How Much Is Vehicle Stamp Duty In Qld

The Queensland Stamp Duty Calculator will give you a more accurate figure for Queensland than other stamp duty calculators as it uses figures from the State Revenue Office. Queensland charges a 18100 transfer fee.

White Land Rover Defender 110 Land Rover Defender Land Rover Land Rover Defender 110

White Land Rover Defender 110 Land Rover Defender Land Rover Land Rover Defender 110

The results in this field include.

How much is vehicle stamp duty in qld. Does not include Department of Transport and Main Roads registration fees. The general rate of stamp duty in Queensland is as follows. Is a guide onlyit is not a substitute for professional advice.

And for NON-First Time Buyers purchasing Established Home for Primary Residence stamp duty is. Cannot be used for transactions before 1 July 2018. Any caravan defined as a trailer including a camper trailer permanently fitted for human habitation in the course of a journey is exempt from the payment of Vehicle Licence Duty only.

4 rows Stamp Duty Calculator. 350 for each 100 or part of 100. Below youll find stamp duty calculations data for Queensland from 2018.

5 for each 100 or part of 100. Once your purchase price goes above 500000 you will need to pay a concessional rate of stamp duty up to 600000 but as you can see from the example even a 30k increase in price can cost several thousand dollars extra in stamp duty. Regardless of whether your property is for residential commercial or investment purposes youll need to pay stamp duty unless youre eligible for an exemption or your property is valued at less than 5000.

Estimate how much vehicle registration duty you will pay. Stamp duty on property. The insurance duty rate for both class 1 and class 2 general insurance is 9 of the premium paid including GST.

Queensland charges 181 for mortgage registration. According to the Queensland Government anyone who buys or acquires property in Queensland may need to pay stamp duty. Depending on the type of a property buyer people are interested in different options.

3 for each 100 or part of 100. Up to 100000. Vehicle registration duty calculator.

Vehicle licence duty calculator 20202021 Driver and Vehicle Services is required by the Duties Act 2008 to collect vehicle licence duty when a vehicle is licensed or its licence is transferred. To easily determine the correct stamp duty for your purchase round up to the nearest 100 Example 30 256 rounds UP to 30 300. Stamp Duty Calculator for Vehicles Cars in Queensland.

550 for each 100 or part of 100. Class 2 general insurance is. 7 or more cylinders.

5 or 6 cylinders. 2 rows The Northern Territory arguably has the simplest way of calculating stamp duty. In Queensland first home buyers have a stamp duty concession on purchases up to 500000.

100001 rounds UP to 100100. 150 for every 100 or part of 100 over 5000. 450 plus 2 for each 100 or part of 100 of the value of the vehicle that is more than 45000.

First Time Buyers are mostly looking for a primary residence and check all options - Established Home New Home or Vacant Land. An isolated cost of stamp duty you would be required to pay for your property based on the information provided. QLD Stamp Duty Calculator now includes AFAD Additional Foreign.

However you should still only take these results as a guide and remember that legislation could change and affect stamp duty costs. 1050 plus 350 for every 100 or part of 100 over 75000. 4 for each 100 or part of 100.

She would ordinarily need to pay 7525 in stamp duty but with her discount of 8750 she wont need to pay any stamp duty on her purchase. Class 1 general insurance is general insurance other than compulsory third party CTP or class 2 general insurance. Figures are rounded up to the nearest 100.

