How Much Home Can I Afford On 150k Salary

Use our calculator to get a sense of how much house you can afford. In most parts of the country income cannot be more than 86850 to take out a.

I M A First Time Buyer Do I Earn Enough To Get A Mortgage Help To Buy Scheme The Guardian

I M A First Time Buyer Do I Earn Enough To Get A Mortgage Help To Buy Scheme The Guardian

Either way they win.

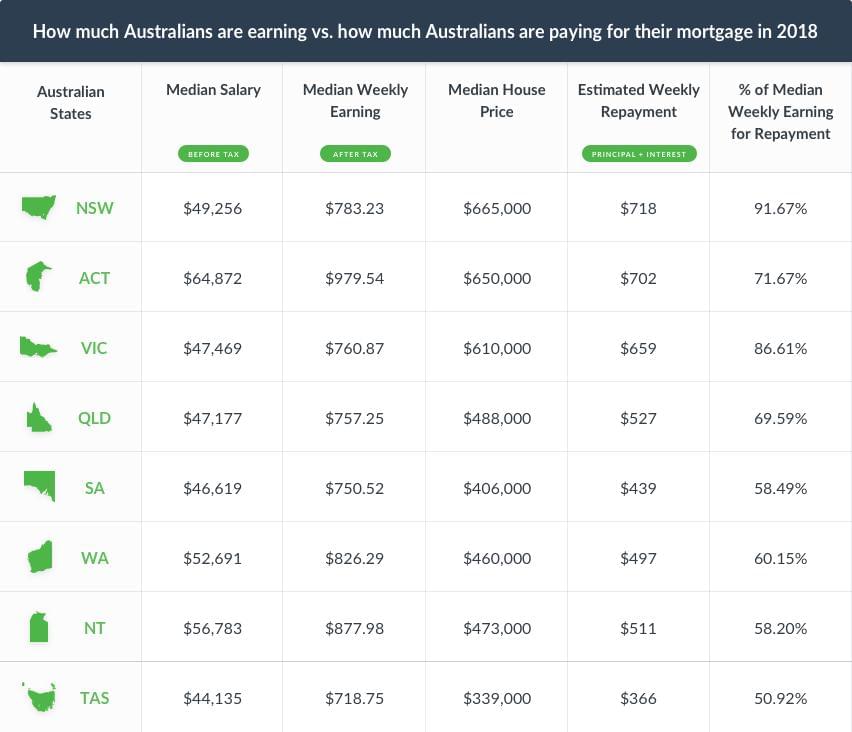

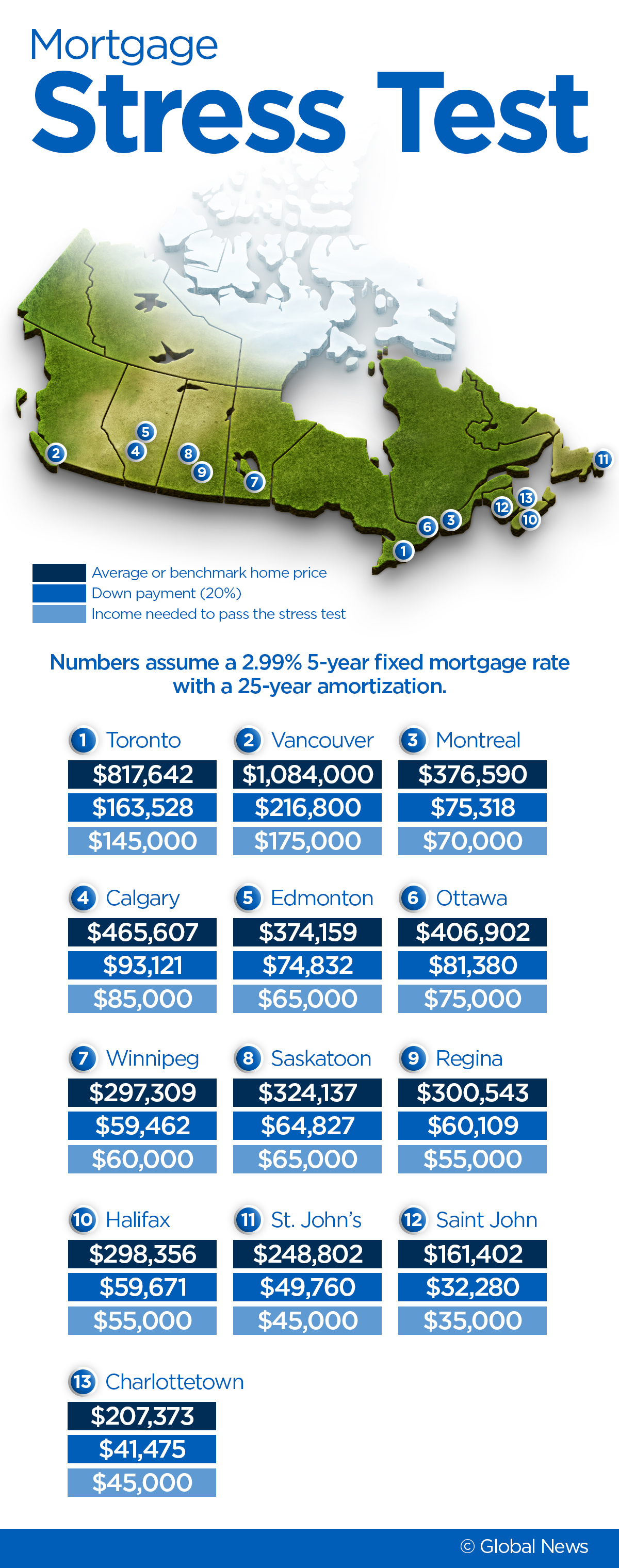

How much home can i afford on 150k salary. DTI Debt to Income ratio is the ratio of your major monthly debt payments to your gross monthly income. Buying a home is a major commitment - and expense. 51 rows To afford a house that costs 150000 with a down payment of 30000 youd need to earn.

Other factors that determine how much you can afford are interest rates and closing costs both of. Remember if you stop paying your car loan the bank repossesses the car. You and your co-borrowers annual income down payment and location which is a primary factor in determining your interest rate and property tax.

How did Research Maniacs calculate how much house you can afford if you make 150000. Use this calculator to calculate how expensive of a home you can afford if you have 150k in annual income. Calculating how much property tax you can afford to pay every year and integrating that into your budget will help you determine how much home you can afford in your state.

Our home affordability calculator estimates how much home you can afford by considering where you live what your annual income is how much you have saved for a down payment and what your monthly debts or spending looks like. This estimate will give you a brief overview of what you can afford when considering buying a house. For example if you and your spouse have a combined annual income of 80000 your mortgage payment should not exceed 1866.

But if you have no debt you can stretch up to 40 of your take-home income which will. The cost of the loan. Multiply the years of your loan by 12 months to.

