What Do U Need To Qualify For A First Time Home Buyer

In fact what qualifies as a first-time homebuyer under many programs is often someone who hasnt owned a home in at least three years or more. The First-Time Home Buyers Tax Credit was first introduced in 2009 and is available to all qualifying.

What Is The First Time Home Buyer Credit And Will It Ever Come Back Forbes Advisor

What Is The First Time Home Buyer Credit And Will It Ever Come Back Forbes Advisor

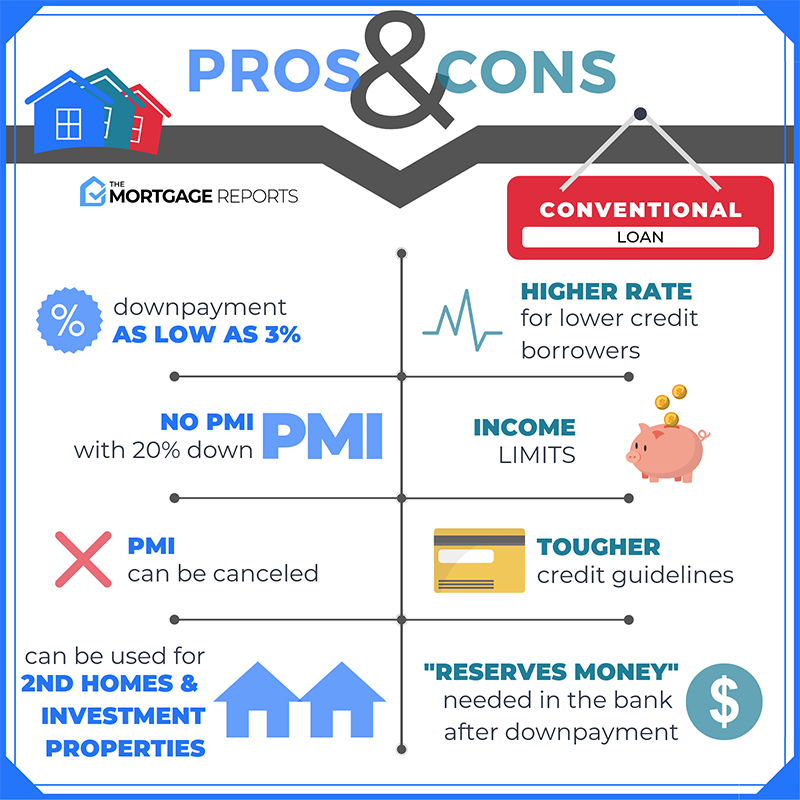

Some mortgage programs like USDA loans and Fannie Maes HomeReady loan come with income.

What do u need to qualify for a first time home buyer. Your credit score commonly called a FICO Score can range from 300 at the low end to 850 at the high end. The maximum debt-to-income ratio is 43 to 50 and a mortgage insurance premium is required along with an upfront MIP fee of. FICO Scores range from 300 to 850.

8 rows In general first-time buyers need to verify at least two years of income and steady employment. Homebuyers who arent purchasing for the first time can still be eligible as long as theyre buying a house in a HUD-approved area. The following criteria are qualifications to be considered.

While 750 isnt a life-changing amount of money it can make buying your first home a little bit easier. 1 day agoAll these apply both to existing homeowners and someone who qualifies as a first-time home buyer. Credit Score to qualify for a mortgage credit score is of the utmost importance.

As a first time buyer these may be new to you but the most important factors that determine if you qualify are. But chances are you may need higher credit scores of around 680 or so to qualify for a conventional mortgage. You could potentially be required to take a homebuyer education course before claiming your credit.

FICO Scores of at least 640 or so are typically all that are needed to qualify for first-time homebuyer assistance. The qualifications for first-time home buyers are broader than perceived. They can vary depending on the state in which you buy.

Each loan program has different qualification requirements but in general theyre all similar. Credit scores are maintained by the national credit bureaus and include debt like credit cards auto loans or student loans. If youre buying a home for the first time claiming the first-time homebuyer credit can land you a total tax rebate of 750.

But you might also count as a first-time buyer if you havent owned a home in the past three years. 3 Primary Factors that Affect First Time Buyer Qualification. A score of 740 or above is generally considered very good but you dont need that score or above to buy a home.

