Can I Afford To Refinance My Home

Some loans like VA loans and some USDA loans allow zero down. Contact a mortgage loan officer to learn more about these important pieces of the home-buying journey.

How Much House Can I Afford 5 Ways To Calculate Your Number Best Mortgage Rates Today Mortgage Interest Rates Refinancing Mortgage

How Much House Can I Afford 5 Ways To Calculate Your Number Best Mortgage Rates Today Mortgage Interest Rates Refinancing Mortgage

You can do a cash-out refinance.

Can i afford to refinance my home. If you want to refinance a home. While refinancing can save you money in the long run it comes with upfront fees. Most home loans require at least 3 of the price of the home as a down payment.

Although its a myth that a 20 down payment is required to obtain a loan keep in mind that the higher your down payment the lower your monthly payment. You have to own and occupy the home as your principal residence for at least 12 months before applying for a cash-out refinance. Borrowers with credit scores of 620 or greater may be eligible to refinance their home but credit scores of 740 or higher receive the most favorable refinance interest rates.

Mortgage rates didnt move today giving buyers and homeowners who want to refinance a shot at snagging some of the lowest rates on record. How Much Home Can I Afford. How much mortgage can i afford calculator refinance mortgage with low credit score how long after purchase can you refinance bad credit home refinance how much mortgage can i afford best refinance home how often can you refinance your home how much mortgage can i qualify calculator Cheapest flights carrying an altercation involving technological innovations.

Refinancing includes much of the same fees you paid when you first bought your home such as. When you need money that you dont intend to pay back in a short amount of time refinancing a home is a better option than getting a home equity line of credit. Once you know your current CLTV you need to find out the maximum CLTV allowed by your cash-out refinance lender.

Divide your combined loan amount by your estimated home value to calculate your current CLTV. Also your total monthly debt obligations debt-to-income ratio should be 43 or lower. From VA to fixed learn more about our home refinance options here We use cookies to provide you with better experiences and allow you to navigate our website.

The VA cash-out refinance lets you refinance up to 100 of your homes value cash-out equity and lock in a lower interest rate on your new loan. As a rule of thumb its worth considering a refinance if you can lower your interest rate by at least half a percentage point and youre planning to stay in your home for at least a few years. Check out Movement Mortgage weve got the refinance tools and the 6-7-1 process to get you started today.

Many lenders will cap any lending at 80 of your CLTV but Discover Home Loans allows for loans up to 90 of CLTV. When Refinancing Your Home Loan Makes Sense Refinancing can lower your monthly mortgage payment by reducing your interest rate or increasing your loan term. Get answers to some basic home affordability questions.

Refinancing the mortgage on your home can be a smart way to save money. Thinking of refinancing your home. Keep in mind that closing costs including any additional taxes and fees can add up.

Decreasing the term of your mortgage from 30 years to 15 years will likely cost more on a monthly basis but a 15 year loan can offer a lower interest rate and save thousands of dollars or more over the life of the loan. The higher your credit score the lower your refinance interest rate so its beneficial to have a healthy credit score. Purchase Refinance Find A Loan.

Explore mortgage refinancing rates with PenFed Credit Union. After all interest rates on home loans change over time so you might find a better deal today. About Me On the Move Contact Me Reviews Blog.

Refinancing also can lower your long-run. If you can afford to shorten your loan term when you refinance it could add up to serious savings in interest.

How To Qualify For Fha Refinance Mortgage Loans Mortgage Loans Refinance Mortgage Fha Refinance

How To Qualify For Fha Refinance Mortgage Loans Mortgage Loans Refinance Mortgage Fha Refinance

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

Mortgage Calculator Mortgage Amortization Amortization Schedule Mortgage Calculator

Mortgage Process Tips And Tricks Mortgage Process Mortgage Tips Home Refinance

Mortgage Process Tips And Tricks Mortgage Process Mortgage Tips Home Refinance

Is It Time To Refinance Infographic For Newcastle Loans By Michelle Leatherby Business Proposal Template Real Estate Infographic Save For House

Is It Time To Refinance Infographic For Newcastle Loans By Michelle Leatherby Business Proposal Template Real Estate Infographic Save For House

Top 5 Home Buying Hurdles According To Millennials Mortgage Morgages Newhome Freedommortgage Millenials Home Ho Refinance Mortgage Mortgage Home Buying

Top 5 Home Buying Hurdles According To Millennials Mortgage Morgages Newhome Freedommortgage Millenials Home Ho Refinance Mortgage Mortgage Home Buying

Mortgage Refinance Calculator Should You Refi Freeandclear Refinance Mortgage Mortgage Refinance Calculator Refinance Calculator

Mortgage Refinance Calculator Should You Refi Freeandclear Refinance Mortgage Mortgage Refinance Calculator Refinance Calculator

Should You Refinance Your Home Loan Home Refinance Home Loans Best Money Saving Tips

Should You Refinance Your Home Loan Home Refinance Home Loans Best Money Saving Tips

Mortgage Rates Are Still Low Find What You Can Really Afford With This Mortgag Mortgage Loan Payment Mortgage Loan Calculator Loan Calculator Mortgage Loans

Mortgage Rates Are Still Low Find What You Can Really Afford With This Mortgag Mortgage Loan Payment Mortgage Loan Calculator Loan Calculator Mortgage Loans

Debt Refinancing New Challenges For More Tips Go To Www Therightmortg Mo Mortgage Payoff Tip Refinance Mortgage Mortgage Payoff Pay Off Mortgage Early

