How Much House Can I Afford Veterans United

Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. Where did this number come from.

Minimum Property Requirements For A Va Home Loan

Minimum Property Requirements For A Va Home Loan

Some loans like VA loans and some USDA loans allow zero down.

How much house can i afford veterans united. Veterans United is the countrys largest VA home loan lender. The amount youll pay to the lender in. How much VA loan can you afford.

VA Home Loan Payment Calculator By Kimberly Duncan Formerly a content contributor at Veterans United Network Kimberly Duncan NMLS 1227482 is a Senior Transaction Coordinator at Veterans United Home Loans analyzing and processing VA home loan applications. Colletti and his wife Rachel Ewing Colletti closed with no money down on a 965000 house. Most home loans require at least 3 of the price of the home as a down payment.

For example if you buy a 400000 house put down 40000 and plan to pay all the closing costs upfront the principal would be 360000 Interest. Well think of your. To calculate how much home you can afford with a VA loan VA lenders will assess your debt-to-income ratio DTI.

The rule of thumb is that a military family can comfortably afford a home that is up to three times their average annual household income. See how Veterans United compares to other lenders and decide whether its right for you. Use our VA home loan calculator to estimate your mortgage payment with taxes and insurance.

DTI ratio reflects the relationship between your gross monthly income and major monthly debts. Simply enter the price of the home your down payment and details about the home loan to calculate your mortgage payment breakdown schedule and more. Find out just how much home you can afford.

The first step in buying a house is determining your budget. Price out your house. In circumstances where the ratio exceeds 41 the VA automatic underwriter can consider the ratio in conjunction with all other credit factors.

1400 Veterans United Dr Columbia MO 65203. Then talk to a Freedom Mortgage specialist to apply for your VA home loan. See why more Veterans and military families chose Veterans United for their VA home purchase than any other lender in 2020.

Our calculator uses the information you provide about your. You should have three months of housing payments and expenses saved up. This calculator is for general education purposes only and is not an illustration of current Navy Federal products and offers.

The VA has determined the acceptable ratio to be 41 and it is used as a guide. Quickly find the maximum home price within your price range. Our VA Mortgage Affordability Calculator can help you get a rough estimate of how much you can afford to pay for a home as well as your estimated monthly mortgage payment.

Use our VA Calculator to determine how much house you can afford. Calculations by this tool are believed to be accurate yet are not guaranteed. Military veterans and activy duty military members can now obtain VA loans with no money down for homes exceeding the conforming loan limit.

Of Veterans Affairs or any government agency. This is for things like insurance taxes maintenance and repairs. Representatives Available 247 to Better Serve Troops Overseas 1-800-884-5560 Get a Quote A VA approved lender.

Not endorsed or sponsored by the Dept. Your debt-to-income ratio DTI should be 36 or less. Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down.

To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross monthly income on home-related. New Law Starting January 2020. Can You Obtain VA Loans Above Conforming Loan Limits.

Your housing expenses should be 29 or less. Find out how much you can borrow for 0 down. We help Veterans become Homeowners.

Find out how much you can qualify to borrow based on your annual income savings and other debts.

List Of Non Allowable Fees On Va Home Loans

List Of Non Allowable Fees On Va Home Loans

Click Through For More Information Click Information Through Va Loan Va Mortgages Refinance Loans

Click Through For More Information Click Information Through Va Loan Va Mortgages Refinance Loans

List Of Non Allowable Fees On Va Home Loans

List Of Non Allowable Fees On Va Home Loans

How Much House Can I Afford Dave Ramsey Style Sell My House Fast Sell My House Sell Your House Fast

How Much House Can I Afford Dave Ramsey Style Sell My House Fast Sell My House Sell Your House Fast

If Your Goal Is To Buy A Home And Your Credit Is Fairly Damaged You Have A Few Great Options Va Loan For Those Who Are Va Mortgages Refinance Loans

If Your Goal Is To Buy A Home And Your Credit Is Fairly Damaged You Have A Few Great Options Va Loan For Those Who Are Va Mortgages Refinance Loans

5 Tips To Avoid Being House Poor Buying First Home Home Buying Process Home Buying Tips

5 Tips To Avoid Being House Poor Buying First Home Home Buying Process Home Buying Tips

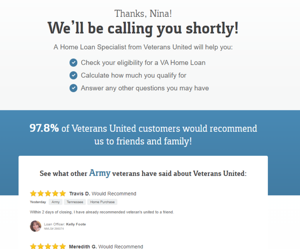

Veterans United Mortgage Review 2020 Smartasset Com

Veterans United Mortgage Review 2020 Smartasset Com

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Steps Of The Va Loan Process Veterans United Home Loans Home Loans Va Loan Refinance Mortgage

Steps Of The Va Loan Process Veterans United Home Loans Home Loans Va Loan Refinance Mortgage

The 5 Biggest Mistakes Veteran And Military Home Buyers Make

The 5 Biggest Mistakes Veteran And Military Home Buyers Make

Veterans United Mortgage Review 2020 Smartasset Com

Veterans United Mortgage Review 2020 Smartasset Com

Va Home Buyer Course Home Loans Home Buying Process Mortgage Refinance Calculator

Va Home Buyer Course Home Loans Home Buying Process Mortgage Refinance Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Buying First Home Home Buying Process Home Buying Tips

How Much House Can I Afford Insider Tips And Home Affordability Calculator Buying First Home Home Buying Process Home Buying Tips

Veterans United Mortgage Review 2020 Smartasset Com

Veterans United Mortgage Review 2020 Smartasset Com

If You Follow This Tip Your Weekend Getaway Could Help You Save Some Money On Your Utility Bill Va Loan Veterans United Homeowner

If You Follow This Tip Your Weekend Getaway Could Help You Save Some Money On Your Utility Bill Va Loan Veterans United Homeowner

Veterans United Mortgage Review 2020 Smartasset Com

Veterans United Mortgage Review 2020 Smartasset Com

An Overview Of Property Types Eligible For Va Loans

An Overview Of Property Types Eligible For Va Loans

Va Loans For First Time Homebuyers From Veterans United Home Loans Veterans United Va Loan Home Buying

Va Loans For First Time Homebuyers From Veterans United Home Loans Veterans United Va Loan Home Buying

Va Home Loans For Veterans And Military Veterans United Home Loans Veterans United Va Mortgage Loans Home Loans

Va Home Loans For Veterans And Military Veterans United Home Loans Veterans United Va Mortgage Loans Home Loans

Post a Comment for "How Much House Can I Afford Veterans United"