Whether youre a first-time home buyer considering a new residence in New Mexico or anywhere else in the United States there are three basic guidelines you will want to follow to prepare for whats ahead. All first time buyer programs and all loan programs in general with the exception of a VA loan have a minimum required credit score. If your family has a low income or is in public housing and you want to buy a home the Department of Housing and Urban Development HUD Homeownership Voucher Program may help you meet your monthly mortgage payments and other home expenses.

To qualify for an FHA loan borrowers will need to meet guidelines that may include a minimum credit score of 580 a maximum debt-to-income ratio of 45 and. Buyers with a 500-579 credit score may qualify with 10 down. If youre buying your very first home you count as a first-time home buyer by default.

FHA loans are perfect for first-time buyers because they require just a 580 credit score with 35 down. Websites like HUDGOV are trustworthy resources for up-to-date information about statewide and regional homeownership assistance programs and grants offered in. This distinction can make all.

According to the Federal Housing Administration FHA there are many factors considered to qualify as a first time home buyer. Provided you are considered a first-time buyer here are the main benefits you might receive depending on your situation.

Awesome Home Buying Process Infographic Developed By The Linda Craft Team Lindacraftrealtors Home Buying Process Real Estate Infographic Real Estate Fun

Awesome Home Buying Process Infographic Developed By The Linda Craft Team Lindacraftrealtors Home Buying Process Real Estate Infographic Real Estate Fun

First Time Buyer What You Need To Know Before Buying A House

First Time Buyer What You Need To Know Before Buying A House

:max_bytes(150000):strip_icc()/homeowners_78751811-5bfc375146e0fb00265eea42.jpg) First Time Homebuyer S Guide Steps For Buying

First Time Homebuyer S Guide Steps For Buying

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

Pin By Renee Ciufo Realtor On Your Real Estate Consultant For Life Real Estate Infographic Real Estate Real Estate Tips

Pin By Renee Ciufo Realtor On Your Real Estate Consultant For Life Real Estate Infographic Real Estate Real Estate Tips

Pin On Kentucky Grants First Time Home Buyer Loan Programs

Pin On Kentucky Grants First Time Home Buyer Loan Programs

/client-signing-a-contract-in-a-real-estate-agency-580177d15f9b5805c240cd93.jpg) First Time Homebuyer S Guide Steps For Buying

First Time Homebuyer S Guide Steps For Buying

Home Buyers 9 Easy Steps To Follow During Your Home Buying Process Great Resource From The U S Depart Home Buying First Time Home Buyers Home Buying Process

Home Buyers 9 Easy Steps To Follow During Your Home Buying Process Great Resource From The U S Depart Home Buying First Time Home Buyers Home Buying Process