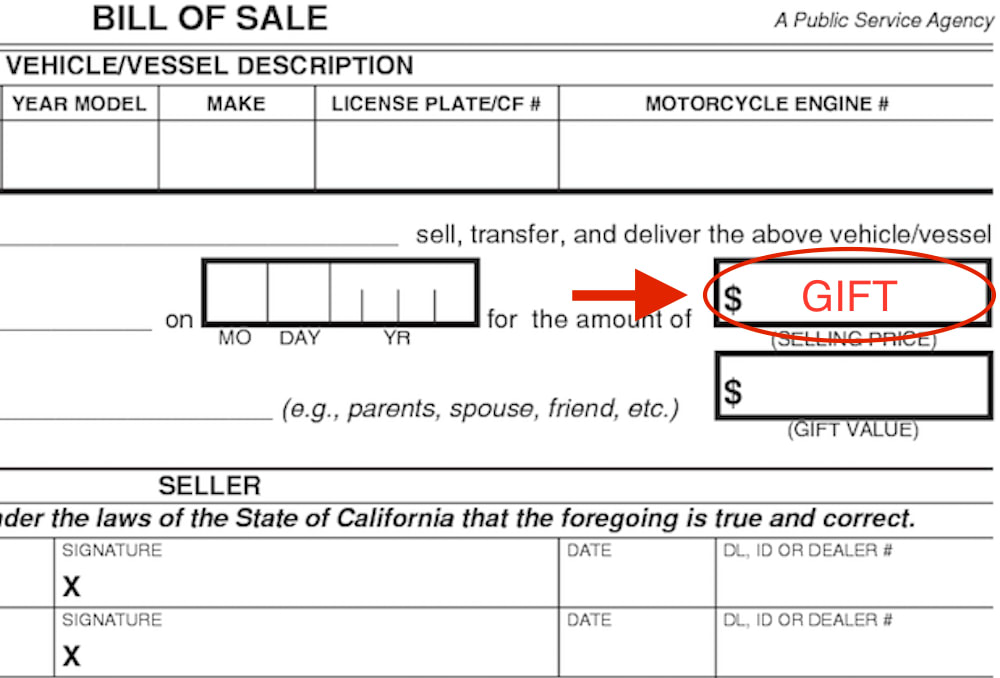

C-rated vehicle and non-rated vehicle. In Queensland Stamp Duty on a new car is calculated on the full retail price of the vehicle before discounts For used cars the market value or selling price which ever is the.

I Just Need Help For The Letter And The Tax Liabil Chegg Com

I Just Need Help For The Letter And The Tax Liabil Chegg Com

Pin On Newsletters Blogs Videos

Pin On Newsletters Blogs Videos

Brisbane Property Valuers For Your Property Valuation Property Valuation How To Find Out Property

Brisbane Property Valuers For Your Property Valuation Property Valuation How To Find Out Property

Car Stamp Duty Explained State By State Calculators

Car Stamp Duty Explained State By State Calculators

Valuation Process Is The Way To Find Out The Value Of Your Property And West Coast Valuers Make This Process Very E Property Valuation How To Find Out Property

Valuation Process Is The Way To Find Out The Value Of Your Property And West Coast Valuers Make This Process Very E Property Valuation How To Find Out Property

Free Course Home First Home Home Free

Free Course Home First Home Home Free

How Much Is Motor Vehicle Stamp Duty In My State Srg Finance

How Much Is Motor Vehicle Stamp Duty In My State Srg Finance

Check Out My New Post Goalcast Http Ljgilland Blogspot Com 2017 05 Goalcast 28 Html Utm Campaign Crowd Real Estate Investment Property Property For Sale

Check Out My New Post Goalcast Http Ljgilland Blogspot Com 2017 05 Goalcast 28 Html Utm Campaign Crowd Real Estate Investment Property Property For Sale

