How Much House Can I Afford With 200k Salary

How much house can I afford with an FHA loan. Amount of money for a down payment and closing.

Is A Guy Earning 200 000 In The Us Considered Rich Or Is That An Average Annual Income Quora

Is A Guy Earning 200 000 In The Us Considered Rich Or Is That An Average Annual Income Quora

Youll need more income for a more expensive home.

How much house can i afford with 200k salary. Its critical to choose a home you can afford. The monthly cost of property taxes HOA dues and homeowners insurance. The cost of the loan.

The mandatory insurance to protect your lenders investment of 80 or more of the homes value. The monthly mortgage payment would be 870. Quickly find the maximum home price within your price range.

One of the first questions you ask when you want to buy a home is how much house can I afford. How much house can I afford if I make 200K per year. 51 rows To afford a house that costs 200000 with a down payment of 40000 youd need to earn.

Considering you get a 30-year fixed at 275 you can buy a 1300000 home with a total monthly payment of 67800 per year which is around 34 of your gross income. Its important to consider taxes when deciding how much house you can afford. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 250000 to cover the total cost of debt payment s insurance and property tax.

Multiply the years of your loan by 12 months to. A mortgage on 200k salary using the 25 rule means you could afford 500000 20000 x 25. To know how much house you can afford an affordability calculator can help.

Gross annual income. Research Maniacs checked with different financial institutions and found that most mortgage lenders do not allow more than 36 percent of a gross income of 200000 to cover the total cost of debt payment s insurance and property tax. If your household income is 200k which is really good then your housing expenses should be no more than 60000-70000 per year.

The amount you can afford doesnt just depend on your salary but on your mortgage rate down payment and more. A 100K salary puts you in a good position to buy a home. But remember that when it comes to affordability the amount a lender will lend you and the amount you can comfortably pay without stretching your budget too thin could be very.

With a 100000 salary. Lenders often use the 2836 rule to determine how much house you can afford. For example if you and your spouse have a combined annual income of 80000 your mortgage payment should not exceed 1866.

Because property tax is calculated on the homes assessed value the amount typically can change drastically once a home is sold depending on how. Use our calculator to get a sense of how much house you can afford. When you buy a home you will typically have to pay some property tax back to the seller as part of closing costs.

To afford a house that costs 250000 with a down payment of 50000 youd need to earn 37303 per year before tax. With a 45 percent interest rate and a 30-year term your monthly payment would be 2533 and youd pay 912034 over the life of the mortgage due to interest. The traditional monthly mortgage payment calculation includes.

Depending on these factors you might afford a house. Your home is one of the largest purchases of your lifetime. The golden rule in determining how much home you can afford is that your monthly mortgage payment should not exceed 28 of your gross monthly income your income before taxes are taken out.

Average 630-689 After plugging in these numbers HomeLight estimates that you can afford a home that costs 275218 with monthly payments of 1850. To illustrate how some of these variables can interact to determine your income requirements consider the example of a 30-year fixed mortgage on a home with a 230000 market value for which youre prepared to make a 13 down payment of 30000leaving a. Getting pre-approved for a loan can help you find out how much youre qualified to borrow.

Based on 56902 in annual income we believe you can comfortably afford a total monthly payment of 1679 which including your other debt payments represents 36 of your income. How much do you need to make to be able to afford a house that costs 250000. Mortgage Payment 1068 Estimated Other Costs 611 Total Payment 1679.

How did Research Maniacs calculate how much house you can afford if you make 200000. The ensuing mortgage taxes and maintenance expenses will impact your finances for the next 15-30 years. Buying a home is a major commitment - and expense.

Lets break down how everything factors in. The amount of money you borrowed. Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down.

Use Money Under 30s home affordability calculator to find out how much home you can afford.

