What Determines How Much You Pay In Taxes

When you complete your Form 1040 and its attached schedules you enter all of your income from various categories such as wages interest and dividends and business income. Your total federal income tax owed is based on your adjusted gross income AGI.

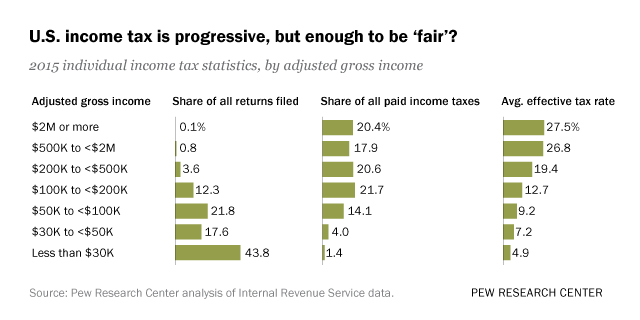

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

The federal tax brackets will guide you on your quest to determine how much you are taxed on every additional dollar of income you earn ie.

What determines how much you pay in taxes. That puts your estimated taxable income at 32200 placing you in the 12 tax bracket for your top dollars. Social Security and Medicare. Besides income the taxes you pay depend on your filing status.

Your employer sends the federal income tax withholding to the IRS on your behalf. The total FITW for the year will be reported on your Form W-2 in box 2. If you exceed that threshold youll move up to the 24 bracket.

So as you get to the end of the tax year you may want to consider scaling back if youre in that ballpark if it makes sense. In our area each parcel of property has to be assessed at least once every 5 years and a sales ratio study is done to determine if the property is assessed similarly to like properties in the area. Your goal is to have at least enough FITW during the year to cover your expected federal income tax liability.

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. How Much Youre Taxed. If your previous years adjusted gross income was more than 150000 or 75000 for those who are married and filing separate returns last year you will have to pay in 110 percent of your previous years taxes to satisfy the safe-harbor requirement.

For tax year 2019 single filers with taxable income of up to 9700 and married couples filing jointly with taxable income of up to 19400 are taxed at a rate of 10. An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

After getting the assessed value it is multiplied by the mill levy to determine your property taxes due. Youll pay 10 on the first 19750 of taxable income and 12 on the income that falls between 19750 and 80250. 7 rows When you file your tax return youll figure out if you paid enough tax in the previous.

Traditional IRA and 401k contributions are tax-deductible the year you make them and you pay income tax on withdrawals in retirement. How withholding is determined The amount withheld depends on. The money you pay in.

Pre-tax deductions such as retirement plan contributions are subtracted first before withholding is calculated on the remaining balance. Your property value will play a big role probably the biggest role in determining how much you pay in property taxes. Market Values Of Other Properties.

For example suppose the assessor determines that your property value is. Use a financial planning. Overview of Federal Taxes.

Your standard deduction for 2020the tax return youll file in 2021would be 24800 as a married couple filing jointly. The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on. So whether you file as single married filing separately married filing jointly or head of household will affect how much income tax you owe.

Tax Withholding Estimator Internal Revenue Service. Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Wages paid along with any amounts withheld are reflected on the Form W-2 Wage and Tax Statement the employee receives at the end of the year.

For example if your adjusted gross income AGI is somewhere between 40126 and 85525 youll pay a tax rate of 22. The amount of taxes that an employer must withhold and remit to the IRS depends on how much in the way of gross income youve earned in the form of wages for the year. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors including your income number of dependents and filing status.

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It Capital Gain Capital Gains Tax What Is Capital

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It Capital Gain Capital Gains Tax What Is Capital

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

Simple Tax Refund Calculator Find Out How Much You Ll Get Back In Taxes

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

How To Fill Out Form W 4 In 2021 Tax Forms W4 Tax Form Form

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

How To Fill Out Form W 4 In 2021 Employee Tax Forms Payroll Taxes Tax Forms

How To Fill Out Form W 4 In 2021 Employee Tax Forms Payroll Taxes Tax Forms

What Are The Tax Brackets H R Block

What Are The Tax Brackets H R Block

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Irs Website

Child Dependent Care Tax Credit Calculator Tax Credits After School Program Irs Website

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Deciding Where To Retire Can Be As Important As Planning When To Retire After All Your Retirement Destination D Retirement When To Retire Health Care Options

Deciding Where To Retire Can Be As Important As Planning When To Retire After All Your Retirement Destination D Retirement When To Retire Health Care Options

Tuesday 16 April 2013 Paying Taxes Tax Investing

Tuesday 16 April 2013 Paying Taxes Tax Investing

The Property Taxes And Insurance Are Variables That Contribute To The Total Payment Property Tax Property Home Hacks

The Property Taxes And Insurance Are Variables That Contribute To The Total Payment Property Tax Property Home Hacks

Who Pays U S Income Tax And How Much Pew Research Center

Who Pays U S Income Tax And How Much Pew Research Center

Pin By Best Website Tools Llc On Sales Tax Calculator Calculator App Calculator Sales Tax

Pin By Best Website Tools Llc On Sales Tax Calculator Calculator App Calculator Sales Tax

Long Island Index Infographic Property Tax Investment Property

Long Island Index Infographic Property Tax Investment Property

Income Taxes What You Need To Know The New York Times

Income Taxes What You Need To Know The New York Times

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Tax Payment

What S The Difference Between Quarterly Taxes Vs Annual Taxes Quarterly Taxes Tax Tax Payment

Get Solution Of All Type Of Accounting Related Problem From Tax Expert Business Read Accounting Tax Accountant

Get Solution Of All Type Of Accounting Related Problem From Tax Expert Business Read Accounting Tax Accountant

How Much Does A Small Business Pay In Taxes

How Much Does A Small Business Pay In Taxes

Post a Comment for "What Determines How Much You Pay In Taxes"