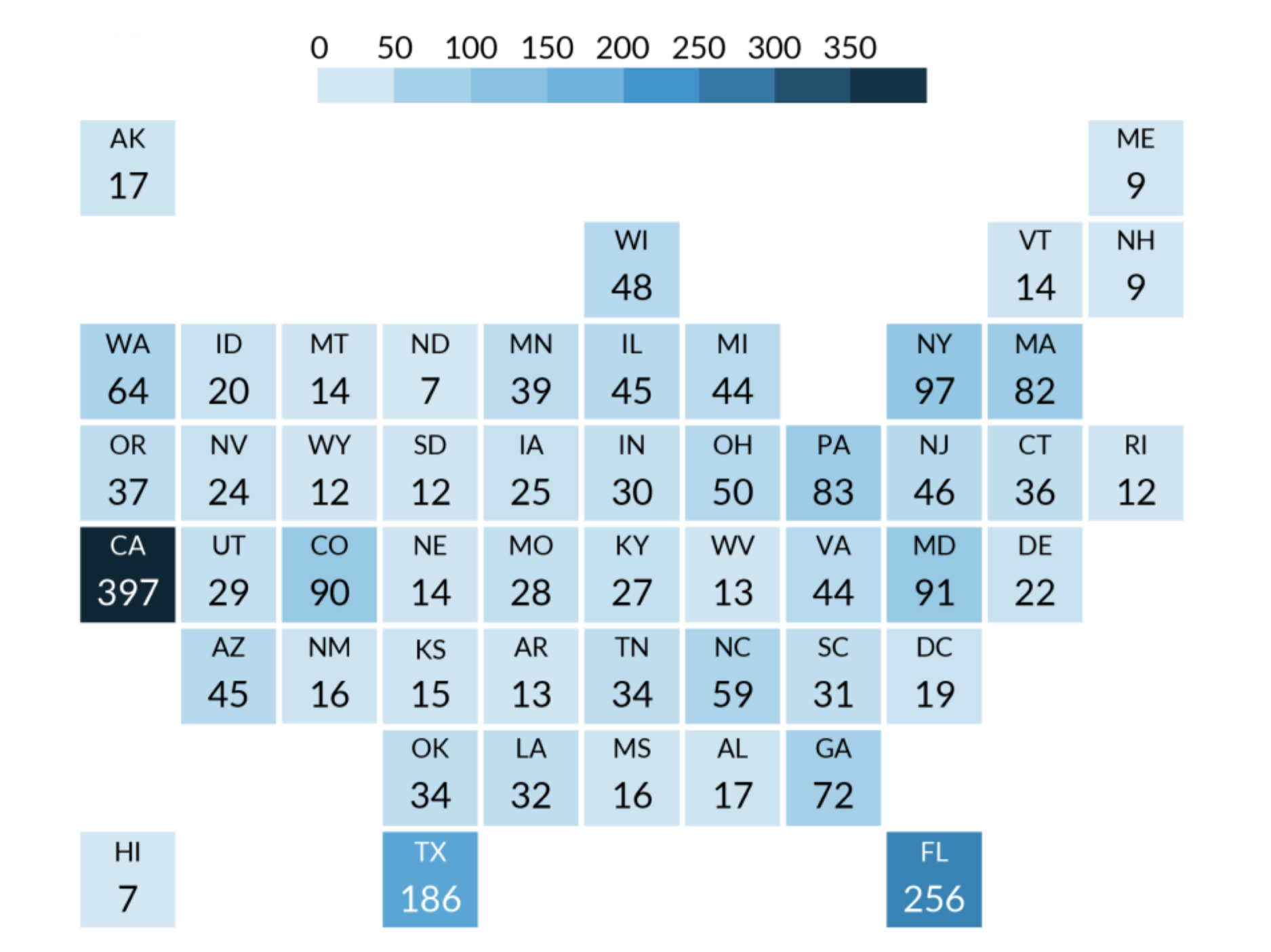

Colorado First Time Home Buyer Programs Of 2021 Nerdwallet

Colorado First Time Home Buyer Programs Of 2021 Nerdwallet

U Haul Home Renovation Loan Moving Truck New Home Buyer

U Haul Home Renovation Loan Moving Truck New Home Buyer

First Time Home Buyer Down Payment How Much Is Needed

First Time Home Buyer Down Payment How Much Is Needed

How To Buy A House With Low Income In 2021 Loan Options

How To Buy A House With Low Income In 2021 Loan Options

Here S Exactly What It Takes To Buy A House First Home Buyer Buying First Home Home Buying

Here S Exactly What It Takes To Buy A House First Home Buyer Buying First Home Home Buying

First Time Homebuyer S Checklist Money Com

First Time Homebuyer S Checklist Money Com

First Time Buyer What You Need To Know Before Buying A House

First Time Buyer What You Need To Know Before Buying A House

7 First Time Home Buyer Tips First Time Home Buyers The More You Know Home Buying

7 First Time Home Buyer Tips First Time Home Buyers The More You Know Home Buying

First Time Home Buyer Down Payment How Much Is Needed

First Time Home Buyer Down Payment How Much Is Needed

Free First Time Home Buyer S Event Everyone Is Welcome And Bring A Friend Home Buying Process What Is Escrow First Time Home Buyers

Free First Time Home Buyer S Event Everyone Is Welcome And Bring A Friend Home Buying Process What Is Escrow First Time Home Buyers

First Time Homebuyer Definition

First Time Homebuyer Definition

Post a Comment for "What Do U Need To Qualify For A First Time Home Buyer"