How Much Stamp Duty Am I Saving

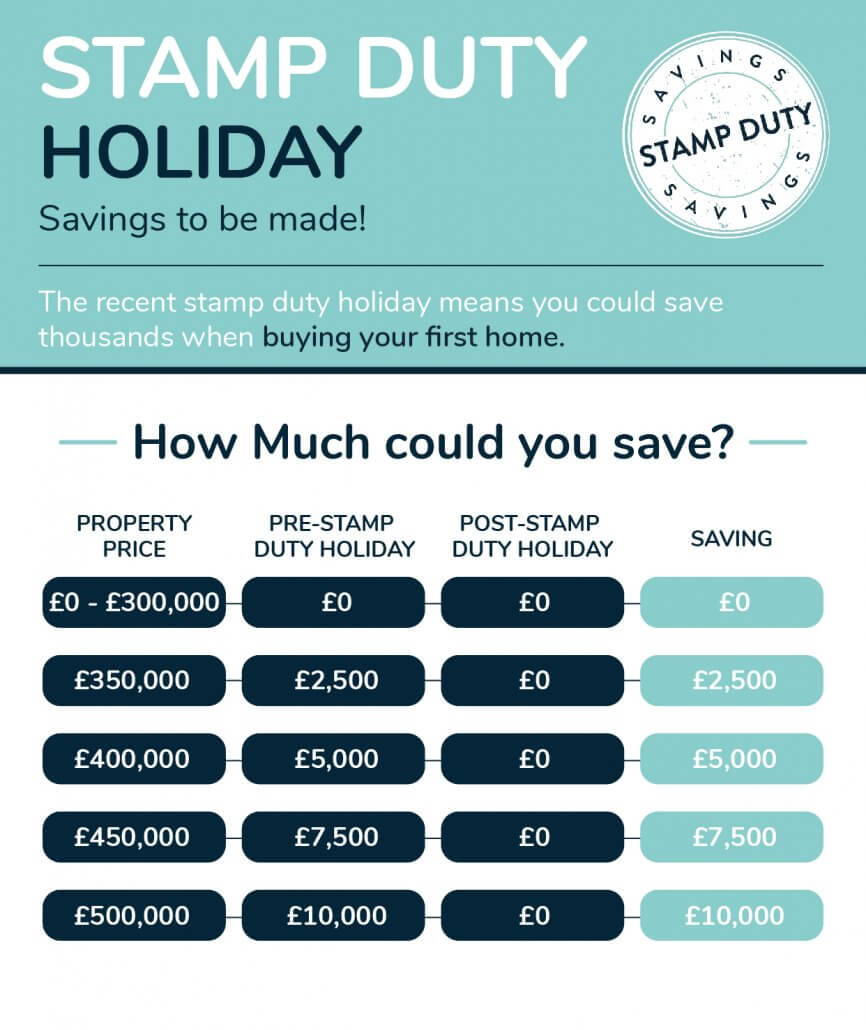

So if you buy a 600000 property for example while the holidays on youll pay just 5000 stamp duty 5 of the 100000 above the threshold rather than the standard 20000. You can calculate how much Stamp Duty youll have to pay here using our calculator.

Nikos Kazantzakis Sayings Picture Quotes Famous Quotes

Nikos Kazantzakis Sayings Picture Quotes Famous Quotes

If you exchange on or before 30 June but complete after 30 June then youll have missed the deadline and will need to pay the normal rate of stamp duty.

How much stamp duty am i saving. Total SDLT 3750. This is a saving of 15000 based on the Stamp Duty rates that were in place before 8 July 2020. On a property purchased for 750000 the total stamp duty payable would be 12500.

That means the stamp duty threshold for first-time buyers is as follows. You need to have completed by 30 June to benefit from the stamp duty holiday. This calculator is powered by our banking partner NAB.

If youre buying your first home. If youre purchasing a buy-to-let property or second home youll pay 3 extra on each band. Use the SDLT calculator to work out how much tax youll pay.

The stamp duty calculation is as follows. How much you could save from not having to pay stamp duty depends on how much the house costs and whether or not its a second property but it could be tens of thousands. Its worth noting that for properties costing more than 500000 the stamp duty holiday hasnt changed the bands above 500000 but youll still make a saving of 15000 on the first 500000.

5 stamp duty on next 250001 - 925000 of property value. The stamp duty holiday has temporarily raised this threshold to 500000 until 30th June 2021 so if youre looking to trade up you may save a fair amount of money on your move if you can complete your purchase before then. Total government fees 48260.

For example if you buy a house for 575000 the Stamp Duty Land Tax you owe is calculated as follows. This means that a home mover purchasing a house costing a typical 320000 for example would save 6000 now that the stamp duty threshold has moved to 500000 says accountancy and tax firm Blik Rothenberg. The table below shows the rates of stamp duty for someone buying their next home with a completion date on or before 30 June 2021 would pay.

0-250000 0-300000 for first-time buyers 0. No stamp duty is payable on the first 500000 and 12500 is payable on the 250000 portion within the next band between 500000 925000. 12 stamp duty above 15 million of property value.