A home price up to 285372 would be affordable with this budget. Debt to Income Ratio. A bank or car dealer will likely approve you for much more than your result on our calculator.

Depending on these factors you might afford a. The amount of money you borrowed. The mandatory insurance to protect your lenders investment of 80 or more of the homes value.

The traditional monthly mortgage payment calculation includes. How much you can afford to spend on a home depends on several factors including these primary factors. To determine how much house you can afford use this home affordability calculator to get an estimate of the property price you can afford based upon your income and debt profile.

Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. Make sure to consider property taxes home insurance and your other debt payments. So ideally if we round that 28-to-36 rule to one-third of your take-home income you wouldnt be spending more than 1442 on your housing payment dont forget that should include your principal and interest payment taxes and insurance any HOA fees plus PMI or mortgage insurance if you have it.

How much house can I afford with an FHA loan. Quickly find the maximum home price within your price range. The amount you can afford doesnt just depend on your salary but on your mortgage rate down payment and more.

Generally lenders cap the maximum monthly housing allowance including taxes and insurance to lesser of Front End Ratio 28 usually and Back End Ratio 36 usually. Prequalifying for a mortgage is simple and is intended to give you a working idea of how much mortgage you can afford. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 150000 to cover the total cost of debt payment s insurance and property tax.

But what the dealer says you can afford and what you can actually afford are very different. The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income your income before taxes are taken out. Some programs such as the zero-down USDA mortgage have income limits on who can qualify.