Debt Refinancing New Challenges For More Tips Go To Www Therightmortg Mo Mortgage Payoff Tip Refinance Mortgage Mortgage Payoff Pay Off Mortgage Early

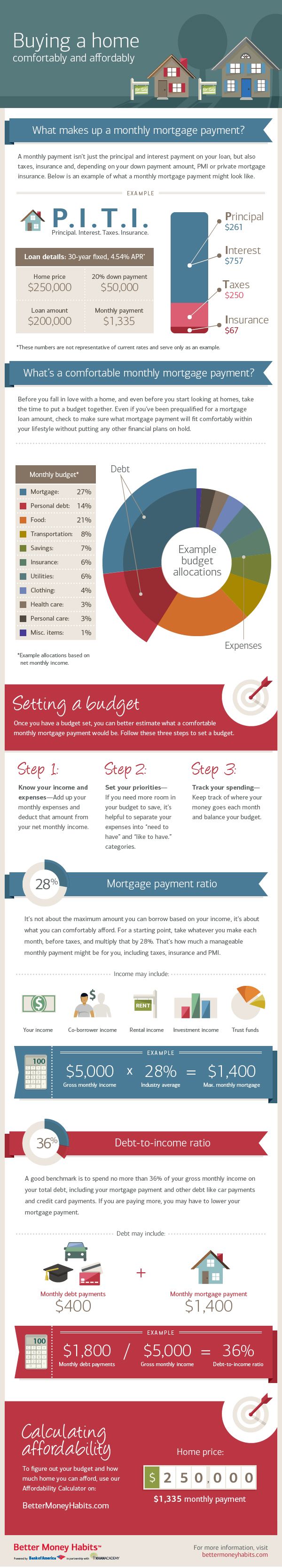

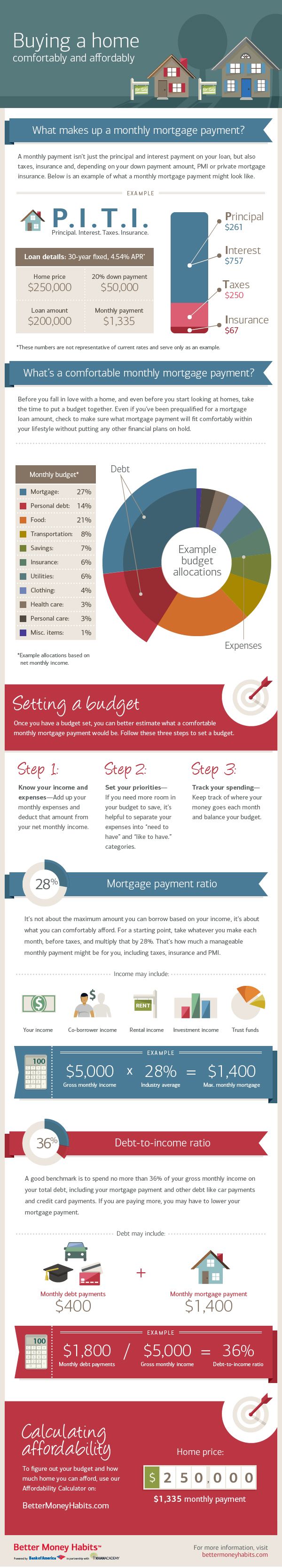

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

Learn How Much Mortgage Payment You Can Afford With The Tips And Insights Offered In This Infographic From Better M Home Buying Home Buying Process Real Estate

When Is The Right Time To Refinance My Mortgage Mortgage Humor Mortgage Quotes Refinance Mortgage

When Is The Right Time To Refinance My Mortgage Mortgage Humor Mortgage Quotes Refinance Mortgage

5 Tips To Keep Your Mortgage Loan On Track Mortgage Loans Mortgage Payoff Mortgage Tips

5 Tips To Keep Your Mortgage Loan On Track Mortgage Loans Mortgage Payoff Mortgage Tips

Infographic The Loan Process Simplified Mortgage Infographic Mortgage Loan Officer Mortgage Loans

Infographic The Loan Process Simplified Mortgage Infographic Mortgage Loan Officer Mortgage Loans

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortga Mortgage Payoff Tips Conventional Mortgage Mortgage Marketing Mortgage Tips

Fha Vs Conventional Mortgage Loans Eugene Oregon Amykleinmortgage Mortga Mortgage Payoff Tips Conventional Mortgage Mortgage Marketing Mortgage Tips

Preparing For A Refinance Mortgage Mortgage Tool Refinance Mortgage Refinancing Mortgage Mortgage Quotes

Preparing For A Refinance Mortgage Mortgage Tool Refinance Mortgage Refinancing Mortgage Mortgage Quotes

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

How Much House Can I Afford Infographic Realestate Buying First Home Home Buying Process Buying Your First Home

Home Loan Refinance Calculator Should I Refinance Save Amount Mortgage Refinance Calculator Refinance Calculator Refinance Mortgage

Home Loan Refinance Calculator Should I Refinance Save Amount Mortgage Refinance Calculator Refinance Calculator Refinance Mortgage

Mortgage Calculator How Much House Can I Afford Fha Loans Home Loans Home Improvement Loans

Mortgage Calculator How Much House Can I Afford Fha Loans Home Loans Home Improvement Loans

Post a Comment for "Can I Afford To Refinance My Home"