This is known as first time buyer stamp duty relief. 0 stamp duty on first 0 - 125000 of property value. Rishi Sunak raised the threshold at which stamp duty kicks in to 500000 today to help people move home save them up to 15000 in tax and boost the economy in the coronavirus recovery.

The effective tax rate is 000. However if the lease extension is on your main residence you are exempt. Pay more for the extension and own other properties and youll pay the additional stamp duty rate.

Portion of property price. First time buyer stamp duty. The issue with the stamp duty for second homes rate is that it kicks in at a much lower 40000.

Stamp Duty to pay is. Stamp Duty Holiday 2021 As of 3rd March 2021 the Chancellor announced an extension to the Stamp Duty holiday for all properties in England and Northern Ireland up to the value of 500000 this will continue to be the case for all properties purchased by. 10 stamp duty on next 925001 - 15 million of property value.

How much could I save on stamp duty. 0 on the first 500000 0. Take a shortcut to your new home.

5 on the final 75000 3750. How much you will save from not having to pay stamp duty depends on how much the house costs - but it could be tens of thousands of pounds. The rate on the amount between 300000 and 500000 was 5.

Stamp Duty is paid at different rates depending on the purchase price. The stamp duty holiday will end on 30 June meaning that normal stamp duty rates will apply from July onwards. A home mover purchasing a house worth a typical 320000.

You can claim a discount relief if you buy your first home before 8 July 2020 or from 1 July 2021. You must pay 5 stamp duty on the portion between 300001 and 500000. 250001-925000 300001-925000 for first-time buyers 5.

2 stamp duty on next 125001 - 250000 of property value. How much you will save from not having to pay stamp duty depends on how much the house costs and whether or not its a second property but it could be tens of thousands.

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

What Is The New Stamp Duty Rate Will I Have To Pay Home Security Systems Best Home Security System Home Automation System

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Self Inking Address Stamp Custom Stamp Custom Address Stamp Etsy Personalized Self Inking Stamps Self Inking Address Stamp Custom Address Stamp

Self Inking Address Stamp Custom Stamp Custom Address Stamp Etsy Personalized Self Inking Stamps Self Inking Address Stamp Custom Address Stamp

Under Construction Vs Sub Sale Properties 8 Things You Need To Know This Or That Questions Property Under Construction

Under Construction Vs Sub Sale Properties 8 Things You Need To Know This Or That Questions Property Under Construction

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Stamp Duty Cut On Home Registration In Maharashtra Is A Band Aid Solution

Stamp Duty Cut On Home Registration In Maharashtra Is A Band Aid Solution

Access Bank Dear Access Bank Customers Please Do Well To Read This Before Heading To The Bank Tomorrow I Guess This Will Be Of Help To You Dear Bank Reading

Access Bank Dear Access Bank Customers Please Do Well To Read This Before Heading To The Bank Tomorrow I Guess This Will Be Of Help To You Dear Bank Reading

Sms Alerts 8 Sms Charge Bank Rupees

Sms Alerts 8 Sms Charge Bank Rupees

Homebuyers Struggle Sellers Just Add The Stamp Duty Saving To The Price Housing Market The Guardian

Homebuyers Struggle Sellers Just Add The Stamp Duty Saving To The Price Housing Market The Guardian

Banking Suvidha Stamp Duty On Mutual Funds To Apply From 1 July 2020 Mutuals Funds Typing Jobs Mutual

Banking Suvidha Stamp Duty On Mutual Funds To Apply From 1 July 2020 Mutuals Funds Typing Jobs Mutual

7 Income Tax Saving Tips You Might Not Know Income Tax Saving Tips Tax Deductions

7 Income Tax Saving Tips You Might Not Know Income Tax Saving Tips Tax Deductions

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

Stamp Duty Calculator Planned Housing Developments In Devon Cornwall Somerset Dorset

In A Big Move To Revive Business In The Real Estate Sector The Maharashtra Government Has Reduced The Stamp Duty On Sale Dream Properties Investing Stamp Duty

In A Big Move To Revive Business In The Real Estate Sector The Maharashtra Government Has Reduced The Stamp Duty On Sale Dream Properties Investing Stamp Duty

Arihant Presents The Grand Dil Dhadkane Wala Sale Where You Save Big Buy A Flat Get Half Kitchen Area Free A Unique Opport Kitchen Area Sale Stuff To Buy

Arihant Presents The Grand Dil Dhadkane Wala Sale Where You Save Big Buy A Flat Get Half Kitchen Area Free A Unique Opport Kitchen Area Sale Stuff To Buy

Stamp Duty Stamp Duty Good Credit Save Yourself

Stamp Duty Stamp Duty Good Credit Save Yourself

Snowflake Winter Wedding Save The Date Postage Wedding Saving Winter Wedding Save The Date

Snowflake Winter Wedding Save The Date Postage Wedding Saving Winter Wedding Save The Date

Post a Comment for "How Much Stamp Duty Am I Saving"