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

Your Dream House Will Rob You Of Wealth Building Potential Blog

Your Dream House Will Rob You Of Wealth Building Potential Blog

A Guide On How To Invest 200k Make A Successful Decision Biltwealth

A Guide On How To Invest 200k Make A Successful Decision Biltwealth

England And Wales Average Property Prices 1995 2016 Vivid Maps Wales England England Property Prices

England And Wales Average Property Prices 1995 2016 Vivid Maps Wales England England Property Prices

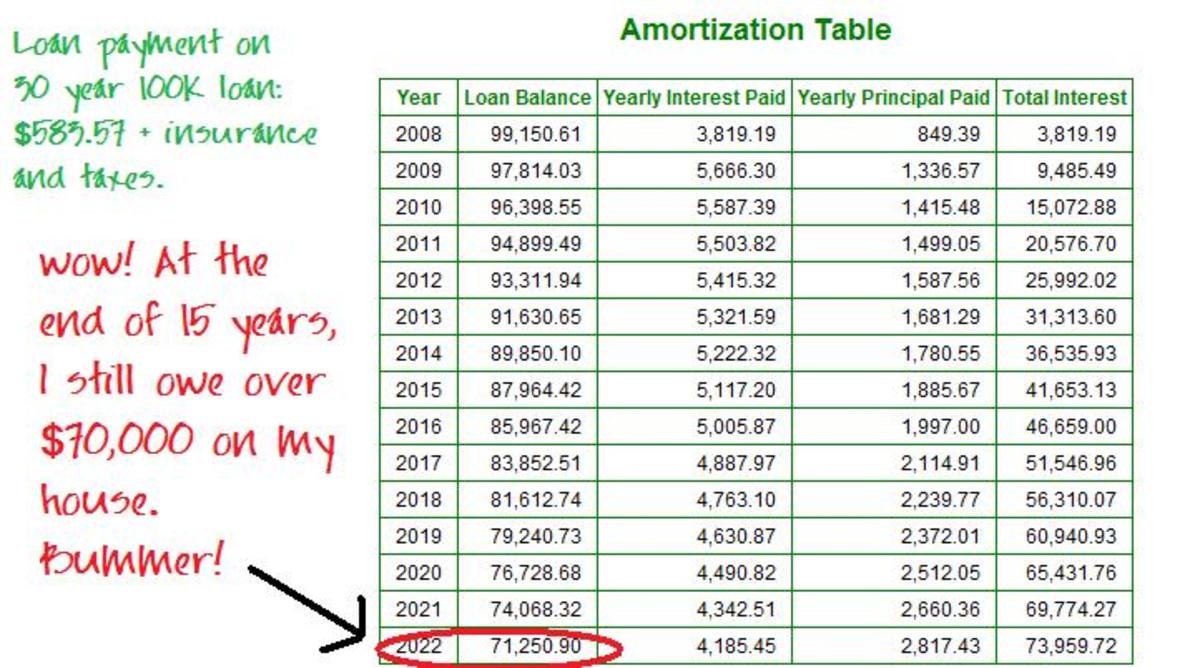

How Much House Can I Afford Do The Math To Find Out The Truth About Mortgage

How Much House Can I Afford Do The Math To Find Out The Truth About Mortgage

The Salary Needed To Buy A Home In 50 U S Metro Areas Vivid Maps Map Home Buying Home Ownership

The Salary Needed To Buy A Home In 50 U S Metro Areas Vivid Maps Map Home Buying Home Ownership

No Debt Buying A House That S Priced Equal To 4x My Annual Income

No Debt Buying A House That S Priced Equal To 4x My Annual Income

House Plans Under 200k Nsw House Plans New House Plans Ranch House Plans

House Plans Under 200k Nsw House Plans New House Plans Ranch House Plans

200k A Year How Much House Online

200k A Year How Much House Online

200k Salary And Still Broke Blind

200k Salary And Still Broke Blind

200k A Year How Much House Online

200k A Year How Much House Online

Is Making 200k A Year Considered Successful In The San Francisco Bay Area Quora

Marketwatch On Twitter Map Home Buying Stuff To Buy

Marketwatch On Twitter Map Home Buying Stuff To Buy

How Much House Can I Afford Bhhs Fox Roach

How Much House Can I Afford Bhhs Fox Roach

What Income Level Is Considered Rich Financial Samurai

What Income Level Is Considered Rich Financial Samurai

200k A Year How Much House Online

200k A Year How Much House Online

200k A Year How Much House Online

200k A Year How Much House Online

A Guide On How To Invest 200k Make A Successful Decision Biltwealth

200k A Year How Much House Online

200k A Year How Much House Online

Post a Comment for "How Much House Can I Afford With 200k Salary"