The monthly cost of property taxes HOA dues and homeowners insurance.

How Much Money Do You Need To Buy A Rental Property

How Much Money Do You Need To Buy A Rental Property

England And Wales Average Property Prices 1995 2016 Vivid Maps Wales England England Property Prices

England And Wales Average Property Prices 1995 2016 Vivid Maps Wales England England Property Prices

House Buying Tendencies Great Info Barringtonsbest Www Besthomebrokers Com Real Estate Buyers Real Estate Infographic Real Estate Trends

House Buying Tendencies Great Info Barringtonsbest Www Besthomebrokers Com Real Estate Buyers Real Estate Infographic Real Estate Trends

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

700k Mortgage Mortgage On 700k Bundle

700k Mortgage Mortgage On 700k Bundle

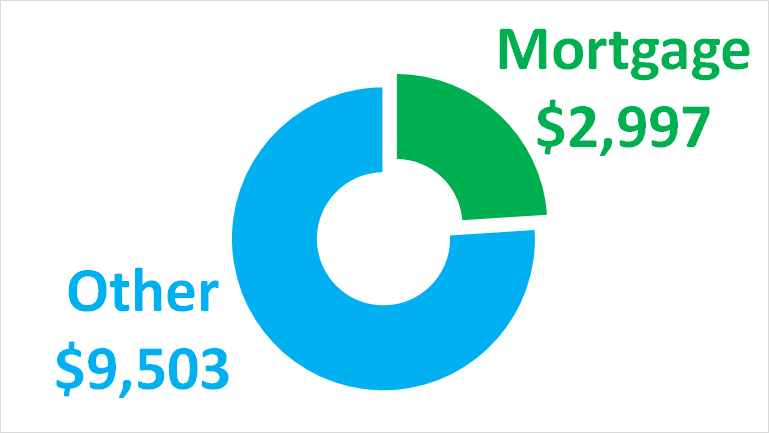

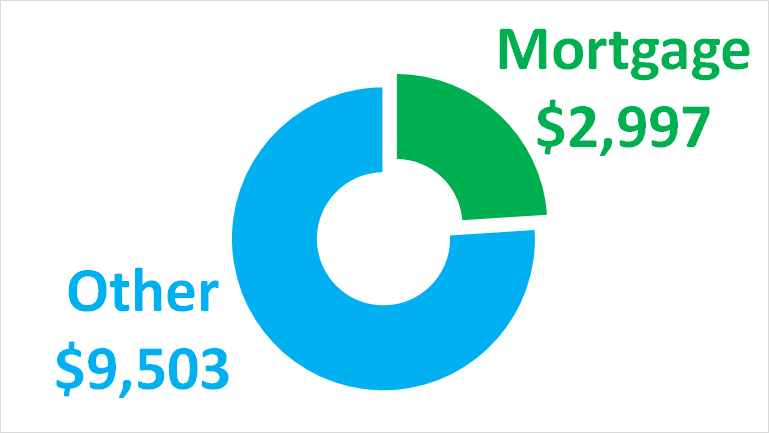

Here S The Budget Of A Couple Who Earns 150 000 And Tithes

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

Homes For Sale In Lafayette Louisiana 150k 175k

Definitions Of A Middle Class Income Consider Yourself Middle Class

Definitions Of A Middle Class Income Consider Yourself Middle Class

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Millionaire 36 S Style On Instagram Time To Check In Halfway Through The Year With My Goals Goal 150k In Total Income Side Income Goals Income

Millionaire 36 S Style On Instagram Time To Check In Halfway Through The Year With My Goals Goal 150k In Total Income Side Income Goals Income

I Make 150 000 A Year How Much House Can I Afford Bundle

I Make 150 000 A Year How Much House Can I Afford Bundle

To Reduce Inequality In The Election Process All States Should Allow Voting At Home Institute For Policy Studies

To Reduce Inequality In The Election Process All States Should Allow Voting At Home Institute For Policy Studies

How To Build A Modular Home For 150k Next Modular

How To Build A Modular Home For 150k Next Modular

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

What Mortgage Can I Afford On 150k Online

Post a Comment for "How Much Home Can I Afford On 150k Salary"