much home you can purchase for 2500 a month vs renting for the same monthly payment.

In concrete numbers the 2836 rule means that someone who makes 5000 a month should not spend more than 1400 on housing costs every month. An estimate of how much home you can afford. Consider all your earnings for the year which could include salary wages tips commission etc.

The principle is pretty simple. You and your co-borrowers annual income down payment and location which is a primary factor in determining your interest. IMO its too low.

If you buy a house of 2mil with 30 downplay assuming 27 mortgage rate your mortgage tax ins 8400. You should have three months of housing payments and expenses saved up. With Rising Rents Owning a Home is a Better Investment.

Based on term of your mortgage interest rate loan amount annual taxes and annual insurance. The final number represents the money you have left to spend per month. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679.

The amount you spend on housing should not exceed 36 of your gross monthly pay or 28 of your gross income plus all other monthly debt payments. In order to determine how much mortgage you can afford to pay each month start by looking at how much you earn each year before taxes. 2020 - 19 min read How much home can you afford.

Your front-end ratio is 2000 8000 or 25 percent. Ok 245k annual means roughly 13000month after tax. In other words even though lets assume you can afford to pay a maximum of 2000 per month but with zero savings scenario you have to analyze whether having a payment of 1700 only and saving 300 per month wouldnt be a safer approach.

If you use the additional options we deduct the rent from your income and subtract your debt expenses and savings from the remaining money depending on which fields you filled in. Take those same numbers above a down payment of 30000 on a 30-year fixed interest rate mortgage in the 3 range and youd be able to afford a home worth 364500.

3 Simple Mortgage Tricks Can Save You Over 5000 Year Growthrapidly Best Money Saving Tips Mortgage Real Estate Advice

3 Simple Mortgage Tricks Can Save You Over 5000 Year Growthrapidly Best Money Saving Tips Mortgage Real Estate Advice

What Is The Average Car Payment And What Can You Afford Roadloans Car Payment Kids Saving Money Car Finance

What Is The Average Car Payment And What Can You Afford Roadloans Car Payment Kids Saving Money Car Finance

Buy A Home Vs Rent Home Home Buying Home Buying Process First Time Home Buyers

Buy A Home Vs Rent Home Home Buying Home Buying Process First Time Home Buyers

The Interest Rate You Secure Directly Impacts Your Monthly Payment And The Amount Of House T Mortgage Interest Rates Real Estate Advice Real Estate Infographic

The Interest Rate You Secure Directly Impacts Your Monthly Payment And The Amount Of House T Mortgage Interest Rates Real Estate Advice Real Estate Infographic

Buying A Home How Much Mortgage Can I Afford

Buying A Home How Much Mortgage Can I Afford

How Much Rent Can I Afford Moving To New York Guide Rent Rent In Nyc Affordable

How Much Rent Can I Afford Moving To New York Guide Rent Rent In Nyc Affordable

How Much House Can I Afford The Simple Dollar

How Much House Can I Afford The Simple Dollar

Mortgage Calculator Mortgage Calculator In Excel Calculate Your Monthly Mor Mortgage Loan Calculator Mortgage Amortization Mortgage Amortization Calculator

Mortgage Calculator Mortgage Calculator In Excel Calculate Your Monthly Mor Mortgage Loan Calculator Mortgage Amortization Mortgage Amortization Calculator

Tuesday Top Tips About Mortgages How Much House Can You Afford Mortgage Payoff Jumbo Loans Mortgage

Tuesday Top Tips About Mortgages How Much House Can You Afford Mortgage Payoff Jumbo Loans Mortgage

Home Affordability Calculator Money

Home Affordability Calculator Money

Can I Afford To Buy A Home Mortgage Affordability Calculator

Can I Afford To Buy A Home Mortgage Affordability Calculator

I Make 90 000 A Year How Much House Can I Afford Bundle

I Make 90 000 A Year How Much House Can I Afford Bundle

Popular Places To Buy A Second Home Osage Beach Remote Work Cabin Fever

Popular Places To Buy A Second Home Osage Beach Remote Work Cabin Fever

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Top Mortgage Lenders Mortgage Lenders

Mortgage Affordability Calculator How Much House Can I Afford Mortgage Top Mortgage Lenders Mortgage Lenders

Simple Home Affordability Calculator How Much Home Can You Afford Mortgage Payment Private Mortgage Insurance Homeowners Insurance

Simple Home Affordability Calculator How Much Home Can You Afford Mortgage Payment Private Mortgage Insurance Homeowners Insurance

Homes More Affordable Today Than 1985 2000 Mortgage Estimator Interest Only Mortgage Mortgage

Homes More Affordable Today Than 1985 2000 Mortgage Estimator Interest Only Mortgage Mortgage

Amazing How Much House You Can Afford With Today S Historically Low Interest Rates If Yo Mortgage Interest Rates Real Estate Infographic Real Estate Marketing

Amazing How Much House You Can Afford With Today S Historically Low Interest Rates If Yo Mortgage Interest Rates Real Estate Infographic Real Estate Marketing

How Much House Can I Afford Rocket Mortgage

How Much House Can I Afford Rocket Mortgage

Home Loan Infographic Design Element Real Estate Stock Vector Image Home Loans Infographic Design Loan

Home Loan Infographic Design Element Real Estate Stock Vector Image Home Loans Infographic Design Loan

Post a Comment for "How Much Home Can I Afford For 2000 A Month"