Solved Pbl 1 Part A Group Discussion And Group Written Chegg Com

Solved Pbl 1 Part A Group Discussion And Group Written Chegg Com

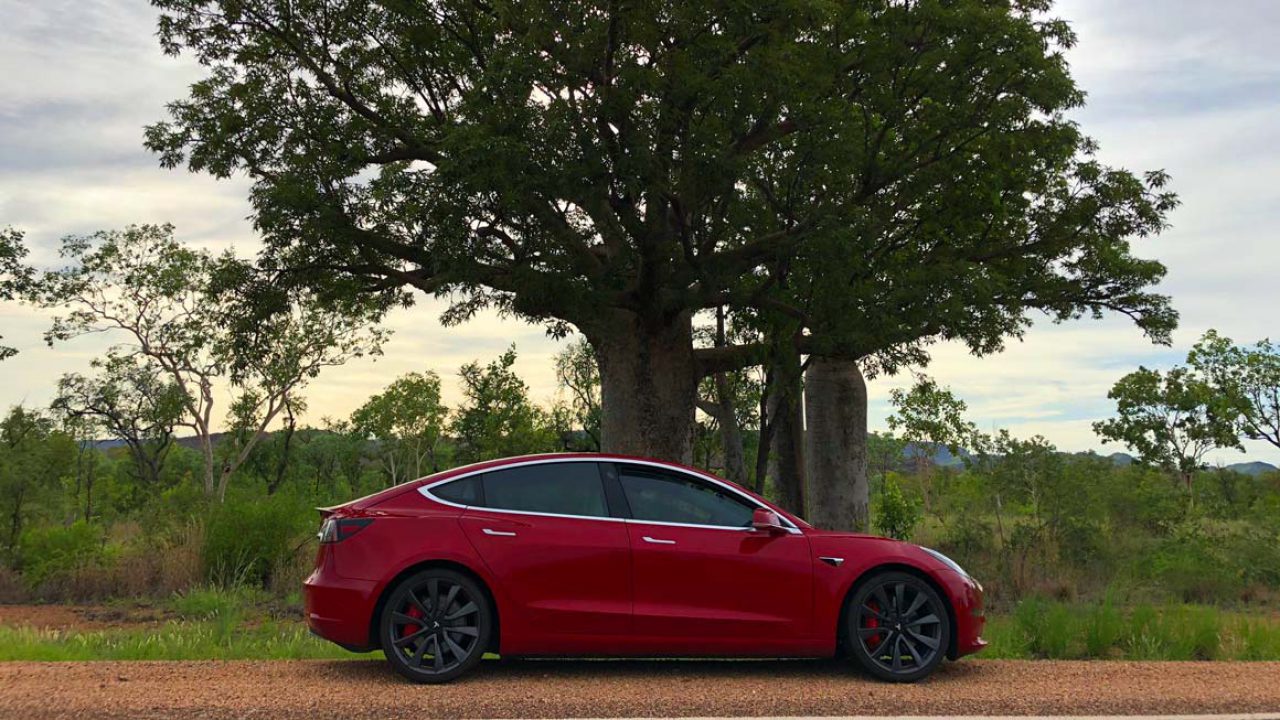

Australia S Luxury Car Tax Threshold Quietly Lifted For Electric Vehicles

Australia S Luxury Car Tax Threshold Quietly Lifted For Electric Vehicles

Pin By Shanjhaiy Rao On Das Auto Police Cars Emergency Vehicles Vehicles

Pin By Shanjhaiy Rao On Das Auto Police Cars Emergency Vehicles Vehicles

Safe Ways To Pay Or To Accept Payment For A Used Car Auto City

Safe Ways To Pay Or To Accept Payment For A Used Car Auto City

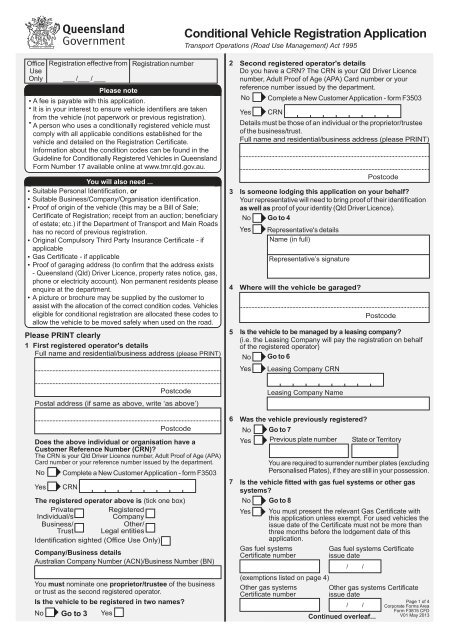

Conditional Vehicle Registration Application Queensland

Conditional Vehicle Registration Application Queensland

Stamp Duty For Cars Explained Car Advice Carsguide

Stamp Duty For Cars Explained Car Advice Carsguide

Post a Comment for "How Much Is Vehicle Stamp Duty In Qld"