Was The First Stimulus Check Based On Adjusted Gross Income

The Economic Impact Payments were based on your 2018 or 2019 tax information. Eligible individuals dont need a minimum income for the payment.

However for higher income individuals the first payment amount was reduced by 5 of the amount that their adjusted gross income AGI exceeds.

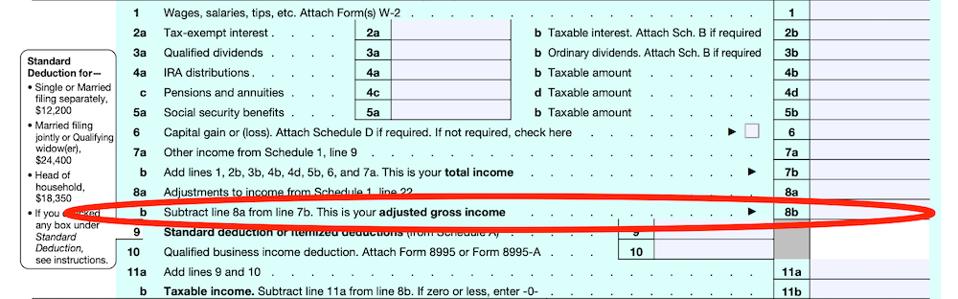

Was the first stimulus check based on adjusted gross income. The next relief package could reduce the number of people who receive a stimulus check by lowering the cutoff for a payment to individuals with an adjusted gross income of 80000. Your eligibility for a 1400 stimulus check is based on your adjusted gross incomeheres how to calculate it March 4 2021 While lawmakers have not yet agreed on the details of another coronavirus relief package fresh 1400 stimulus checks are expected to be included. With the deadline looming on May 17 it is high time you gather your 1099 and W-2 forms.

Singles with adjusted gross income of up to 75000 will get the. 4 hours agoThe first monthly payment of the expanded child tax credit from the 19 trillion coronavirus. Single taxpayers with an AGI over 80000 will not be eligible for any stimulus money down from a 99000 cutoff for the first check and 87000 for the second check.

Your AGI determines more than your tax refund or payment this year. Payments of up to 1200 and 600 per person were issued before. Your adjusted gross income.

It is all based upon an individuals adjusted gross income. If a single taxpayer earned an AGI of 80000 in 2019 and 70000 in 2020 for example she would have received 0 based on her 2019 income but the full 1400 based. 112500 for taxpayers filing as head of household.

Some people may have received less than the full Economic Impact Payments because their adjusted gross income was too high. If you are filing as single with an adjusted gross income AGI up to 75000 married filing jointly with an AGI up to 150000 or head of household with an AGI up to 112500 you will receive the full payment. And then there are the 1444 notices both A.

HR Block has also published a handy coronavirus stimulus calculator. Following are some factors that may affect eligibility for the Recovery Rebate Credit. To make it work youre going to need to know such things as your adjusted gross income from your 2019 tax return.

150000 for taxpayers filing a joint return. Above these income limits the payment amount decreases 5 percent for every additional. If you meet the following four requirements you likely qualify for the first stimulus check.

How do you qualify for a plus-up payment For taxpayers stimulus checks are based on your adjusted gross income or AGI from your most recent tax. This tax season will give some people a second chance at money from the first two stimulus checks. Adjusted gross income for taxes child tax credit stimulus checks.

First it is important to understand how the payments are calculated. For the first round of payments the total amount of your stimulus check was based on your adjusted gross income or AGI from your 2019 federal tax filing or if. These are the income limits to be eligible for the 600 stimulus check Published Mon Dec 21 2020 457 PM EST Updated Mon Dec 21 2020 645 PM EST Alicia Adamczyk AliciaAdamczyk.

If you havent filed your tax returns for 2020 you can determine how much you ought to have received from the initial stimulus check. How to find it.

600 Second Stimulus Check Calculator Forbes Advisor

600 Second Stimulus Check Calculator Forbes Advisor

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

Who Qualifies For A 1 400 Stimulus Payment Under The House Bill

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

What Is Adjusted Gross Income How To Calculate If You Re Eligible For Third Stimulus Check

What Is Adjusted Gross Income How To Calculate If You Re Eligible For Third Stimulus Check

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Adjusted Gross Income For Taxes Child Tax Credit Stimulus Checks How To Find It Cnet

Stimulus Check Qualifications Find Out If You Re Eligible For 1 400 Or More Personal Finance Irs Tax Refund

Stimulus Check Qualifications Find Out If You Re Eligible For 1 400 Or More Personal Finance Irs Tax Refund

Stimulus Update 1 400 Checks Could Come With New Income Limits Tax Tie In How To Get Money Money Spells Need Money

Stimulus Update 1 400 Checks Could Come With New Income Limits Tax Tie In How To Get Money Money Spells Need Money

Who Is Eligible For A Stimulus Check Forbes Advisor

Who Is Eligible For A Stimulus Check Forbes Advisor

Stimulus Update 1 400 Checks Could Come With New Income Limits Tax Tie In Being A Landlord Income Tax Return This Or That Questions

Stimulus Update 1 400 Checks Could Come With New Income Limits Tax Tie In Being A Landlord Income Tax Return This Or That Questions

Proposals Free Rent And 2 000 Monthly Stimulus Checks Adjusted Gross Income Being A Landlord Mortgage Agreement

Proposals Free Rent And 2 000 Monthly Stimulus Checks Adjusted Gross Income Being A Landlord Mortgage Agreement

Stimulus Check Lost In The Mail Probably Not 11 Things Causing A Holdup Tax Deadline Prepaid Debit Cards Irs

Stimulus Check Lost In The Mail Probably Not 11 Things Causing A Holdup Tax Deadline Prepaid Debit Cards Irs

Proposal You Get A 2 000 Stimulus Check Every Month Money Skills Poor People S Campaign Proposal

Proposal You Get A 2 000 Stimulus Check Every Month Money Skills Poor People S Campaign Proposal

Stimulus Checks Plus Up Payments Irs Delivery Timeline Everything Else You Should Know In 2021 How To Get Money Filing Taxes Tax Season

Stimulus Checks Plus Up Payments Irs Delivery Timeline Everything Else You Should Know In 2021 How To Get Money Filing Taxes Tax Season

Much Awaited Stimulus Cash Will Begin Flooding Into Millions Of Bank Accounts Next Week In The First Wave Of Payouts To Sh How To Get Money One Wave Tax Refund

Much Awaited Stimulus Cash Will Begin Flooding Into Millions Of Bank Accounts Next Week In The First Wave Of Payouts To Sh How To Get Money One Wave Tax Refund

How To Calculate Your Adjusted Gross Income

How To Calculate Your Adjusted Gross Income

Stimulus Checks 2020 Do You Get 1 200

Stimulus Checks 2020 Do You Get 1 200

New Second Stimulus Check Update 2nd Check 3 400 Sending Now And Stimulus Check Update Youtube Sent Youtube News

New Second Stimulus Check Update 2nd Check 3 400 Sending Now And Stimulus Check Update Youtube Sent Youtube News

Your Stimulus Check Tax Deadline Emergency Loans How To Get Money

Your Stimulus Check Tax Deadline Emergency Loans How To Get Money

Post a Comment for "Was The First Stimulus Check Based On Adjusted Gross Income"